How To Find My Minimum Payment

adminse

Apr 05, 2025 · 8 min read

Table of Contents

Unlocking the Mystery: How to Find Your Minimum Payment

What if understanding your minimum payment is the key to unlocking better financial health? Mastering this seemingly simple concept can significantly impact your credit score and long-term financial well-being.

Editor’s Note: This article on finding your minimum payment was published today, providing you with the most up-to-date information and strategies to manage your debt effectively.

Why Knowing Your Minimum Payment Matters:

Understanding your minimum payment isn't just about avoiding late fees; it's a fundamental aspect of responsible credit management. Knowing this figure allows you to budget effectively, avoid accumulating excessive debt, and ultimately, improve your credit score. Ignoring or misunderstanding minimum payments can lead to a snowball effect of late fees, increased interest charges, and potentially, serious damage to your creditworthiness. This impacts your ability to secure loans, rent apartments, and even obtain certain jobs. In short, understanding and consistently meeting your minimum payments is crucial for building a solid financial foundation.

Overview: What This Article Covers:

This article provides a comprehensive guide to locating and understanding your minimum payment across various credit accounts. We will explore different methods of finding this information, address common scenarios and challenges, and offer practical tips for managing your payments effectively. We'll also delve into the implications of only paying the minimum, and discuss strategies for paying more to accelerate debt repayment.

The Research and Effort Behind the Insights:

This article draws upon research from reputable financial institutions, credit bureaus, and consumer advocacy groups. We've analyzed numerous statements, online banking platforms, and mobile apps to ensure the information provided is accurate and applicable to a wide range of users. The strategies presented are based on established financial principles and best practices.

Key Takeaways:

- Locating Minimum Payment Information: We'll detail the various places to find your minimum payment information.

- Understanding Minimum Payment Components: We'll break down what constitutes a minimum payment and its implications.

- Managing Multiple Minimum Payments: We'll provide strategies for juggling multiple accounts and payments.

- Consequences of Only Paying the Minimum: We'll analyze the long-term financial impact of minimum payment-only strategies.

- Strategies for Accelerated Debt Repayment: We'll outline methods for paying down debt faster and saving money on interest.

Smooth Transition to the Core Discussion:

Now that we've established the importance of understanding your minimum payment, let's explore the practical methods for finding this critical information.

Exploring the Key Aspects of Finding Your Minimum Payment:

1. Checking Your Credit Card Statements:

The most straightforward method is to examine your monthly credit card statement. The minimum payment amount is clearly stated, usually near the top or in a section dedicated to payment details. Look for phrases like "minimum payment due," "minimum payment amount," or a similar designation. The statement will also usually include the due date, which is equally crucial to avoid late fees. Keep your statements in a safe place for record-keeping purposes.

2. Accessing Your Online Banking Portal:

Most banks and credit card companies offer online banking portals where you can access detailed account information. Log into your account, navigate to the credit card section, and look for a summary of your account activity. The minimum payment due should be prominently displayed, often accompanied by the payment due date and the total balance. Many online portals also allow you to schedule automatic payments, a valuable tool for ensuring timely payments.

3. Utilizing Mobile Banking Apps:

Mobile banking apps mirror the functionality of online portals, offering a convenient way to access account information on the go. Open the app, select your credit card account, and look for the minimum payment information. The layout may vary slightly depending on your bank or credit card issuer, but the minimum payment due is usually clearly displayed. Many apps also send payment reminders, helping you stay on top of your financial obligations.

4. Contacting Your Credit Card Company Directly:

If you are unable to locate your minimum payment using the previously mentioned methods, don't hesitate to contact your credit card company directly. You can usually find their contact information on your statement or on their website. Explain your situation and politely request your minimum payment amount. They will likely provide this information promptly and may also address any other questions or concerns you have regarding your account.

5. Reviewing Your Loan Documents:

For loans such as personal loans, auto loans, or mortgages, the minimum payment information is usually detailed in your loan agreement. Review the terms and conditions of your loan to find the monthly minimum payment required. This information is usually clearly stated and may also include an amortization schedule, showing how your payments are allocated toward principal and interest over the loan's lifespan.

Closing Insights: Summarizing the Core Discussion

Finding your minimum payment is a crucial step in responsible financial management. Utilizing the various methods outlined above ensures you can easily locate this information and make timely payments. Remember, consistently making your minimum payments is vital for maintaining a good credit score and avoiding costly late fees.

Exploring the Connection Between Payment History and Credit Score:

The relationship between your payment history and your credit score is paramount. Consistent and timely minimum payments significantly impact your credit score, which in turn affects your access to credit and the interest rates you'll be offered. Missing payments, even if only by a small amount, can negatively impact your credit score, potentially leading to higher interest rates and difficulties securing loans in the future.

Key Factors to Consider:

- Roles and Real-World Examples: A consistently poor payment history can result in higher interest rates on future loans, impacting your ability to buy a home or a car. Conversely, a strong payment history can lead to lower interest rates and better loan terms.

- Risks and Mitigations: Failing to make minimum payments can lead to account delinquency, negatively affecting your credit score. This can be mitigated by setting up automatic payments or reminders to ensure timely payments.

- Impact and Implications: Long-term consequences of poor payment habits include higher borrowing costs, restricted access to credit, and potential legal action from creditors.

Conclusion: Reinforcing the Connection

The connection between on-time payments and a healthy credit score is undeniable. By diligently making your minimum payments, you are building a strong credit history that will benefit you financially in the long run.

Further Analysis: Examining Late Payment Fees in Greater Detail

Late payment fees can significantly impact your overall debt. These fees vary depending on the creditor, but they can range from a few dollars to a substantial percentage of your missed payment. Understanding these fees and avoiding them is crucial for maintaining financial stability. Many credit card agreements detail the late payment fee structure, and this information is often available on the creditor's website. Always review the terms and conditions of your credit agreements to understand the potential costs associated with late payments.

FAQ Section: Answering Common Questions About Minimum Payments:

Q: What happens if I only pay the minimum payment?

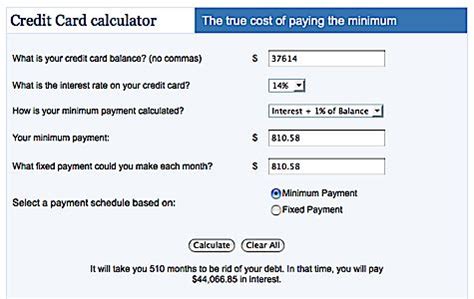

A: While paying the minimum payment avoids late fees, it significantly prolongs the repayment period and increases the total interest paid over the life of the debt. This strategy can leave you in debt for much longer than necessary and cost significantly more in the long run.

Q: Can I negotiate a lower minimum payment?

A: In some cases, you might be able to negotiate a lower minimum payment with your creditor, especially if you're facing financial hardship. Contacting your creditor and explaining your situation may result in a temporary adjustment. However, this is not always guaranteed.

Q: What if I can't afford my minimum payment?

A: If you cannot afford your minimum payment, contact your creditors immediately. They may offer options such as hardship programs, temporary payment reductions, or debt consolidation plans to help you manage your debt. Seeking professional financial advice is also highly recommended.

Practical Tips: Maximizing the Benefits of Understanding Minimum Payments:

- Set up automatic payments: Automate your minimum payments to avoid late fees and ensure timely payments.

- Budget effectively: Create a budget that includes all your minimum payments to ensure you have enough funds available.

- Track your payments: Keep track of all your payments and due dates to avoid missing any payments.

- Pay more than the minimum whenever possible: Paying more than the minimum will reduce your debt faster and save you money on interest.

- Consider debt consolidation: If you have multiple debts, consider consolidating them into a single loan with a lower interest rate.

Final Conclusion: Wrapping Up with Lasting Insights:

Understanding your minimum payment is a fundamental aspect of responsible financial management. By utilizing the methods described in this article and implementing the practical tips provided, you can effectively manage your debt, improve your credit score, and achieve better long-term financial health. Remember, proactive management of your finances, including a clear understanding of your minimum payments, is key to building a secure financial future. Don't underestimate the power of this seemingly small piece of information – it can make a significant difference in your overall financial well-being.

Latest Posts

Latest Posts

-

How Much Of A Credit Card Limit Should I Use

Apr 07, 2025

-

If My Credit Card Limit Is 1500 How Much Should I Spend

Apr 07, 2025

-

How Much Of 300 Credit Limit Should I Use

Apr 07, 2025

-

If I Have A 1000 Credit Limit How Much Should I Spend

Apr 07, 2025

-

How Much Of My Credit Limit Should I Use

Apr 07, 2025

Related Post

Thank you for visiting our website which covers about How To Find My Minimum Payment . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.