If My Credit Card Limit Is 1500 How Much Should I Spend

adminse

Apr 07, 2025 · 7 min read

Table of Contents

Credit Card Limit of $1500: How Much Should You Spend? Unlocking Financial Freedom

What if responsible credit card use is the key to unlocking a brighter financial future? Mastering your spending habits with a $1500 limit can build a strong credit foundation and pave the way for bigger financial goals.

Editor’s Note: This article on managing credit card spending with a $1500 limit was published today. It offers practical advice for building good credit and avoiding debt.

Why a $1500 Credit Card Limit Matters: Relevance, Practical Applications, and Financial Significance

A $1500 credit card limit, while seemingly small, represents a significant stepping stone in personal finance. For individuals building credit, it provides a manageable amount to demonstrate responsible spending habits. For those seeking to improve their credit score, it allows for controlled utilization and timely repayments, crucial factors in creditworthiness. Understanding how much to spend on a card with this limit is key to maximizing its benefits and avoiding the pitfalls of debt. The principles discussed here are applicable to any credit limit, making this knowledge valuable regardless of your financial circumstances.

Overview: What This Article Covers

This article will delve into the core aspects of managing a $1500 credit card limit. We will explore the significance of responsible spending, the implications of credit utilization, strategies for budgeting and tracking expenses, and the importance of timely repayments. Readers will gain actionable insights and a comprehensive understanding of how to use their credit card responsibly to improve their financial health.

The Research and Effort Behind the Insights

This article is the result of extensive research, incorporating insights from financial experts, credit scoring models, and practical examples. Every recommendation is grounded in established financial principles and data-driven analysis, ensuring readers receive accurate and trustworthy information.

Key Takeaways: Summarize the Most Essential Insights

- Understanding Credit Utilization: Learn how much you should spend to maintain a healthy credit utilization ratio.

- Budgeting and Expense Tracking: Discover effective strategies for managing your spending and avoiding overspending.

- The Importance of Timely Payments: Understand the impact of on-time payments on your credit score.

- Building a Strong Credit History: Learn how responsible credit card use contributes to a positive credit history.

- Avoiding High-Interest Debt: Explore strategies for preventing debt accumulation and managing existing debt.

Smooth Transition to the Core Discussion

With a clear understanding of why responsible credit card management matters, let’s dive deeper into the specific strategies for effectively using a $1500 credit limit.

Exploring the Key Aspects of Managing a $1500 Credit Limit

1. Understanding Credit Utilization:

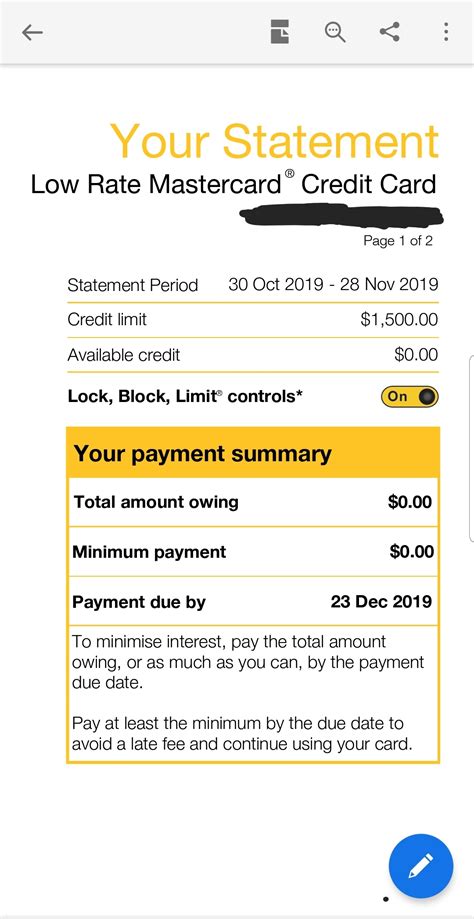

Your credit utilization ratio is the percentage of your available credit that you're currently using. Credit scoring models heavily weigh this factor. Ideally, you should aim to keep your credit utilization below 30%, and preferably even lower. With a $1500 limit, this means spending no more than $450 ($1500 x 0.30 = $450). Exceeding this threshold can negatively impact your credit score. Consistent low utilization demonstrates responsible credit management to lenders.

2. Budgeting and Expense Tracking:

Before you even swipe your card, create a detailed budget. Track your income and expenses meticulously. This allows you to anticipate your spending and avoid exceeding your predetermined limit. Numerous budgeting apps and spreadsheets can help you stay organized. Allocate specific amounts for different categories (groceries, transportation, entertainment, etc.) and stick to them. Regularly review your spending habits to identify areas for potential savings.

3. The Importance of Timely Payments:

Paying your credit card bill on time, every time, is paramount. Late payments significantly damage your credit score. Set up automatic payments to avoid missing deadlines. Even a single late payment can have a lasting negative impact. Aim to pay your balance in full each month to avoid accumulating interest charges.

4. Building a Strong Credit History:

Responsible credit card use is a cornerstone of building a strong credit history. By consistently paying your bills on time and keeping your credit utilization low, you're demonstrating to lenders that you're a reliable borrower. A positive credit history opens doors to better interest rates on loans, mortgages, and other financial products.

5. Avoiding High-Interest Debt:

Credit cards carry high-interest rates. Accumulating debt on your card can quickly become a burden. Always aim to pay your balance in full each month to avoid accruing interest. If you're unable to do so, make larger than minimum payments to reduce your balance as quickly as possible. Consider exploring debt consolidation options if you're struggling to manage your debt.

Exploring the Connection Between Emergency Funds and Credit Card Spending

The relationship between having an emergency fund and responsible credit card spending is symbiotic. An emergency fund acts as a safety net, preventing you from relying on your credit card for unexpected expenses. This reduces the likelihood of high credit utilization and prevents the accumulation of debt.

Key Factors to Consider:

-

Roles and Real-World Examples: A robust emergency fund minimizes the need to use your credit card for unforeseen events like car repairs or medical bills. Imagine a sudden $500 car repair. With an emergency fund, you can pay cash, keeping your credit utilization low. Without it, you'd be forced to charge it, potentially impacting your credit score.

-

Risks and Mitigations: Relying on your credit card for emergencies due to a lack of savings increases your risk of high credit utilization and debt accumulation. The mitigation strategy is building a dedicated emergency fund—ideally, three to six months' worth of living expenses—to cover unexpected costs.

-

Impact and Implications: A well-funded emergency fund promotes responsible credit card use, leading to a healthier credit score, lower interest payments, and improved overall financial stability.

Conclusion: Reinforcing the Connection

The interplay between an emergency fund and credit card spending is critical for maintaining a healthy financial life. By prioritizing savings and responsible spending, individuals with a $1500 credit limit can build a strong credit foundation and avoid the pitfalls of high-interest debt.

Further Analysis: Examining Budgeting Strategies in Greater Detail

Effective budgeting is crucial when managing a $1500 credit limit. Several strategies can help optimize spending:

-

50/30/20 Rule: Allocate 50% of your income to needs (housing, food, transportation), 30% to wants (entertainment, dining out), and 20% to savings and debt repayment. Adjust these percentages based on your individual circumstances.

-

Zero-Based Budgeting: Assign every dollar of your income to a specific category, ensuring your expenses don't exceed your income. This method promotes mindful spending and helps identify areas for potential savings.

-

Envelope System: Allocate cash to separate envelopes for different spending categories. Once the cash is gone, you can't spend more in that category. This provides a visual representation of your spending and prevents overspending.

FAQ Section: Answering Common Questions About Managing a $1500 Credit Limit

-

What is the best way to use a $1500 credit card? Use it only for purchases you can afford to pay in full at the end of the month. Keep your credit utilization below 30%.

-

How can I improve my credit score with a $1500 limit? Pay your bills on time, maintain a low credit utilization ratio, and keep your credit card accounts open and in good standing.

-

What happens if I exceed my $1500 credit limit? You'll likely incur over-limit fees and potentially damage your credit score.

-

Should I request a credit limit increase? Only when you're confident you can manage a higher limit responsibly. A higher limit doesn't equate to more spending power; it simply increases your available credit.

Practical Tips: Maximizing the Benefits of a $1500 Credit Limit

- Track your spending: Use budgeting apps or spreadsheets to monitor your expenses closely.

- Pay your balance in full each month: Avoid accumulating interest charges.

- Set up automatic payments: Ensure timely payments and avoid late fees.

- Review your credit report regularly: Monitor your credit utilization and identify any potential issues.

- Consider a secured credit card: If you're struggling to obtain an unsecured card, a secured card can help you build credit.

Final Conclusion: Wrapping Up with Lasting Insights

A $1500 credit limit, while seemingly modest, offers a powerful opportunity to build a strong financial foundation. By understanding credit utilization, budgeting effectively, and prioritizing timely payments, individuals can leverage this credit responsibly. Remember, the goal isn't about how much you spend, but rather how well you manage your spending and build a positive credit history—a crucial step towards achieving long-term financial goals. The principles discussed here apply to any credit limit; responsible credit card use is the cornerstone of financial well-being.

Latest Posts

Latest Posts

-

What Is A Credit Score Of 645 Considered

Apr 08, 2025

-

Is A 645 Credit Score Bad

Apr 08, 2025

-

What Does A 645 Credit Score Mean

Apr 08, 2025

-

Credit One Credit Limit Increase Request

Apr 08, 2025

-

Increase Your Credit Limit

Apr 08, 2025

Related Post

Thank you for visiting our website which covers about If My Credit Card Limit Is 1500 How Much Should I Spend . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.