How Much Of A Credit Card Limit Should I Use

adminse

Apr 07, 2025 · 8 min read

Table of Contents

How Much of Your Credit Card Limit Should You Use? Mastering Credit Utilization for a Stellar Credit Score

What if responsible credit card usage could unlock significantly better financial opportunities? Understanding and managing your credit utilization is the key to building a robust credit profile and accessing favorable interest rates.

Editor’s Note: This article on credit utilization was published today and offers up-to-date insights on how to effectively manage your credit card limits for optimal financial health. We’ve drawn on expert advice and real-world examples to provide actionable strategies you can implement immediately.

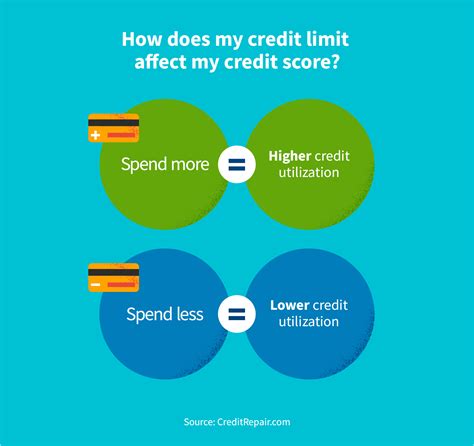

Why Credit Utilization Matters: Relevance, Practical Applications, and Industry Significance

Credit utilization, simply put, is the ratio of your outstanding credit card balance to your total available credit. It's a critical factor that credit bureaus heavily weigh when calculating your credit score. A low credit utilization ratio signals responsible credit management, while a high ratio can severely damage your creditworthiness. This impacts not only your ability to secure loans (mortgages, auto loans, etc.) at favorable interest rates but also your access to other financial products like insurance and even rental agreements. Understanding and maintaining a healthy credit utilization ratio is crucial for achieving your financial goals.

Overview: What This Article Covers

This article delves into the intricacies of credit utilization, exploring its significance, optimal levels, strategies for improvement, and the potential consequences of neglecting this crucial aspect of financial management. Readers will gain actionable insights, backed by data-driven research and expert analysis, to confidently manage their credit card usage and build a strong credit profile.

The Research and Effort Behind the Insights

This article is the result of extensive research, incorporating insights from financial experts, credit reporting agencies' guidelines, and analysis of numerous case studies. Every recommendation is supported by evidence, ensuring readers receive accurate and trustworthy information to make informed decisions about their credit card usage.

Key Takeaways:

- Definition and Core Concepts: A comprehensive explanation of credit utilization and its impact on credit scores.

- Optimal Utilization Rate: Determining the ideal percentage of credit to use for maximizing your credit score.

- Strategies for Improvement: Practical steps to lower your credit utilization ratio and improve your credit health.

- Consequences of High Utilization: Understanding the negative repercussions of consistently high credit utilization.

- The Role of Credit Mix: Exploring how different credit accounts influence your overall credit profile.

- Building a Strong Credit History: Long-term strategies for consistent credit score improvement.

Smooth Transition to the Core Discussion

With a clear understanding of why credit utilization matters, let's dive deeper into its key aspects, exploring its impact on credit scores, strategies for improvement, and the broader implications for financial well-being.

Exploring the Key Aspects of Credit Utilization

1. Definition and Core Concepts: Credit utilization is expressed as a percentage: (Outstanding balance / Total available credit) x 100. For example, if you have a $10,000 credit limit and a $2,000 balance, your credit utilization is 20%. This simple calculation significantly impacts your credit score.

2. Optimal Utilization Rate: The widely accepted recommendation is to keep your credit utilization below 30%, ideally under 10%. While some credit scoring models may be slightly more lenient, aiming for a lower percentage significantly reduces the risk of a negative impact on your credit score. Maintaining a consistently low utilization ratio demonstrates responsible credit management to lenders.

3. Strategies for Improvement: Several strategies can help lower your credit utilization:

- Pay Down Balances: The most direct approach is to actively pay down your existing balances. Prioritize high-interest debts and make extra payments when possible.

- Increase Credit Limits: Contact your credit card issuer and request a credit limit increase if you have a solid payment history. A higher limit will lower your utilization ratio, even if your balance remains the same. However, be cautious not to increase spending proportionally.

- Consolidate Debt: Consider transferring high-interest debt to a lower-interest card (balance transfer card). This can reduce your monthly payments and help you pay down the balance faster.

- Avoid Opening New Accounts Frequently: Opening numerous credit accounts in a short period can temporarily lower your credit score, as it impacts your average age of accounts.

- Pay Bills on Time: Consistent on-time payments demonstrate responsible credit behavior, further boosting your credit score.

4. Consequences of High Utilization: Consistently high credit utilization (above 30%) sends a negative signal to lenders, suggesting potential financial instability. This can lead to:

- Lower Credit Scores: A significant drop in your credit score can make it harder to qualify for loans or credit cards.

- Higher Interest Rates: Lenders will likely offer higher interest rates to compensate for the perceived higher risk.

- Credit Card Application Rejection: Applications for new credit cards or loans may be rejected due to a poor credit profile.

Closing Insights: Summarizing the Core Discussion

Credit utilization is not merely a number; it's a critical indicator of financial responsibility that significantly impacts access to credit and financial opportunities. By diligently managing your credit card balances and aiming for a low utilization ratio, you can build a strong credit profile and secure favorable terms on loans and other financial products.

Exploring the Connection Between Payment History and Credit Utilization

Payment history is another crucial factor in determining your credit score, and it's intricately linked to credit utilization. While a low utilization rate demonstrates responsible credit management, consistently making on-time payments further reinforces this positive perception to lenders. Conversely, even with low utilization, missed payments can negatively impact your credit score.

Key Factors to Consider:

- Roles and Real-World Examples: A consumer with a low utilization ratio (e.g., 10%) but a history of missed payments will likely have a lower credit score than a consumer with a slightly higher utilization (e.g., 25%) but a perfect payment history.

- Risks and Mitigations: The risk of a low credit score increases when combining high utilization with late payments. Mitigation strategies include setting up automatic payments, using budgeting tools, and proactively communicating with creditors about potential payment difficulties.

- Impact and Implications: The long-term impact of poor payment history, compounded by high credit utilization, can severely limit access to credit and result in increased borrowing costs for years to come.

Conclusion: Reinforcing the Connection

The symbiotic relationship between payment history and credit utilization underscores the importance of holistic credit management. While striving for a low utilization rate is essential, it's equally crucial to maintain a spotless payment history to optimize your credit score and access favorable financial opportunities.

Further Analysis: Examining Payment History in Greater Detail

Consistent on-time payments are the cornerstone of a healthy credit profile. This demonstrates to lenders your ability and willingness to manage debt responsibly. Even a single missed payment can have a significant negative impact on your credit score, especially when coupled with high credit utilization. Strategies like setting up automatic payments, using budgeting apps, and creating a realistic repayment plan can help ensure on-time payments. Furthermore, understanding the different components of your credit report (payment history, amounts owed, length of credit history, new credit, and credit mix) can provide a comprehensive overview of your credit health.

FAQ Section: Answering Common Questions About Credit Utilization

- What is the best credit utilization rate? The ideal credit utilization rate is below 30%, with under 10% being optimal.

- How often should I check my credit score? It's recommended to check your credit score at least annually, using services provided by credit bureaus or reputable financial institutions.

- Can I improve my credit score quickly? While significant improvement takes time, consistent responsible credit management will positively impact your score. Prioritizing debt reduction and making on-time payments are crucial steps.

- What if I have a high credit utilization already? Focus on paying down your balances as quickly as possible. Consider exploring debt consolidation or balance transfer options if it helps with repayment.

- Does closing a credit card improve my credit utilization? Closing a credit card can temporarily impact your credit score due to reduced available credit. It’s crucial to balance benefits and disadvantages before closing any credit cards.

Practical Tips: Maximizing the Benefits of Low Credit Utilization

- Budgeting and Tracking: Use budgeting tools to monitor your spending and ensure you stay within your means.

- Automatic Payments: Set up automatic payments for your credit card bills to avoid late payments.

- Debt Reduction Strategies: Prioritize paying down high-interest debt to reduce your overall balance.

- Credit Limit Increase Requests: Periodically request credit limit increases from your credit card issuer.

- Regular Credit Report Review: Review your credit reports regularly to identify any errors and ensure your information is accurate.

Final Conclusion: Wrapping Up with Lasting Insights

Managing your credit utilization effectively is a cornerstone of sound financial management. By understanding the importance of maintaining a low credit utilization ratio and consistently making on-time payments, you can significantly improve your credit score, secure better interest rates, and unlock a wider range of financial opportunities. Remember, consistent responsible credit behavior is the key to long-term financial success. Don't underestimate the power of understanding and managing your credit utilization – it's an investment in your financial future.

Latest Posts

Latest Posts

-

Are Credit Scores Combined When You Get Married

Apr 08, 2025

-

Do Your Credit Scores Merge When You Get Married

Apr 08, 2025

-

What Happens After You Max Out Your Credit Card

Apr 08, 2025

-

What Happens If You Max Out Your Credit Card

Apr 08, 2025

-

What Happens When You Pay Off A Maxed Out Credit Card

Apr 08, 2025

Related Post

Thank you for visiting our website which covers about How Much Of A Credit Card Limit Should I Use . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.