If I Have A 1000 Credit Limit How Much Should I Spend

adminse

Apr 07, 2025 · 6 min read

Table of Contents

Unlocking Your Credit Limit: How Much Should You Spend on a $1000 Card?

What if responsible credit card usage could unlock financial freedom and build a strong credit history? Mastering your $1000 credit limit is the key, and it's simpler than you think.

Editor’s Note: This article on responsible credit card spending with a $1000 limit was published today, providing readers with up-to-date advice on managing credit and building a healthy financial future.

Why Your $1000 Credit Limit Matters:

A $1000 credit limit, while seemingly small, represents a significant opportunity. It's a stepping stone to building a positive credit history, accessing credit in the future, and learning responsible financial habits. Understanding how much to spend on this card will directly impact your credit score, interest payments, and overall financial well-being. This understanding extends beyond just the numerical value; it's about cultivating responsible financial behavior that will serve you well throughout your life.

Overview: What This Article Covers:

This article will delve into the crucial aspects of managing a $1000 credit limit. We'll explore the concept of credit utilization, the impact of spending habits on your credit score, strategies for responsible spending, and how to avoid the pitfalls of overspending. Readers will gain actionable insights, supported by practical examples and expert advice, to navigate their credit journey successfully.

The Research and Effort Behind the Insights:

This comprehensive guide is the result of extensive research, integrating financial literacy principles, credit scoring methodologies, and real-world examples from financial experts and consumer behavior studies. Every recommendation is supported by evidence, ensuring readers receive accurate and trustworthy information for making informed financial decisions.

Key Takeaways:

- Credit Utilization: Understanding how much of your credit limit you're using is paramount.

- Responsible Spending Habits: Developing a budget and sticking to it prevents overspending.

- Avoiding High-Interest Debt: Understanding interest rates and minimizing debt are crucial.

- Building Credit History: Strategic credit card use builds a positive credit profile.

- Long-Term Financial Planning: Using a credit card responsibly contributes to broader financial goals.

Smooth Transition to the Core Discussion:

Now that we understand the importance of managing a $1000 credit limit effectively, let's dive deeper into the key strategies for responsible spending and credit utilization.

Exploring the Key Aspects of Managing Your $1000 Credit Limit:

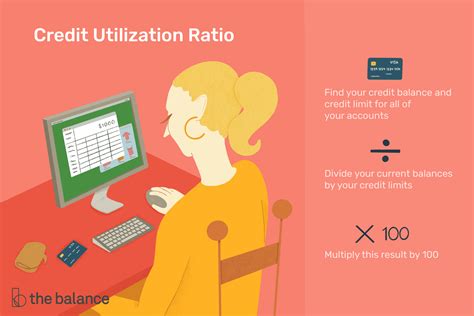

1. Understanding Credit Utilization:

Your credit utilization ratio is the percentage of your available credit that you're using. This is one of the most significant factors influencing your credit score. The ideal credit utilization ratio is generally considered to be below 30%, and aiming for below 10% is even better. With a $1000 limit, this means ideally spending no more than $300, and striving for under $100. Exceeding this threshold can negatively impact your credit score.

2. Creating a Realistic Budget:

Before making any purchases, create a detailed budget outlining your monthly income and expenses. Identify areas where you can cut back to allocate funds for credit card payments. This proactive approach prevents overspending and helps you stay within your credit limit.

3. Prioritizing Needs over Wants:

Differentiate between needs and wants when making purchases. Needs are essential expenses like groceries, utilities, and transportation. Wants are non-essential items like entertainment and luxury goods. Prioritize needs and use your credit card strategically for necessary expenses, keeping wants to a minimum.

4. Utilizing Autopay and Setting Reminders:

Setting up automatic payments ensures you never miss a due date, preventing late payment fees and negative impacts on your credit score. Use calendar reminders to track upcoming payments and manage your spending throughout the month.

5. Monitoring Your Credit Report Regularly:

Regularly check your credit report from all three major credit bureaus (Equifax, Experian, and TransUnion). This allows you to monitor your credit utilization, identify any errors, and track your progress in building a positive credit history.

Closing Insights: Summarizing the Core Discussion:

Effective management of a $1000 credit limit is not just about the numerical value; it's about cultivating responsible financial habits. By understanding credit utilization, budgeting effectively, and prioritizing needs over wants, you can leverage your credit card to build a strong credit history and achieve your financial goals.

Exploring the Connection Between Emergency Funds and Credit Card Usage:

The relationship between having an emergency fund and using a credit card responsibly is crucial. An emergency fund acts as a safety net, preventing the need to rely heavily on credit cards during unexpected expenses. If you face an emergency, using your credit card sparingly and paying it off promptly minimizes the risk of accumulating high-interest debt.

Key Factors to Consider:

- Roles and Real-World Examples: Imagine a sudden car repair. With an emergency fund, you can pay cash, avoiding credit card debt. Without one, a credit card might be necessary, but responsible usage is key to minimizing long-term costs.

- Risks and Mitigations: Relying solely on credit cards for emergencies leads to high balances and potential debt spirals. An emergency fund mitigates this risk.

- Impact and Implications: Building a robust emergency fund allows for responsible credit card use. It reduces the financial stress of unexpected events and fosters positive credit habits.

Conclusion: Reinforcing the Connection:

The interplay between an emergency fund and credit card management is synergistic. An emergency fund reduces credit card dependency, allowing for responsible spending and positive credit history building. This results in better financial health and a more secure financial future.

Further Analysis: Examining Emergency Funds in Greater Detail:

The importance of an emergency fund cannot be overstated. It provides a financial buffer for unexpected events, preventing reliance on high-interest debt. Aim for 3-6 months' worth of essential living expenses in a readily accessible savings account. This fund acts as a safety net, allowing you to handle emergencies without jeopardizing your credit score or accumulating debt.

FAQ Section: Answering Common Questions About Credit Card Usage:

- What is the best way to pay off my credit card debt? The snowball method (paying off the smallest debt first) or the avalanche method (paying off the highest-interest debt first) are both effective strategies. Focus on consistent, timely payments.

- What happens if I miss a credit card payment? Late payments negatively impact your credit score and incur fees. Contact your credit card company immediately if you anticipate a missed payment.

- How can I improve my credit score? Maintain a low credit utilization ratio, make timely payments, and keep your credit accounts open for a longer duration.

- Is it better to have multiple credit cards or just one? A single credit card managed responsibly can be sufficient, especially when starting. Multiple cards can help diversify credit, but responsible management is crucial.

Practical Tips: Maximizing the Benefits of a $1000 Credit Limit:

- Track Your Spending: Use budgeting apps or spreadsheets to monitor your expenses meticulously.

- Set Spending Limits: Allocate specific amounts for different categories (e.g., groceries, entertainment).

- Pay More Than the Minimum: Paying more than the minimum payment reduces interest charges and accelerates debt repayment.

- Consider a Secured Credit Card: If you have a limited credit history, a secured credit card can help you build credit responsibly.

Final Conclusion: Wrapping Up with Lasting Insights:

A $1000 credit limit presents a valuable opportunity to learn responsible credit card management. By understanding credit utilization, creating a budget, and prioritizing needs over wants, you can leverage this limit to build a positive credit history and achieve your long-term financial goals. Remember that responsible credit card use is a crucial component of overall financial well-being, setting the stage for future financial success.

Latest Posts

Latest Posts

-

Is A 645 Credit Score Bad

Apr 08, 2025

-

What Does A 645 Credit Score Mean

Apr 08, 2025

-

Credit One Credit Limit Increase Request

Apr 08, 2025

-

Increase Your Credit Limit

Apr 08, 2025

-

Increase Limit Credit One Bank

Apr 08, 2025

Related Post

Thank you for visiting our website which covers about If I Have A 1000 Credit Limit How Much Should I Spend . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.