How To Teach Money Management For Kids

adminse

Apr 06, 2025 · 7 min read

Table of Contents

Unlock Your Child's Financial Future: A Comprehensive Guide to Teaching Money Management

What if the key to your child's future success lies in mastering money management? Early financial literacy empowers children, equipping them with skills that extend far beyond mere budgeting, fostering responsibility, and setting them on a path toward financial independence.

Editor’s Note: This article on teaching money management to kids has been published today, providing parents and educators with up-to-date strategies and insights to cultivate responsible financial habits in young minds.

Why Teaching Kids About Money Matters:

Financial literacy is no longer a luxury; it's a necessity. In a world increasingly driven by financial decisions, children who understand money management are better equipped to navigate adulthood’s complexities. Teaching kids about money isn't just about avoiding debt; it's about fostering responsibility, building confidence, and cultivating a healthy relationship with finances. The benefits extend to improved decision-making skills, increased self-reliance, and a greater sense of personal empowerment. From understanding the value of saving for a desired item to comprehending the importance of budgeting and investing, early financial education lays a solid foundation for future success.

Overview: What This Article Covers:

This comprehensive guide delves into the practical aspects of teaching children about money management, catering to different age groups and learning styles. We'll explore age-appropriate strategies, engaging techniques, and effective tools to help your child develop essential financial skills. The article will cover: introducing basic financial concepts, establishing a savings plan, teaching about needs versus wants, understanding earning and spending, the importance of giving back, and addressing common challenges parents face in this process.

The Research and Effort Behind the Insights:

This article draws upon extensive research from leading financial literacy organizations, child development experts, and practical experience from educators and parents. Numerous studies and reports highlight the positive correlation between early financial education and improved financial outcomes in adulthood. We've incorporated real-world examples and case studies to illustrate effective strategies and address potential hurdles.

Key Takeaways:

- Age-Appropriate Introduction: Tailoring financial lessons to a child's developmental stage is crucial for effective learning.

- Hands-On Experiences: Practical activities and real-world examples make learning more engaging and memorable.

- Consistent Reinforcement: Regular conversations and consistent application of financial principles solidify understanding.

- Open Communication: Creating a safe space for questions and discussions fosters a healthy relationship with money.

- Goal Setting: Setting achievable financial goals motivates children and reinforces the importance of saving.

Smooth Transition to the Core Discussion:

With a clear understanding of why teaching children about money management is crucial, let's explore practical strategies and techniques to make this process engaging and effective.

Exploring the Key Aspects of Teaching Money Management for Kids:

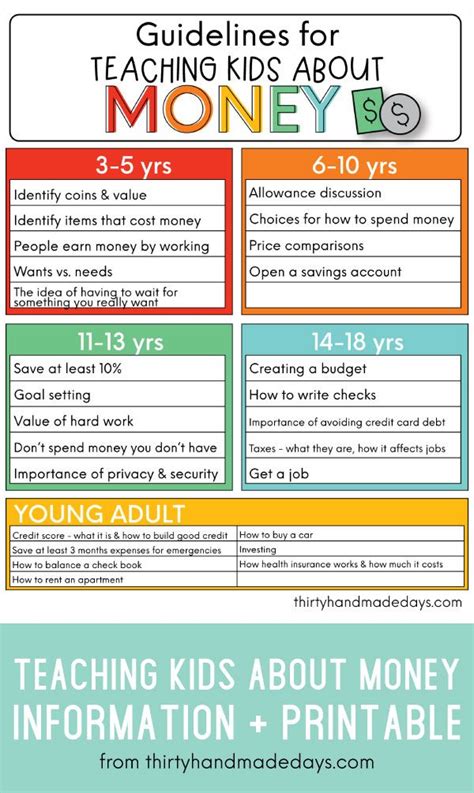

1. Age-Appropriate Introduction to Financial Concepts:

-

Preschool (Ages 3-5): Focus on basic concepts like needs versus wants. Use visual aids like pictures to differentiate between essential items (food, shelter) and non-essential items (toys, candy). Introduce the concept of saving using a piggy bank and visually tracking progress. Short, simple stories about saving and spending can be effective.

-

Early Elementary (Ages 6-8): Introduce the concept of earning money through chores and allowances. Connect the allowance to responsibilities and emphasize the link between work and reward. Begin teaching about delayed gratification by helping them save for a specific goal (a toy, a book). Use simple budgeting exercises to track spending and saving.

-

Late Elementary (Ages 9-11): Introduce more complex concepts like budgeting, saving, and spending. Introduce the idea of different types of accounts (savings, checking). Start incorporating simple banking activities, like opening a savings account and making deposits. Explore different ways to earn money, such as mowing lawns or babysitting (with parental supervision).

-

Middle School (Ages 12-14): Introduce more advanced concepts like interest, credit, and debt. Explain the importance of credit scores and responsible borrowing. Encourage the exploration of different investment options, like savings bonds or educational savings plans. Discuss the dangers of impulse buying and the importance of making informed financial decisions.

2. Establishing a Savings Plan:

A savings plan is the cornerstone of financial literacy. Start with a piggy bank for younger children, progressing to a savings account as they get older. Help them set realistic savings goals, such as saving for a specific toy or a trip. Visual aids like charts or graphs can help track progress and maintain motivation. Regularly review savings goals and adjust them as needed. Consider linking savings to specific achievements or rewards to reinforce positive behavior.

3. Teaching Needs vs. Wants:

Differentiating between needs and wants is essential for responsible spending. Use real-life examples and discussions to help children understand the difference. Needs are essential for survival (food, shelter, clothing), while wants are items that are desired but not necessary. Engage in role-playing scenarios where they must prioritize needs over wants, making choices based on limited resources.

4. Understanding Earning and Spending:

Allowances and chores provide practical experience in earning and managing money. Link allowances to responsibilities, fostering a sense of accountability. Encourage children to track their spending and identify areas where they can save. Involve them in family budgeting discussions to understand how money is allocated for household expenses.

5. The Importance of Giving Back:

Incorporating charitable giving teaches children the value of compassion and generosity. Encourage them to donate a portion of their savings or allowance to a cause they care about. This fosters empathy and reinforces the idea that money can be used to make a positive impact on the community.

6. Addressing Common Challenges:

- Impulse Buying: Teach children to delay gratification by waiting before purchasing non-essential items.

- Peer Pressure: Encourage open communication about financial pressures from peers and help them develop strategies to resist impulse buying driven by social influence.

- Lack of Motivation: Make saving and budgeting fun by using games, apps, or visual aids to track progress and celebrate achievements.

- Misunderstanding of Concepts: Use simple language and real-world examples to clarify complex financial ideas. Regularly review and reinforce key concepts.

Exploring the Connection Between Allowance and Effective Money Management:

Allowance is a powerful tool in teaching money management. It provides children with a controlled environment to practice budgeting, saving, and spending. A well-structured allowance system connects earning to responsibility, promoting self-reliance and accountability. However, the amount of allowance should be age-appropriate and linked to responsibilities. It shouldn't be a blank check but a structured system to practice financial skills.

Key Factors to Consider:

- Roles and Real-World Examples: Linking allowances to chores provides a clear connection between work and reward.

- Risks and Mitigations: Overly generous allowances can lead to irresponsible spending. Setting limits and guidelines helps mitigate this risk.

- Impact and Implications: A well-managed allowance system develops responsible financial habits that extend far beyond childhood.

Conclusion: Reinforcing the Connection:

The connection between allowance and effective money management is crucial for fostering financial literacy in children. By providing a structured system for earning, saving, and spending, allowances become invaluable tools for teaching crucial life skills.

Further Analysis: Examining Different Allowance Models:

Different models exist for structuring allowances, including a fixed amount based on age or responsibilities, or a variable amount linked to completed chores. Each model has advantages and disadvantages. Parents should choose a model that best fits their family's values and the child's maturity level.

FAQ Section: Answering Common Questions About Teaching Money Management:

- What is the best age to start teaching kids about money? As early as preschool, basic concepts like needs vs. wants can be introduced.

- How much allowance should I give my child? The amount should be age-appropriate and linked to responsibilities.

- What if my child spends their allowance quickly? Use this as a teaching moment to discuss budgeting and delayed gratification.

- How can I make learning about money fun? Use games, apps, and visual aids to engage children and make learning more enjoyable.

Practical Tips: Maximizing the Benefits of Financial Education:

- Start early: Begin teaching basic concepts as soon as your child shows an understanding of numbers.

- Use real-world examples: Relate financial concepts to everyday situations to make them more relatable.

- Make it fun: Use games, apps, and activities to keep your child engaged.

- Be patient: Learning about money takes time and practice.

- Lead by example: Children learn by observing their parents' behavior. Demonstrate responsible financial habits yourself.

Final Conclusion: Wrapping Up with Lasting Insights:

Teaching your children about money management is an investment in their future. By starting early, using age-appropriate strategies, and making learning engaging, you can equip them with the skills they need to make sound financial decisions throughout their lives. The benefits extend far beyond managing finances; it fosters responsibility, independence, and a greater understanding of the world around them. Empower your children with financial literacy—it's a gift that will keep on giving.

Latest Posts

Latest Posts

-

What Is A Good Credit Utilization Ratio Reddit

Apr 07, 2025

-

What Is A Good Credit Utilization Ratio Uk

Apr 07, 2025

-

What Is An Excellent Credit Utilization Ratio

Apr 07, 2025

-

Is 1500 Credit Limit Good

Apr 07, 2025

-

1500 Credit Limit How Much To Use

Apr 07, 2025

Related Post

Thank you for visiting our website which covers about How To Teach Money Management For Kids . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.