How Is Minimum Student Loan Payment Calculator

adminse

Apr 06, 2025 · 9 min read

Table of Contents

Unlocking the Mystery: How a Minimum Student Loan Payment Calculator Works

What if navigating your student loan repayment felt less daunting and more manageable? A minimum student loan payment calculator can be your key to understanding and controlling your debt.

Editor’s Note: This article provides a comprehensive guide to understanding how minimum student loan payment calculators function, exploring their features, limitations, and how to use them effectively to manage your student loan debt. Updated [Date of Publication].

Why a Minimum Student Loan Payment Calculator Matters:

Student loan debt is a significant financial burden for millions. Understanding your minimum payment is crucial for budgeting, avoiding delinquency, and ultimately, achieving financial freedom. A minimum student loan payment calculator simplifies this complex process, providing a clear picture of your repayment obligations and helping you make informed decisions about your financial future. It's a tool relevant to anyone with federal or private student loans, aiming to improve financial literacy and responsible debt management.

Overview: What This Article Covers:

This article will dissect the inner workings of a minimum student loan payment calculator. We’ll explore the input variables, the calculation process, different repayment plan options, the limitations of these calculators, and best practices for utilizing them effectively. You'll gain a practical understanding of how these calculators function and how to leverage them for better financial planning.

The Research and Effort Behind the Insights:

The information presented here is based on extensive research of reputable sources including the U.S. Department of Education, leading financial institutions, and consumer finance websites. We've analyzed various calculator algorithms and compared results across multiple platforms to ensure accuracy and clarity. This article strives for neutrality and avoids promotional language, focusing solely on providing useful and reliable information.

Key Takeaways:

- Understanding the Inputs: Learn which information is needed to accurately use a minimum student loan payment calculator (loan amount, interest rate, loan type, repayment term).

- Calculation Methods: Grasp the underlying mathematical principles used to determine minimum payments.

- Repayment Plan Options: Explore the different repayment plans offered (standard, extended, income-driven) and their impact on your minimum payment.

- Limitations and Considerations: Recognize the potential limitations and factors not always included in basic calculators (fees, capitalization of interest, future interest rate changes).

- Practical Application: Master how to use the calculator effectively to plan your budget and manage your debt.

Smooth Transition to the Core Discussion:

Now that we've established the importance of understanding minimum student loan payments, let's delve into the specifics of how a minimum student loan payment calculator actually functions.

Exploring the Key Aspects of Minimum Student Loan Payment Calculators:

1. Input Variables:

A minimum student loan payment calculator requires several key pieces of information to provide an accurate estimate. These typically include:

- Loan Amount (Principal): The original amount borrowed.

- Interest Rate: The annual percentage rate (APR) charged on the loan. This is usually a fixed rate, but can be variable for some loans.

- Loan Type: Whether the loan is federal (e.g., subsidized, unsubsidized, PLUS loans) or private. This distinction is crucial because federal loans offer various repayment plans and options not available for private loans.

- Repayment Term (Loan Length): The number of months allotted to repay the loan. This impacts the monthly payment amount significantly; shorter terms lead to higher monthly payments but less interest paid overall.

- Additional Fees: Some calculators may allow you to include additional fees associated with the loan, such as origination fees, which are added to the principal balance.

2. Calculation Methods:

The core calculation within a minimum student loan payment calculator utilizes an amortization formula. Amortization is the process of gradually paying off a debt over time with regular payments that cover both principal and interest. The formula considers the loan's principal, interest rate, and loan term to calculate the minimum payment required to pay off the loan within the specified time frame.

The standard amortization formula is complex, but simplified versions are used in many calculators. These calculators often use iterative methods to solve for the minimum monthly payment. The basic concept is to find the payment that, when applied over the loan term, will result in a final balance of zero. The formula accounts for the compounding interest, where interest is added to the principal balance over time.

3. Repayment Plan Options:

Federal student loans offer various repayment plans, each affecting the minimum monthly payment calculation:

-

Standard Repayment Plan: This is the most common plan, typically requiring repayment within 10 years. The minimum payment is calculated based on the loan's total amount, interest rate, and 10-year term.

-

Extended Repayment Plan: This plan allows for a longer repayment period (up to 25 years), resulting in lower minimum monthly payments but higher total interest paid over the life of the loan.

-

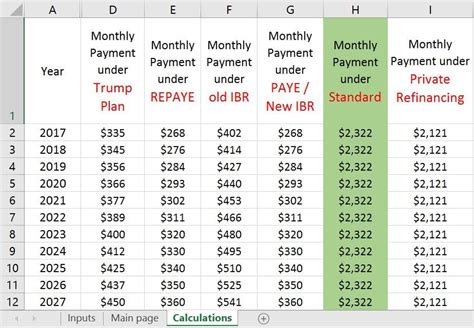

Income-Driven Repayment (IDR) Plans: These plans base your minimum monthly payment on your income and family size. There are several IDR plans (IBR, PAYE, REPAYE, ICR), each with specific income-based calculations. These plans typically require a recalculation of the minimum payment each year, based on your reported income. The minimum payment may be lower than in standard repayment plans, but you could end up paying more interest overall depending on your income.

Private student loans often offer fewer repayment options, usually sticking to fixed-term repayment plans similar to the standard federal repayment plan.

4. Limitations and Considerations:

While minimum student loan payment calculators are helpful tools, they have some limitations:

-

Simplified Models: Many calculators utilize simplified models and might not account for all the nuances of student loan repayment.

-

Interest Rate Fluctuations: Calculators typically assume a fixed interest rate. If you have a variable interest rate, the actual minimum payment may vary over time.

-

Future Interest Capitalization: For some loans, unpaid interest might be capitalized (added to the principal balance), increasing the loan amount and future payments. Calculators may not always accurately reflect this.

-

Fees and Charges: Some fees or charges might not be factored into the calculation.

-

Changes in Circumstances: Life events (job loss, unexpected expenses) can significantly impact repayment capacity. The calculator cannot predict these changes.

-

Accuracy of Inputs: The accuracy of the calculation depends entirely on the accuracy of the input data. Incorrect information will lead to inaccurate results.

5. Practical Application:

To effectively use a minimum student loan payment calculator:

-

Gather all necessary loan information: This includes loan amounts, interest rates, loan types, and repayment terms for each loan.

-

Select the appropriate repayment plan: Consider your financial situation and choose a plan that fits your budget and long-term goals.

-

Input the data into the calculator: Carefully enter all the required information.

-

Review the results: Carefully analyze the calculated minimum monthly payment, total interest paid, and total repayment amount.

-

Compare different scenarios: Experiment with different repayment plans and terms to see how they impact your minimum payments and overall cost.

-

Factor in other expenses: Integrate the calculated minimum payment into your overall budget, considering other expenses and financial priorities.

Exploring the Connection Between Interest Rates and Minimum Student Loan Payments:

The relationship between interest rates and minimum student loan payments is directly proportional. A higher interest rate means a higher minimum payment for the same loan amount and repayment term. This is because more interest accrues each month, requiring a larger payment to cover both interest and principal.

Key Factors to Consider:

-

Roles and Real-World Examples: A 1% increase in the interest rate on a $50,000 loan over 10 years could significantly increase the minimum monthly payment and the total interest paid over the life of the loan.

-

Risks and Mitigations: High interest rates increase the risk of falling behind on payments. Mitigation strategies include exploring refinancing options, income-driven repayment plans, or budgeting for higher monthly payments.

-

Impact and Implications: High interest rates significantly impact the total cost of borrowing and can lengthen the repayment timeline, leading to a larger overall debt burden.

Conclusion: Reinforcing the Connection:

The influence of interest rates on minimum student loan payments underscores the importance of understanding your loan terms and exploring options to minimize the overall cost of borrowing. Responsible financial planning and careful consideration of repayment strategies are crucial for managing student loan debt effectively.

Further Analysis: Examining Interest Rate Changes in Greater Detail:

Interest rates can change over time, particularly for variable-rate loans. Understanding how these changes affect the minimum payment is crucial. Monitoring interest rate movements and their potential impact on your repayment schedule enables proactive adjustments to your budget and repayment strategy. Reflective of this, some sophisticated calculators offer simulations of interest rate changes and their effects.

FAQ Section: Answering Common Questions About Minimum Student Loan Payment Calculators:

-

Q: What is a minimum student loan payment calculator?

- A: It's an online tool that estimates your minimum monthly payment for student loans based on your loan details (principal, interest rate, loan term, and repayment plan).

-

Q: Are all calculators created equal?

- A: No. Some are more sophisticated than others, incorporating more variables. Always check the source and methodology before using a calculator.

-

Q: What if my loan has a variable interest rate?

- A: Many basic calculators assume a fixed rate. For variable rates, the minimum payment can change over time. Use a calculator that accommodates variable rates for a more accurate prediction.

-

Q: Can I use these calculators for private student loans?

- A: Yes, but keep in mind the available repayment options may be more limited than with federal loans.

-

Q: What happens if I don't make the minimum payment?

- A: You'll likely incur late fees and potentially negatively impact your credit score. Delinquency could also lead to default.

Practical Tips: Maximizing the Benefits of a Minimum Student Loan Payment Calculator:

-

Explore multiple calculators: Compare results across several reputable calculators.

-

Understand the assumptions: Pay attention to the assumptions made by the calculator (e.g., fixed interest rates, no capitalization).

-

Plan for unexpected events: Build a buffer into your budget to accommodate unexpected expenses that could impact your ability to make payments.

-

Consider professional advice: Consult a financial advisor for personalized guidance on student loan repayment.

-

Keep track of your payments: Maintain accurate records of your payments and regularly check your loan statements for accuracy.

Final Conclusion: Wrapping Up with Lasting Insights:

A minimum student loan payment calculator is an invaluable tool for managing student loan debt. While these calculators offer valuable insights, it's essential to understand their limitations and use them in conjunction with sound financial planning and, if needed, professional guidance. By understanding the mechanics of these calculators and leveraging their functionality responsibly, you can navigate the complexities of student loan repayment more confidently and effectively, paving the way toward achieving your long-term financial goals.

Latest Posts

Latest Posts

-

Credit One Credit Increase

Apr 08, 2025

-

How Much Does Credit One Increase Credit Limit

Apr 08, 2025

-

How To Get Credit One To Increase Credit Limit

Apr 08, 2025

-

How Do I Increase My Credit One Credit Card Limit

Apr 08, 2025

-

How Long To Increase Capital One Credit Limit

Apr 08, 2025

Related Post

Thank you for visiting our website which covers about How Is Minimum Student Loan Payment Calculator . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.