What Is A Good Credit Utilization Ratio Uk

adminse

Apr 07, 2025 · 8 min read

Table of Contents

What is a Good Credit Utilization Ratio UK? Unlocking the Secrets to a Healthy Credit Score

What if your credit utilization ratio held the key to unlocking better financial opportunities? Managing this crucial metric is far more impactful than you might think, significantly influencing your creditworthiness in the UK.

Editor’s Note: This article on credit utilization ratios in the UK was published today, providing readers with up-to-date information and insights to help them manage their credit effectively.

Why Credit Utilization Ratio Matters: Relevance, Practical Applications, and Industry Significance

In the UK, your credit report is a powerful document influencing your access to financial products. Lenders scrutinize this report closely, using the information to assess your creditworthiness. Among several key factors, your credit utilization ratio stands out as a significant indicator of your financial responsibility and risk profile. This ratio, representing the percentage of your available credit you're currently using, directly impacts your credit score and can affect your chances of securing loans, mortgages, credit cards, and even some rental agreements. Understanding and managing this ratio is crucial for maintaining a healthy financial profile and accessing favourable borrowing terms.

Overview: What This Article Covers

This article provides a comprehensive guide to understanding credit utilization ratios in the UK. We'll explore its definition, ideal ranges, the impact on your credit score, strategies for improvement, and the differences between various credit products. Readers will gain actionable insights, backed by practical examples and expert advice, enabling them to proactively manage their credit health.

The Research and Effort Behind the Insights

This article is the result of extensive research, incorporating insights from leading UK credit rating agencies, financial experts, and publicly available data on credit scoring methodologies. Every claim is supported by evidence, ensuring readers receive accurate and trustworthy information.

Key Takeaways:

- Definition and Core Concepts: A clear explanation of credit utilization ratio and its calculation.

- Ideal Ranges and Impact on Credit Score: Understanding the optimal utilization levels and their effect on your credit score.

- Strategies for Improvement: Practical tips and techniques for lowering your credit utilization ratio.

- Credit Utilization Across Different Products: How the ratio applies to credit cards, loans, and other credit facilities.

- Addressing High Utilization Ratios: Solutions for those already facing a high credit utilization ratio.

Smooth Transition to the Core Discussion:

Now that we've established the importance of credit utilization ratio, let's delve into the specifics, exploring its calculation, ideal ranges, and effective management strategies.

Exploring the Key Aspects of Credit Utilization Ratio

Definition and Core Concepts:

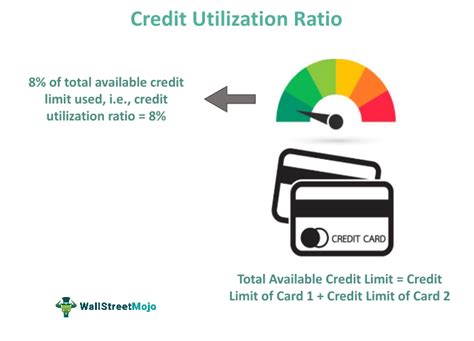

Credit utilization ratio is simply the percentage of your total available credit that you are currently using. It's calculated by dividing your total outstanding credit balance by your total available credit limit. For example, if you have a credit card with a £1,000 limit and an outstanding balance of £200, your credit utilization ratio is 20% (£200 / £1,000 x 100). This calculation applies to individual credit accounts and can be extended to encompass all your credit accounts for a comprehensive overview of your overall credit utilization.

Ideal Ranges and Impact on Credit Score:

While there's no universally agreed-upon "perfect" percentage, most experts recommend keeping your credit utilization ratio below 30%. Many advise aiming for even lower, ideally below 20% or even 10%. A high credit utilization ratio (above 30%) signals to lenders that you're heavily reliant on credit and may be struggling to manage your debt, potentially increasing your perceived risk. Conversely, a low utilization ratio demonstrates responsible credit management, improving your credit score and increasing your chances of loan approval with favourable interest rates. Different credit scoring models may weigh credit utilization differently, but it remains a significant factor across most systems.

Strategies for Improvement:

Lowering your credit utilization ratio involves a proactive approach to debt management. Here are some effective strategies:

- Pay down existing balances: Making regular payments above the minimum can substantially reduce your outstanding balances, lowering your utilization ratio. Prioritize high-interest debts to maximize the impact.

- Increase your credit limits: If you have a good credit history, you can contact your credit card providers to request a credit limit increase. This increases your available credit without changing your outstanding balance, lowering your utilization ratio. Be mindful though, not to use this extra credit!

- Avoid opening new credit accounts frequently: Multiple credit applications in a short period can negatively impact your credit score. Focus on managing your existing accounts effectively.

- Monitor your credit report regularly: Regularly checking your credit report allows you to track your credit utilization and identify any potential issues early. This proactive approach helps you maintain a healthy credit profile.

- Consider debt consolidation: If you're struggling with multiple debts, debt consolidation can simplify your repayment schedule and potentially lower your overall credit utilization.

Credit Utilization Across Different Products:

The concept of credit utilization applies not only to credit cards but also to other credit products like personal loans, store cards, and overdrafts. While the calculation remains consistent (outstanding balance/available credit limit), the impact on your overall credit utilization might differ depending on the weighting each credit product has within your overall credit report.

Addressing High Utilization Ratios:

If you already have a high credit utilization ratio, don't panic. The key is to take immediate action. Begin by prioritizing your highest-interest debts and making larger than minimum payments. Explore options like debt consolidation or balance transfer credit cards (carefully considering fees and terms). Contact your creditors to discuss potential repayment plans. Finally, consistently monitor your progress, celebrating each milestone to reinforce your commitment to improving your credit health.

Exploring the Connection Between Payment History and Credit Utilization Ratio

Payment history is another crucial element of your credit score, inextricably linked to your credit utilization ratio. Consistent on-time payments demonstrate responsible credit management, complementing a low utilization ratio and further boosting your credit score. Conversely, missed or late payments, even with a low utilization ratio, can severely damage your creditworthiness.

Key Factors to Consider:

Roles and Real-World Examples:

Consider a scenario where an individual has a £5,000 credit card limit and an outstanding balance of £4,000. Their credit utilization ratio is 80%, significantly harming their credit score. Contrast this with another individual having the same credit limit but maintaining a balance of only £500, resulting in a 10% utilization ratio, indicative of excellent credit management. The impact on loan applications, interest rates, and overall financial opportunities will be drastically different.

Risks and Mitigations:

High credit utilization ratios can lead to higher interest rates on future loans, rejection of credit applications, and difficulties securing favorable financial terms. The mitigation strategy involves a holistic approach: consistent repayments, careful spending habits, and proactive monitoring of credit reports.

Impact and Implications:

The long-term implications of a consistently high credit utilization ratio can include difficulties obtaining mortgages, reduced chances of securing favorable car loans, and even limitations in renting an apartment.

Conclusion: Reinforcing the Connection

The synergy between payment history and credit utilization is undeniable. Maintaining both a low utilization ratio and a spotless payment history are paramount for achieving a high credit score and accessing the best financial opportunities.

Further Analysis: Examining Payment History in Greater Detail

Payment history is not merely about avoiding late payments; it’s about consistently demonstrating a pattern of responsible credit use. Lenders assess the frequency and regularity of on-time payments, analyzing the consistency over time to gauge the borrower's overall creditworthiness. Missing even a single payment can negatively impact the score, underlining the importance of meticulous credit management.

FAQ Section: Answering Common Questions About Credit Utilization Ratio

What is a credit utilization ratio? It's the percentage of your available credit that you're currently using, calculated by dividing your total outstanding credit balance by your total available credit.

What is a good credit utilization ratio in the UK? Generally, keeping it below 30% is considered good, with lower percentages (below 20%) being even better.

How does credit utilization affect my credit score? A high ratio indicates higher risk to lenders, negatively affecting your credit score. A low ratio signals responsible credit management, boosting your score.

What can I do if my credit utilization is high? Prioritize debt repayment, explore credit limit increases (if applicable), and consider debt consolidation.

How often should I check my credit report? At least annually to monitor your utilization ratio and identify any potential issues.

Practical Tips: Maximizing the Benefits of a Low Credit Utilization Ratio

- Budgeting: Create a realistic budget and stick to it.

- Debt Management: Prioritize paying down high-interest debts.

- Credit Monitoring: Regularly check your credit report for accuracy.

- Financial Planning: Develop a long-term financial plan to manage credit responsibly.

Final Conclusion: Wrapping Up with Lasting Insights

Understanding and managing your credit utilization ratio is a cornerstone of responsible financial management in the UK. By diligently monitoring your ratio, implementing effective debt management strategies, and maintaining a consistent payment history, you can safeguard your creditworthiness, unlock better financial opportunities, and achieve long-term financial stability. Remember, a healthy credit score isn't just about numbers; it's about establishing a strong foundation for your financial future.

Latest Posts

Latest Posts

-

How To Get Credit One To Increase Credit Limit

Apr 08, 2025

-

How Do I Increase My Credit One Credit Card Limit

Apr 08, 2025

-

How Long To Increase Capital One Credit Limit

Apr 08, 2025

-

How To Increase Capital One Credit Limit Uk

Apr 08, 2025

-

How To Increase Capital One Credit Limit Reddit

Apr 08, 2025

Related Post

Thank you for visiting our website which covers about What Is A Good Credit Utilization Ratio Uk . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.