How Much Is The Payment On A Heloc

adminse

Apr 05, 2025 · 8 min read

Table of Contents

Decoding HELOC Payments: A Comprehensive Guide

What if securing the ideal home improvement or tackling unexpected expenses hinged on a clear understanding of HELOC payments? Navigating the complexities of Home Equity Lines of Credit (HELOCs) requires a thorough grasp of its payment structure and potential implications.

Editor’s Note: This article on HELOC payments was published today, providing you with the most up-to-date information and insights available. We've broken down the complexities of HELOC payment calculations, exploring various scenarios and providing actionable advice to help you make informed financial decisions.

Why HELOC Payments Matter: Relevance, Practical Applications, and Industry Significance

HELOCs have become a cornerstone of personal finance, offering homeowners a flexible way to access funds secured by their home's equity. Understanding the intricacies of HELOC payments is crucial for responsible borrowing and avoiding potential financial pitfalls. From home renovations and debt consolidation to unexpected medical bills and business ventures, HELOCs provide a versatile financing tool. However, miscalculating or misunderstanding payments can lead to late fees, damage to credit scores, and even foreclosure. This article aims to equip you with the knowledge to confidently navigate the world of HELOC payments.

Overview: What This Article Covers

This comprehensive guide unravels the intricacies of HELOC payments. We'll explore the factors influencing payment amounts, dissect the different payment phases (draw and repayment), examine interest calculations, and discuss strategies for managing payments effectively. Furthermore, we will explore the connection between interest rates and payment amounts and delve into potential risks and mitigation strategies. Finally, we'll address frequently asked questions and provide practical tips for maximizing the benefits of a HELOC.

The Research and Effort Behind the Insights

This article is the product of extensive research, drawing upon authoritative sources including financial institutions' websites, industry publications, and legal documents related to HELOC agreements. The information presented is intended to provide accurate and trustworthy guidance, although it should not be considered financial advice. Consult with a qualified financial advisor before making any financial decisions.

Key Takeaways: Summarize the Most Essential Insights

- Understanding Draw Period vs. Repayment Period: Knowing the distinction and implications for your payments.

- Variable vs. Fixed Interest Rates: The impact on your monthly payment and overall cost.

- Calculating Interest Accrual: Understanding how interest is calculated on your outstanding balance.

- Payment Strategies: Exploring options for minimizing interest charges and managing your debt responsibly.

- Potential Risks and Mitigation: Identifying potential problems and steps to avoid them.

Smooth Transition to the Core Discussion

With a foundation laid on the importance of understanding HELOC payments, let's delve into the critical aspects that determine your monthly payments and overall repayment strategy.

Exploring the Key Aspects of HELOC Payments

1. The Draw Period: This is the initial phase of your HELOC, where you can borrow funds up to your approved credit limit. During this period, you typically only make interest-only payments. This means you only pay the interest that accrues on the outstanding balance; you don't pay down the principal. The length of the draw period is specified in your HELOC agreement and can vary considerably, ranging from 5 to 10 years or even longer.

2. The Repayment Period: Once the draw period ends, the HELOC transitions to the repayment period. During this phase, you'll typically make amortized payments, meaning each payment includes both principal and interest. The repayment period is also defined in your agreement and usually spans 10 to 20 years. The length of the repayment period significantly impacts your monthly payments. A longer repayment period results in lower monthly payments but higher overall interest costs. A shorter repayment period results in higher monthly payments but lower overall interest costs.

3. Interest Rate Calculation: HELOC interest rates are usually variable, meaning they fluctuate based on market conditions and a benchmark interest rate (like the prime rate). This variability introduces uncertainty into your monthly payment calculations. Understanding how the interest rate is applied to your outstanding balance is crucial. Interest is typically calculated daily on the outstanding balance and added to your account. Your monthly payment then covers the accrued interest plus a portion of the principal.

4. Factors Influencing HELOC Payments: Several factors determine the precise amount of your monthly HELOC payment. These include:

- Credit Limit: The higher your credit limit, the greater your potential borrowing capacity, and potentially higher monthly interest payments if you borrow heavily.

- Interest Rate: As explained above, a variable rate can lead to fluctuating monthly payments.

- Loan Term: The length of the repayment period (longer term equals lower monthly payment, but higher total interest).

- Draw Amount: How much you borrow during the draw period directly impacts your interest payments.

- Payment Frequency: Monthly payments are standard, but some lenders may offer options for bi-weekly or even weekly payments.

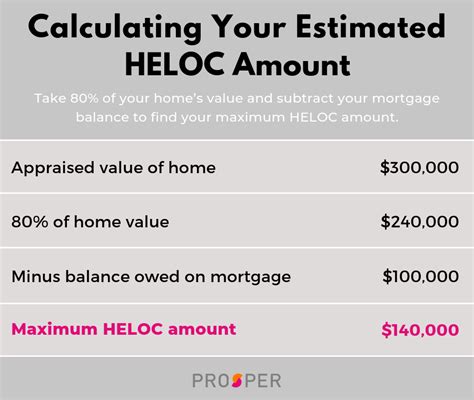

5. Calculating Your HELOC Payment: While lenders provide payment estimates, understanding the underlying calculation is valuable. A simple calculation won't fully reflect the intricacies of a variable-rate loan, but it illustrates the core principle. You can use an online HELOC calculator or consult with your lender for an accurate projection. These calculators generally require inputs such as the loan amount, interest rate, and loan term.

Closing Insights: Summarizing the Core Discussion

HELOC payments are multifaceted, driven by a blend of interest-only and amortized phases, variable interest rates, and the borrower's creditworthiness. Understanding these dynamics empowers you to make informed borrowing decisions, manage your payments effectively, and avoid potential financial pitfalls.

Exploring the Connection Between Interest Rates and HELOC Payments

The relationship between interest rates and HELOC payments is paramount. Variable interest rates directly impact your monthly payment amounts. When interest rates rise, your monthly payment will increase (assuming you've drawn the maximum amount), and vice versa. This creates both opportunities and challenges. Rising rates necessitate careful budgeting and financial planning to avoid default. Conversely, falling rates can lead to lower monthly payments, creating more financial breathing room.

Key Factors to Consider:

- Roles and Real-World Examples: Consider a scenario where interest rates rise unexpectedly during the draw period. This could significantly increase your monthly payments, straining your budget unless you've prepared for potential rate increases.

- Risks and Mitigations: The biggest risk associated with variable interest rates is payment shock from a sudden increase. Mitigation strategies involve establishing an emergency fund, creating a budget that allows for rate fluctuations, and exploring the possibility of a fixed-rate HELOC (though these are less common).

- Impact and Implications: The implications extend beyond the monthly payment. Higher interest rates lead to a greater overall cost of borrowing, ultimately increasing the total amount repaid.

Conclusion: Reinforcing the Connection

The dynamic interplay between interest rates and HELOC payments underscores the importance of careful financial planning and proactive risk management. Understanding the potential for rate fluctuations allows for informed decision-making and mitigates potential financial strain.

Further Analysis: Examining Interest Rate Volatility in Greater Detail

Understanding the factors driving interest rate volatility is crucial. These factors include broader economic conditions, inflation, central bank policies, and the overall performance of financial markets. Monitoring these factors can help borrowers anticipate potential changes in their HELOC payments.

FAQ Section: Answering Common Questions About HELOC Payments

-

What is a HELOC? A Home Equity Line of Credit (HELOC) is a loan that uses your home's equity as collateral.

-

How are HELOC payments calculated? HELOC payments usually consist of interest-only payments during the draw period and amortized payments during the repayment period, calculated based on the outstanding balance and the applicable interest rate.

-

What happens if I miss a HELOC payment? Missing payments can result in late fees, damage to your credit score, and potentially foreclosure.

-

Can I refinance my HELOC? Refinancing might be possible, depending on your lender and the prevailing market conditions. It may help lower your interest rate or adjust your payment schedule.

-

What are the risks associated with HELOCs? The primary risks include fluctuating interest rates, the possibility of foreclosure if payments aren’t made, and potential damage to your credit score.

Practical Tips: Maximizing the Benefits of a HELOC

- Shop around for the best rates and terms: Don't settle for the first offer you receive.

- Carefully review your HELOC agreement: Understand the terms, conditions, and payment schedule.

- Create a realistic budget: Account for potential interest rate increases.

- Establish an emergency fund: This will provide a buffer in case of unexpected expenses or payment increases.

- Make payments on time: Avoid late fees and protect your credit score.

- Consider making extra payments: This can help you pay off your HELOC faster and reduce overall interest costs.

Final Conclusion: Wrapping Up with Lasting Insights

Mastering the intricacies of HELOC payments is crucial for responsible homeownership. By understanding the draw period, repayment period, interest rate calculations, and influencing factors, homeowners can make informed borrowing decisions, effectively manage their payments, and unlock the financial flexibility offered by HELOCs while mitigating potential risks. Remember to consult with financial professionals for personalized guidance.

Latest Posts

Latest Posts

-

How To Establish Your Credit Score Without A Credit Card

Apr 07, 2025

-

What Credit Score Do You Need To Get Alaska Credit Card

Apr 07, 2025

-

What Credit Score Needed For Alaska Airlines Visa

Apr 07, 2025

-

What Credit Score Do You Need For An Alaska Card

Apr 07, 2025

-

What Credit Score Do You Need For Alaska Airlines Visa

Apr 07, 2025

Related Post

Thank you for visiting our website which covers about How Much Is The Payment On A Heloc . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.