Minimum Payment On Credit Card Calculator Uk

adminse

Apr 05, 2025 · 7 min read

Table of Contents

Unlocking the Secrets: A Comprehensive Guide to UK Minimum Credit Card Payment Calculators

What if understanding your minimum credit card payment could save you thousands over the life of your debt? Mastering minimum payment calculations is crucial for responsible credit card management in the UK.

Editor’s Note: This article on UK minimum credit card payment calculators was published today, providing you with the most up-to-date information and strategies for managing your credit card debt effectively.

Why Minimum Credit Card Payment Calculators Matter:

Understanding minimum credit card payments is paramount for several reasons. In the UK, failing to meet even the minimum payment can have severe consequences, including late payment fees, increased interest charges, damage to your credit score, and potential debt collection actions. Conversely, diligently tracking and managing minimum payments empowers you to control your debt, avoid unnecessary fees, and plan for responsible repayment strategies. These calculators offer transparency and allow for proactive financial planning, helping individuals avoid the pitfalls of high-interest debt.

Overview: What This Article Covers

This article delves into the intricacies of minimum credit card payment calculators in the UK. We will explore how these calculators work, the factors influencing minimum payment calculations, potential pitfalls of relying solely on minimum payments, alternative repayment strategies, and the importance of understanding the overall cost of credit. Readers will gain actionable insights, backed by real-world examples and practical tips.

The Research and Effort Behind the Insights

This comprehensive guide is the culmination of extensive research, incorporating information from reputable financial websites, consumer protection agencies, and industry reports. We have analyzed various calculator methodologies and considered the impact of different interest rates and repayment periods. The aim is to provide readers with accurate and trustworthy information to make informed financial decisions.

Key Takeaways:

- Understanding Minimum Payment Calculations: A detailed breakdown of how UK credit card companies determine minimum payments.

- Factors Influencing Minimum Payments: Exploring variables such as outstanding balance, interest rate, and promotional periods.

- Pitfalls of Minimum Payments: Highlighting the long-term costs and potential debt traps associated with solely making minimum payments.

- Alternative Repayment Strategies: Presenting various approaches for faster debt repayment, such as debt consolidation and balance transfers.

- Using Calculators Effectively: Practical tips for utilizing online tools to manage your credit card debt.

Smooth Transition to the Core Discussion:

Now that we've established the significance of understanding minimum credit card payments, let's explore the core mechanisms of UK minimum payment calculators and the crucial factors that influence them.

Exploring the Key Aspects of Minimum Credit Card Payment Calculators

1. Definition and Core Concepts:

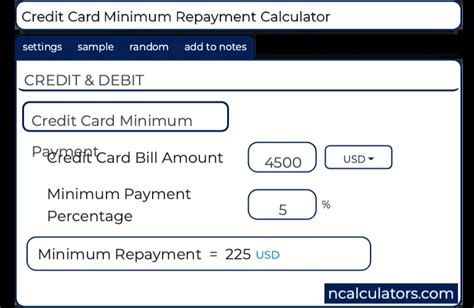

A minimum credit card payment calculator is a tool, often found online, that estimates the minimum amount a cardholder must pay each month to avoid penalties. This calculation is generally based on a percentage of the outstanding balance (often 1-3%, but can vary depending on the card issuer) plus any accrued interest and other charges. It's crucial to understand that this is the minimum required payment, and paying only this amount can significantly prolong the repayment period and increase the total interest paid.

2. Applications Across Industries:

While primarily used by individual consumers, these calculators can also be indirectly useful for businesses that manage employee expenses or corporate credit cards. They offer a quick and efficient way to estimate minimum payments and track spending.

3. Challenges and Solutions:

One primary challenge is the lack of standardization across credit card providers. Minimum payment calculations can differ slightly, and the information presented by online calculators might not perfectly mirror the calculations of specific issuers. To overcome this, always check your credit card statement for the precise minimum payment due.

4. Impact on Innovation:

The increasing sophistication of online financial tools is leading to more user-friendly and accurate minimum payment calculators. These tools often integrate with budgeting apps and personal finance platforms, providing a holistic view of an individual's financial health.

Closing Insights: Summarizing the Core Discussion

Understanding your minimum credit card payment is far more than simply fulfilling a contractual obligation; it’s a crucial element in responsible financial management. Paying only the minimum can trap you in a cycle of high-interest debt for years. Using calculators provides a starting point for informed financial planning, but always refer to your statement for the precise amount due.

Exploring the Connection Between Interest Rates and Minimum Credit Card Payments

The relationship between interest rates and minimum credit card payments is paramount. Higher interest rates significantly impact the minimum payment calculation because a larger portion of the monthly payment goes towards covering interest charges, leaving less to reduce the principal balance. This leads to slower debt repayment and ultimately increases the overall cost of borrowing.

Key Factors to Consider:

-

Roles and Real-World Examples: Imagine two individuals with the same outstanding balance, but one has a card with a 15% APR and the other with a 25% APR. The individual with the higher rate will likely have a higher minimum payment, with a larger proportion allocated to interest. This results in them paying off the debt much slower and paying significantly more interest over the life of the loan.

-

Risks and Mitigations: The main risk is getting trapped in a cycle of minimum payments, never making substantial inroads into the principal balance. Mitigation strategies include seeking lower-interest credit cards through balance transfers, negotiating a lower interest rate with your current provider, or exploring debt consolidation options.

-

Impact and Implications: The long-term impact of high interest rates combined with only making minimum payments can result in thousands of pounds in additional interest charges and significantly extended repayment periods. This can restrict financial flexibility and delay achieving long-term financial goals.

Conclusion: Reinforcing the Connection

The intricate link between interest rates and minimum credit card payments underscores the importance of proactive debt management. Understanding this relationship allows individuals to make informed decisions about repayment strategies and potentially avoid the costly consequences of protracted debt.

Further Analysis: Examining APR and Its Impact in Greater Detail

Annual Percentage Rate (APR) is the annual interest rate charged on a credit card balance. It's a crucial factor in minimum payment calculations. A higher APR means more interest accrues each month, influencing the minimum payment amount and extending the repayment timeline. Understanding the APR is critical for comparing different credit cards and making informed borrowing decisions. Various online tools allow for APR comparison, showing the cumulative interest over the life of the loan under different repayment scenarios.

FAQ Section: Answering Common Questions About Minimum Credit Card Payment Calculators

-

What is a minimum credit card payment calculator? It's an online tool that estimates the minimum amount you need to pay each month to avoid late payment fees.

-

How accurate are these calculators? They provide estimates based on standard calculations, but the actual minimum payment on your statement might slightly vary due to specific card provider policies.

-

Can I only make the minimum payment? Yes, you can, but this will significantly increase the total interest paid and extend the repayment period.

-

Where can I find a reliable minimum credit card payment calculator? Reputable financial websites and comparison sites offer these calculators. Always ensure the site is secure and trustworthy.

-

What happens if I miss a minimum payment? You will likely incur late payment fees and damage your credit score. Your interest rate may also increase.

Practical Tips: Maximizing the Benefits of Minimum Credit Card Payment Calculators

- Use Multiple Calculators: Compare results from different calculators to ensure accuracy.

- Check Your Statement: Always verify the minimum payment amount on your official statement.

- Explore Alternative Strategies: Consider debt consolidation or balance transfers if minimum payments are proving challenging.

- Budget Effectively: Create a realistic budget to allocate sufficient funds for credit card repayments.

- Seek Financial Advice: Consult a financial advisor if you’re struggling to manage your credit card debt.

Final Conclusion: Wrapping Up with Lasting Insights

Minimum credit card payment calculators are valuable tools, but they should be used responsibly. While they offer a starting point for managing credit card debt, understanding the implications of paying only the minimum is crucial. By proactively managing your credit card debt, considering alternative repayment options, and seeking help when needed, you can avoid the costly pitfalls of long-term high-interest debt. Responsible credit card management is key to building a strong financial future.

Latest Posts

Latest Posts

-

What Happens When You Max Out Your Credit Card

Apr 08, 2025

-

What Happens If You Max Out A Credit Card

Apr 08, 2025

-

What Happens When I Max Out A Credit Card

Apr 08, 2025

-

What Happens When U Max Out A Credit Card

Apr 08, 2025

-

What To Do When You Max Out A Credit Card

Apr 08, 2025

Related Post

Thank you for visiting our website which covers about Minimum Payment On Credit Card Calculator Uk . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.