Wm/reuters Benchmark Rates

adminse

Apr 01, 2025 · 8 min read

Table of Contents

Decoding the WM/Reuters Benchmark Rates: A Deep Dive into Global Finance

What if the integrity of global financial markets hinges on the accuracy and transparency of benchmark interest rates? The WM/Reuters benchmark rates, once considered the gold standard, now stand as a crucial case study in the evolution of financial regulation and the fight against manipulation.

Editor’s Note: This article provides a comprehensive overview of WM/Reuters benchmark rates, their history, the scandals that led to their reform, and the lasting impact on global financial markets. The information presented is current as of today's date.

Why WM/Reuters Benchmark Rates Matter: Relevance, Practical Applications, and Industry Significance

The WM/Reuters benchmark rates, specifically the London Interbank Offered Rate (LIBOR), were for decades the cornerstone of global finance. These rates served as a reference point for trillions of dollars worth of financial contracts, impacting everything from mortgages and credit cards to complex derivatives and corporate loans. Their significance stemmed from their widespread use and the assumption of their accuracy and reliability. The rates provided a benchmark for calculating interest payments, pricing financial instruments, and assessing creditworthiness. Their importance spanned across numerous sectors, including banking, insurance, corporate finance, and even individual consumers. Understanding the history and evolution of these rates, particularly in light of past manipulation scandals, is crucial for navigating the complexities of modern financial markets.

Overview: What This Article Covers

This article delves into the intricacies of WM/Reuters benchmark rates, tracing their history from their inception to the present day. We will explore the LIBOR scandal, the subsequent regulatory reforms, and the transition to alternative reference rates. We'll examine the crucial role of the administrator, the contributing banks, and the inherent challenges in setting truly representative benchmark rates. Finally, we will analyze the future implications of these changes and what they mean for market participants.

The Research and Effort Behind the Insights

This article draws upon extensive research, including reports from regulatory bodies like the Financial Conduct Authority (FCA), academic studies on benchmark rate manipulation, and news articles covering the LIBOR scandal and its aftermath. The analysis incorporates insights from financial experts and regulatory documents to ensure accuracy and a comprehensive understanding of the complexities involved. A structured approach has been employed to present the information in a clear, concise, and easily digestible manner.

Key Takeaways:

- Historical Context of LIBOR: Understanding the origins and evolution of LIBOR and its role as a global benchmark.

- The LIBOR Scandal: Analyzing the manipulation allegations, investigations, and consequences.

- Regulatory Response and Reform: Examining the regulatory changes implemented to prevent future manipulation.

- Transition to Alternative Rates: Exploring the shift towards alternative benchmark rates like SOFR and its implications.

- Lessons Learned and Future Outlook: Identifying key lessons learned from the LIBOR crisis and the future of benchmark rate setting.

Smooth Transition to the Core Discussion

Having established the importance of WM/Reuters benchmark rates and the scope of this article, let's delve into the details, starting with the historical context of LIBOR and its rise to prominence.

Exploring the Key Aspects of WM/Reuters Benchmark Rates

1. Definition and Core Concepts:

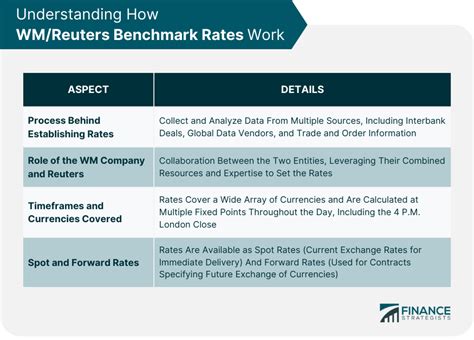

The WM/Reuters benchmark rates, primarily LIBOR, were traditionally calculated based on the estimated rates at which banks could borrow unsecured funds from one another in the interbank market. The rates were submitted daily by a panel of contributing banks, and the average, after removing outliers, constituted the published benchmark rate. This seemingly simple process, however, proved susceptible to manipulation. The reliance on self-reported estimates, combined with the lack of robust oversight, created vulnerabilities that were eventually exploited. Other rates, such as the Euro Interbank Offered Rate (EURIBOR), followed a similar methodology.

2. Applications Across Industries:

LIBOR's widespread adoption stemmed from its role as a reliable and widely accepted benchmark. Its applications spanned across diverse financial sectors:

- Loans: LIBOR formed the basis for interest rate calculations on various loans, including mortgages, corporate loans, and consumer credit.

- Derivatives: Trillions of dollars worth of derivatives, including interest rate swaps and futures contracts, were priced relative to LIBOR.

- Bonds: Some bonds had their coupon payments linked to LIBOR.

- Financial Benchmarks: LIBOR served as a reference rate for a variety of financial indices and benchmarks.

3. Challenges and Solutions:

The most significant challenge associated with LIBOR was its susceptibility to manipulation. The lack of transparency and the reliance on self-reported data allowed banks to influence the reported rates to their advantage. The solutions involved a multifaceted approach:

- Increased Regulatory Oversight: Stricter scrutiny of the rate-setting process and increased penalties for manipulation.

- Transition to Alternative Rates: Development and implementation of robust, transparent, and manipulation-resistant alternative benchmark rates.

- Improved Data Collection: Moving away from self-reported estimates towards more objective and observable data.

4. Impact on Innovation:

The LIBOR scandal significantly impacted financial innovation, forcing a re-evaluation of benchmark rate methodologies and promoting the development of more robust and transparent alternatives. The transition has driven innovation in data collection, rate calculation methods, and regulatory frameworks.

Closing Insights: Summarizing the Core Discussion

The WM/Reuters benchmark rates, epitomized by LIBOR, played a pivotal role in global finance for decades. However, the scandal exposed the inherent risks of relying on self-reported data and the lack of robust oversight. The ensuing reforms have fundamentally reshaped the landscape of benchmark rate setting, highlighting the importance of transparency, accuracy, and regulatory oversight in maintaining the integrity of financial markets.

Exploring the Connection Between the Interbank Market and WM/Reuters Benchmark Rates

The interbank market, the arena where banks lend to each other, is intrinsically linked to WM/Reuters benchmark rates. The rates, in theory, reflected the prevailing borrowing costs within this market. However, the reality was far more nuanced.

Key Factors to Consider:

Roles and Real-World Examples: The interbank market's health and liquidity directly influence the accuracy of benchmark rates. Periods of stress or reduced liquidity can lead to artificially inflated rates, which distort the true picture of borrowing costs. The 2008 financial crisis demonstrated this acutely, where interbank lending dried up, leading to significant volatility and distortions in LIBOR.

Risks and Mitigations: The reliance on the interbank market's inherent self-regulation presented significant risks. Banks could manipulate their submissions to benefit their trading positions or mask underlying financial weaknesses. Mitigations included stricter regulatory oversight, greater transparency in data reporting, and the development of alternative, less susceptible benchmark rates.

Impact and Implications: The manipulation of LIBOR had far-reaching implications. It distorted lending costs, influenced investment decisions, and created an uneven playing field for market participants. It eroded trust in the financial system and led to significant financial losses for many institutions and individuals.

Conclusion: Reinforcing the Connection

The symbiotic relationship between the interbank market and benchmark rates like LIBOR is undeniable. The weaknesses in the interbank market's self-regulation contributed significantly to the LIBOR scandal. Understanding this connection is crucial for designing robust and reliable benchmark rate methodologies in the future.

Further Analysis: Examining the Role of Contributing Banks in Greater Detail

The contributing banks played a central role in the WM/Reuters benchmark rate-setting process. Their submissions directly influenced the published rates. However, this involvement created significant opportunities for manipulation. Banks could, and did, submit biased rates to gain competitive advantages in various financial transactions. The lack of rigorous oversight and accountability allowed this behavior to persist for years. The investigation into the LIBOR scandal revealed a culture of complacency and disregard for the integrity of the benchmark rates. This analysis reinforces the need for independent oversight and robust penalties for manipulation.

FAQ Section: Answering Common Questions About WM/Reuters Benchmark Rates

What is LIBOR? LIBOR, or the London Interbank Offered Rate, was a benchmark interest rate that reflected the cost of borrowing unsecured funds between banks in the London interbank market. It served as the basis for many financial instruments.

How was LIBOR calculated? LIBOR was calculated daily based on submissions from a panel of contributing banks. The average of these submissions, after removing outliers, constituted the published LIBOR rate.

Why was LIBOR discontinued? LIBOR was discontinued due to concerns about its susceptibility to manipulation and the lack of sufficient underlying transactions to support its calculation.

What are the alternative rates replacing LIBOR? Several alternative rates are replacing LIBOR, including the Secured Overnight Financing Rate (SOFR) in the US, SONIA (Sterling Overnight Index Average) in the UK, and €STR (Euro Short-Term Rate) in the Eurozone. These rates are generally based on observable market transactions, rather than expert judgment.

What are the implications of the shift to alternative rates? The transition to alternative rates necessitates significant adjustments to financial contracts, systems, and processes. This transition is a complex and lengthy process, requiring careful planning and coordination across the financial industry.

Practical Tips: Maximizing the Understanding of WM/Reuters Benchmark Rates

- Understand the Historical Context: Knowing the history of LIBOR and its eventual downfall helps in appreciating the complexities of benchmark rate setting.

- Familiarize Yourself with Alternative Rates: Understanding the characteristics and methodologies of alternative rates such as SOFR, SONIA, and €STR is essential for navigating the changing landscape.

- Stay Informed About Regulatory Developments: Keep abreast of regulatory changes and guidelines related to benchmark rates.

Final Conclusion: Wrapping Up with Lasting Insights

The WM/Reuters benchmark rates, and the LIBOR scandal in particular, serve as a cautionary tale regarding the importance of transparency, accountability, and robust regulatory oversight in financial markets. The transition to alternative rates signifies a significant shift towards a more transparent and reliable benchmark rate system. The lessons learned from this experience will undoubtedly shape the future of financial market regulation and contribute to a more resilient and trustworthy global financial system. The continued vigilance and adaptation within the financial community are crucial to ensuring the stability and integrity of future benchmark rates.

Latest Posts

Latest Posts

-

How Much Of 300 Credit Limit Should I Use

Apr 07, 2025

-

If I Have A 1000 Credit Limit How Much Should I Spend

Apr 07, 2025

-

How Much Of My Credit Limit Should I Use

Apr 07, 2025

-

How Much Of My 1500 Credit Limit Should I Use

Apr 07, 2025

-

What Does It Mean When Your Credit Score Goes To 0

Apr 07, 2025

Related Post

Thank you for visiting our website which covers about Wm/reuters Benchmark Rates . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.