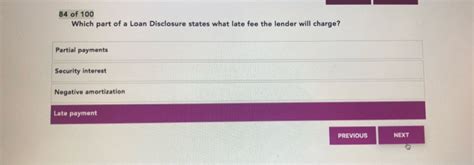

Which Part Of A Loan Disclosure States What Late Fee The Lender Will Charge Quizlet

adminse

Apr 02, 2025 · 8 min read

Table of Contents

Decoding Loan Disclosures: Finding the Late Fee Information

What if your financial well-being hinged on understanding the fine print of loan disclosures? Mastering loan documents is crucial for responsible borrowing and avoiding unexpected costs.

Editor’s Note: This comprehensive guide to understanding late fees in loan disclosures was created to empower borrowers with the knowledge to navigate the complexities of loan agreements. We’ve meticulously examined various disclosure formats to provide clear, actionable information.

Why Understanding Loan Late Fees Matters:

Navigating the world of loans requires understanding not only the interest rate but also the potential penalties for late payments. Late fees can significantly impact the overall cost of borrowing, potentially snowballing into substantial amounts over the loan's lifetime. Knowing where to find this critical information in your loan disclosure is paramount for responsible financial management. Ignoring these details can lead to unexpected expenses and damage your credit score. Understanding late fees allows for proactive planning and budgeting, ensuring you can meet your payment obligations and avoid penalties. This knowledge empowers you to compare loan offers effectively, selecting the option most aligned with your financial capabilities. Moreover, it helps you to engage in informed discussions with lenders and negotiate terms if necessary.

Overview: What This Article Covers

This article will provide a detailed exploration of loan disclosures, focusing specifically on the location and details of late fee information. We will examine various loan types, including mortgages, auto loans, personal loans, and student loans, and highlight the commonalities and differences in their disclosure practices. We’ll analyze different disclosure formats and provide practical examples to illustrate where to find the crucial late fee details. Finally, we'll address frequently asked questions and offer practical tips to help you manage your loan payments effectively.

The Research and Effort Behind the Insights

The information presented here is based on extensive research into federal and state regulations governing loan disclosures, including the Truth in Lending Act (TILA) and other relevant legislation. Analysis of sample loan documents from various lenders and a review of industry best practices have informed this guide. This research ensures the accuracy and reliability of the information provided, empowering you to make informed decisions about your borrowing.

Key Takeaways:

- Location of Late Fee Information: The precise location varies slightly depending on the lender and loan type, but the information is always mandated by law to be clearly disclosed.

- Regulation and Compliance: Loan disclosures are governed by federal and state regulations to protect borrowers.

- Types of Late Fees: Different lenders may use various calculation methods, including flat fees or percentage-based fees.

- Avoiding Late Fees: Proactive financial planning and budgeting are key to avoiding late fees.

Smooth Transition to the Core Discussion:

Now that we understand the importance of understanding late fees in loan disclosures, let's delve into the specifics of where to find this critical information across different loan types.

Exploring the Key Aspects of Loan Disclosure and Late Fees

1. The Truth in Lending Act (TILA) and its Role:

The Truth in Lending Act (TILA) is a cornerstone of consumer protection in the United States. Enacted in 1968, it mandates that lenders provide borrowers with clear and accurate information about the cost of credit. This includes the annual percentage rate (APR), finance charges, and other fees associated with the loan. Crucially, TILA requires the disclosure of any late payment fees.

2. Where to Find Late Fee Information in Loan Disclosures:

The specific location of late fee information within a loan disclosure can vary slightly depending on the lender and the specific loan document format. However, the information is consistently included within the key sections detailing the terms and conditions of the loan agreement. Common locations include:

- Loan Agreement: This is the primary legal document outlining the terms of the loan. The late fee information is usually found in a section dedicated to fees and charges. Look for headings such as "Fees," "Charges," "Late Payment Penalties," or similar.

- Schedule of Payments: Some lenders include the late fee information within the payment schedule itself, either as a footnote or a separate line item detailing the penalty for a late payment.

- Loan Disclosure Statement: This document, often separate from the loan agreement, provides a summary of the key terms of the loan, including fees and charges. The late fee information is typically included in this statement as well.

3. Analyzing Different Loan Types:

While the principles of TILA apply broadly, the specific format and presentation of late fee information may differ slightly across various loan types:

-

Mortgages: Mortgage disclosures, often lengthy and detailed, typically include late fee information within the "Loan Terms" or "Fees and Charges" section of the loan agreement. The information may be specified as a flat fee or a percentage of the monthly payment.

-

Auto Loans: Auto loan disclosures often have a dedicated section detailing fees, including late payment penalties. These fees are typically expressed as a fixed amount or a percentage of the missed payment.

-

Personal Loans: Similar to auto loans, personal loan disclosures clearly state the late fee. This is usually located within the terms and conditions or a separate fee schedule.

-

Student Loans: Federal student loans have specific regulations regarding fees, and late fee information is usually readily available on the lender's website or in the loan documents. Private student loans follow similar disclosure practices as personal loans.

4. Understanding Different Late Fee Structures:

Lenders may employ various methods for calculating late fees. Common structures include:

- Flat Fee: A fixed amount charged for each late payment, regardless of the payment amount.

- Percentage-Based Fee: A percentage of the missed payment amount is charged as a late fee.

- Combination: Some lenders may use a combination of flat fees and percentage-based fees.

5. Common Variations in Disclosure Practices:

While TILA mandates disclosure, lenders may present this information differently. Some may use clear, concise language, while others might bury it within complex legal jargon. Paying close attention to detail is vital to understanding the exact implications of a late payment.

Exploring the Connection Between Loan Agreement Clarity and Borrower Understanding:

The clarity and accessibility of the loan agreement significantly impact borrower understanding. A well-structured agreement with clear headings, bullet points, and straightforward language promotes better comprehension. Conversely, convoluted language and a disorganized layout can obscure crucial information like late payment fees, leading to confusion and potential financial hardship.

Key Factors to Consider:

-

Roles and Real-World Examples: Consider a scenario where a borrower misses a mortgage payment. A clear disclosure stating a $50 flat fee for late payments empowers the borrower to budget accordingly. Conversely, an unclear disclosure could lead to a significantly higher, unexpected penalty.

-

Risks and Mitigations: The risk associated with unclear disclosures is the potential for borrowers to unknowingly incur significant late fees, impacting their credit score and overall financial stability. Mitigation lies in diligently reviewing the loan documents and seeking clarification from the lender if needed.

-

Impact and Implications: The lack of clear disclosure regarding late fees can lead to financial distress for borrowers who may not have budgeted for such charges. This can have long-term repercussions, impacting their creditworthiness and future borrowing ability.

Conclusion: Reinforcing the Connection Between Clear Disclosures and Financial Well-being:

The connection between clear loan disclosures and borrower financial well-being is undeniable. Accurate and easily accessible information about late fees is critical for responsible borrowing. Lenders must prioritize clarity in their documentation, and borrowers should actively review these documents to fully understand the financial implications of their loan agreements.

Further Analysis: Examining the Impact of Late Fees on Credit Scores:

Late payments, and the associated late fees, have a significant impact on a borrower's credit score. Credit bureaus track payment history, and consistent late payments can severely damage creditworthiness, potentially leading to higher interest rates and difficulty securing future loans.

FAQ Section: Answering Common Questions About Loan Disclosures and Late Fees:

Q: What happens if I miss a payment? A: Missing a payment will typically result in a late fee, as specified in your loan agreement. This late fee could be a fixed amount or a percentage of the missed payment, depending on your lender's policy. Moreover, your credit score will likely be negatively impacted.

Q: Where can I find my loan agreement? A: You should have received a copy of your loan agreement at the time you signed the loan. You might also be able to access it electronically through your lender's online portal.

Q: What if I can't afford the late fee? A: If you anticipate difficulties making a payment, contact your lender immediately. They may offer options such as payment arrangements or hardship programs to avoid a late payment and its associated fees.

Q: Are late fees negotiable? A: While not always guaranteed, it's sometimes possible to negotiate a reduced late fee with your lender. Contacting them promptly and explaining your circumstances may lead to a favorable outcome.

Practical Tips: Maximizing the Benefits of Understanding Loan Disclosures:

- Read the Entire Document Carefully: Don't rush the process. Take your time to understand every section.

- Highlight Key Information: Use a highlighter or make notes to emphasize important details, such as the late fee amount and calculation method.

- Ask Questions: If anything is unclear, contact your lender for clarification. It's better to ask questions than to assume and potentially face financial consequences.

- Budget Proactively: Create a budget that accounts for all loan payments, including the potential for late fees, to avoid financial surprises.

- Set Up Automatic Payments: Automating your payments is a reliable way to prevent late payments.

Final Conclusion: Empowering Borrowers Through Transparency and Understanding:

Understanding the intricacies of loan disclosures, particularly the location and details of late fees, is crucial for responsible borrowing. By actively reviewing loan documents, asking clarifying questions, and proactively managing finances, borrowers can avoid unexpected penalties and maintain their financial health. Remember, informed borrowing empowers you to navigate the financial landscape with confidence and control.

Latest Posts

Latest Posts

-

Get Repossession Off Credit Report

Apr 08, 2025

-

How Long Does It Take To Fix Your Credit After A Repossession

Apr 08, 2025

-

How To Fix Your Credit After Repossession

Apr 08, 2025

-

How Do I Fix A Repo On My Credit

Apr 08, 2025

-

How To Fix Repossession On Your Credit Report

Apr 08, 2025

Related Post

Thank you for visiting our website which covers about Which Part Of A Loan Disclosure States What Late Fee The Lender Will Charge Quizlet . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.