Credit Card Issue Complaint Letter

adminse

Apr 02, 2025 · 8 min read

Table of Contents

Unleashing the Power of the Credit Card Complaint Letter: A Comprehensive Guide

What if a simple letter could resolve your frustrating credit card issues? A well-crafted complaint letter is your most powerful weapon against unfair billing practices, unauthorized charges, and poor customer service.

Editor’s Note: This article on writing effective credit card complaint letters was published today. It provides readers with a step-by-step guide to navigating the complexities of credit card disputes and achieving a positive resolution.

Why Credit Card Complaint Letters Matter:

Credit card companies are large, complex organizations. While they strive for efficiency, errors and disputes inevitably arise. A formal complaint letter provides a documented record of your issue, initiating a formal process that can lead to resolution. Ignoring problems often exacerbates them, potentially impacting your credit score and financial well-being. A well-written letter demonstrates your commitment to resolving the issue professionally and increases your chances of a favorable outcome.

Overview: What This Article Covers:

This article will guide you through the entire process of writing a powerful and effective credit card complaint letter. We will cover essential components, strategies for achieving a positive outcome, and what to do if your initial letter fails to resolve the issue. Readers will learn to articulate their concerns clearly, provide compelling evidence, and understand their rights as a cardholder.

The Research and Effort Behind the Insights:

This article draws on extensive research into consumer protection laws, best practices for complaint writing, and analysis of successful credit card dispute cases. It combines legal expertise with practical advice, providing readers with a comprehensive and actionable guide.

Key Takeaways:

- Understanding Your Rights: Knowing your legal rights under the Fair Credit Billing Act (FCBA) and other relevant consumer protection laws is crucial.

- Gathering Evidence: Compiling all necessary documentation, such as transaction records, receipts, and communication logs, strengthens your case.

- Crafting a Compelling Narrative: Presenting your complaint in a clear, concise, and professional manner significantly improves your chances of success.

- Escalation Strategies: Understanding how to escalate your complaint if your initial attempt fails is essential for achieving a resolution.

- Legal Recourse: Knowing when and how to seek legal assistance is vital for resolving complex or intractable disputes.

Smooth Transition to the Core Discussion:

Now that we've established the importance of credit card complaint letters, let's delve into the specifics of crafting a compelling and effective one.

Exploring the Key Aspects of Credit Card Complaint Letters:

1. Identifying the Problem and Gathering Evidence:

Before writing your letter, pinpoint the exact nature of your complaint. Is it an unauthorized charge, a billing error, incorrect interest calculation, poor customer service, or something else? Gather all relevant documentation, including:

- Your credit card statement showing the disputed transaction.

- Receipts or purchase confirmations.

- Copies of any previous correspondence with the credit card company.

- Notes documenting phone calls or emails.

- Any other relevant documentation supporting your claim.

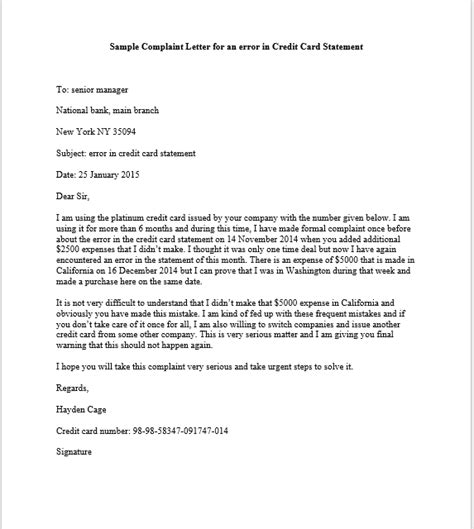

2. Formatting Your Letter for Clarity and Professionalism:

Your letter should be well-organized, easy to read, and professional in tone. Use a standard business letter format, including:

- Your Name and Address: Clearly state your contact information.

- Date: Include the current date.

- Credit Card Company's Address: Use the correct mailing address for the customer service or dispute resolution department.

- Account Number: Include your credit card account number prominently.

- Subject Line: Clearly state the nature of your complaint, e.g., "Dispute of Unauthorized Charge," "Billing Error Correction Request."

- Body Paragraphs: Present your complaint clearly and concisely. Begin with a brief overview of the situation, followed by a detailed explanation of the issue, and conclude with your desired resolution.

- Closing: Politely reiterate your request for resolution and provide your preferred method of contact.

- Signature: Sign and print your name.

3. Writing a Compelling Narrative:

Present your complaint in a chronological order, outlining the sequence of events leading to the dispute. Use factual language and avoid emotional outbursts. Be specific and provide concrete details to support your claims. For example, instead of saying "I was charged incorrectly," state "On [date], I was charged $[amount] for [item/service], which I did not authorize/receive."

4. Stating Your Desired Resolution:

Clearly state what you want the credit card company to do. Are you requesting a refund, a credit to your account, a removal of a late fee, or an adjustment to your interest rate? Be specific and realistic in your expectations.

5. Setting a Reasonable Deadline:

Give the credit card company a reasonable timeframe to respond to your complaint. Typically, 30 days is a suitable timeframe, but check your cardholder agreement for specifics.

Closing Insights: Summarizing the Core Discussion:

A well-crafted credit card complaint letter is more than just a complaint; it’s a strategic communication aimed at achieving a positive outcome. By following these steps, you increase your chances of a fair and efficient resolution.

Exploring the Connection Between Legal Rights and Effective Complaint Letters:

Understanding your legal rights under the Fair Credit Billing Act (FCBA) is critical to writing an effective complaint letter. The FCBA protects consumers from inaccurate or unauthorized charges on their credit card accounts. It outlines specific procedures for disputing transactions and provides timelines for resolution. Knowing these legal provisions allows you to frame your letter accurately and confidently.

Key Factors to Consider:

Roles and Real-World Examples: The FCBA empowers consumers to challenge errors on their credit card statements. For example, if a merchant incorrectly charges you twice, or if a fraudulent charge appears on your statement, the FCBA protects you. Many successful cases involve consumers meticulously documenting their purchases, communications, and dispute timelines, leading to successful charge reversals.

Risks and Mitigations: The primary risk is inaction. Failing to dispute incorrect charges can negatively affect your credit score. Mitigation involves prompt action and diligent documentation of all communication with the credit card company.

Impact and Implications: Successfully resolving a credit card dispute can save you money, protect your credit score, and prevent future problems. Failing to do so can lead to financial hardship and damage to your credit rating.

Conclusion: Reinforcing the Connection:

The interplay between your legal rights and the content of your complaint letter is crucial. Understanding the FCBA, and presenting your case within its framework, significantly strengthens your position. A clear and well-documented letter is the cornerstone of successful credit card dispute resolution.

Further Analysis: Examining the Fair Credit Billing Act (FCBA) in Greater Detail:

The FCBA provides consumers with a specific process for disputing billing errors. It mandates that credit card companies investigate disputes promptly and provide a written response within a specified timeframe. The Act outlines the information consumers must include in their dispute, and the steps credit card companies must take in responding. Understanding these specifics is paramount to writing a compliant and effective letter.

FAQ Section: Answering Common Questions About Credit Card Complaint Letters:

Q: What if the credit card company doesn't respond to my letter?

A: If you don't receive a response within the timeframe specified in your letter (or your cardholder agreement), follow up with a phone call to the customer service department. Keep detailed records of this communication. If the problem remains unresolved, consider escalating the complaint to a higher authority, such as your state's Attorney General's office or the Consumer Financial Protection Bureau (CFPB).

Q: What if the credit card company denies my complaint?

A: If your complaint is denied, request a written explanation of their decision. Review the explanation carefully and assess whether their reasoning is valid. If you believe the denial is unjustified, consider seeking legal advice.

Q: Can I use a template for my complaint letter?

A: Using a template can provide a helpful structure, but personalize it to reflect the specifics of your situation. Avoid generic wording and tailor your letter to your unique circumstances.

Q: What happens if I don't pay the disputed amount while the dispute is being investigated?

A: It's generally advisable to pay the undisputed portion of your bill to maintain a good payment history. However, you should clearly indicate in your letter that you are disputing a specific charge and are withholding payment for that amount only.

Practical Tips: Maximizing the Benefits of Credit Card Complaint Letters:

- Keep Copies: Maintain copies of all correspondence, including your letter, any supporting documents, and the credit card company's responses.

- Send it Certified Mail: Sending your letter via certified mail with return receipt requested provides proof of delivery.

- Be Persistent: Don't be discouraged if you don't get an immediate resolution. Follow up diligently and escalate your complaint if necessary.

- Document Everything: Keep detailed records of all phone calls, emails, and written correspondence.

Final Conclusion: Wrapping Up with Lasting Insights:

Writing an effective credit card complaint letter is a valuable skill that can save you money, protect your credit, and improve your financial well-being. By understanding your rights, gathering evidence, and crafting a compelling narrative, you significantly increase your chances of a successful resolution. Remember, your voice matters, and a well-written letter is your key to navigating the complexities of credit card disputes. Don't hesitate to exercise your rights and stand up for yourself.

Latest Posts

Latest Posts

-

Dave Ramsey Couple Debt

Apr 08, 2025

-

Dave Ramsey Consolidation Loans

Apr 08, 2025

-

Dave Ramsey Debt

Apr 08, 2025

-

Dave Ramsey Loan

Apr 08, 2025

-

What Credit Report Does Credit One Use

Apr 08, 2025

Related Post

Thank you for visiting our website which covers about Credit Card Issue Complaint Letter . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.