If You Have A Credit Score Of 600 What Does That Mean

adminse

Apr 07, 2025 · 8 min read

Table of Contents

Decoding a 600 Credit Score: What It Means and How to Improve It

What if your financial future hinges on understanding your credit score? A credit score of 600 signifies a significant challenge, but it's not a life sentence; it's a call to action.

Editor’s Note: This article on understanding a 600 credit score was published today and provides up-to-date information on credit scoring, its implications, and strategies for improvement. This guide is intended to help individuals understand their credit situation and take proactive steps towards better financial health.

Why a 600 Credit Score Matters: Relevance, Practical Applications, and Industry Significance

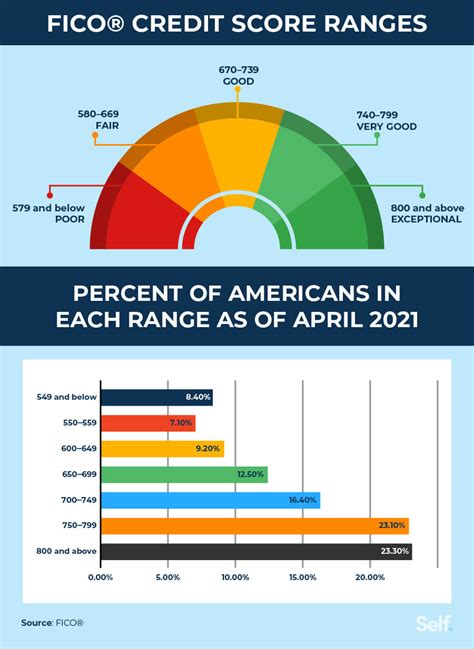

A credit score is a three-digit number that summarizes your creditworthiness. Lenders use it to assess the risk of lending you money. A 600 credit score, falling in the "subprime" range (typically considered 600-660), signals a higher level of risk to lenders than scores in the "fair," "good," or "excellent" categories. This can have significant repercussions across various aspects of your financial life. Obtaining loans, securing favorable interest rates, renting an apartment, even getting some jobs, all become more challenging with a subprime score. Understanding what this score represents is crucial for taking corrective actions and building a stronger financial future. The implications extend beyond immediate financial needs; a low credit score can impact long-term financial goals like buying a home or investing.

Overview: What This Article Covers

This article will delve into the intricacies of a 600 credit score. We'll explore what factors contribute to this score, the consequences of having such a score, and, most importantly, practical steps to improve it. We will examine the specific components of a credit report, the influence of payment history, and strategies for rebuilding credit responsibly. Readers will gain actionable insights, backed by financial best practices and industry knowledge.

The Research and Effort Behind the Insights

This article draws on extensive research from reputable sources, including consumer credit bureaus (like Experian, Equifax, and TransUnion), government publications, and financial literacy organizations. The information presented is based on established credit scoring models and common industry practices. The goal is to provide readers with accurate and reliable information to make informed decisions regarding their credit health.

Key Takeaways: Summarize the Most Essential Insights

- Understanding the Score: A 600 credit score is considered subprime, indicating a higher risk to lenders.

- Factors Affecting the Score: Payment history, amounts owed, length of credit history, new credit, and credit mix all contribute to the score.

- Consequences of a Low Score: Higher interest rates, loan denials, difficulties renting, and potential employment challenges.

- Improvement Strategies: Consistent on-time payments, reducing debt, maintaining a positive credit mix, and avoiding new credit applications.

- Credit Repair Resources: Utilizing credit counseling services and monitoring credit reports regularly.

Smooth Transition to the Core Discussion:

With a foundational understanding of what a 600 credit score represents, let’s delve into the specifics of its composition and explore effective strategies for improvement.

Exploring the Key Aspects of a 600 Credit Score

1. Definition and Core Concepts:

A credit score is a numerical representation of your creditworthiness, based on the information contained in your credit report. The most widely used scoring models are FICO scores and VantageScores. While specific formulas differ, they all consider similar factors. A 600 score signifies that, based on your credit history, you present a higher-than-average risk of defaulting on future loans. Lenders interpret this as a higher probability of non-payment, leading them to charge higher interest rates or deny credit altogether.

2. Applications Across Industries:

The impact of a 600 credit score extends far beyond just loan applications. Landlords often check credit scores before approving tenants. Insurance companies may consider credit scores when setting premiums. Some employers even conduct credit checks, particularly for positions handling finances. In essence, a 600 score can affect various aspects of daily life, creating significant limitations.

3. Challenges and Solutions:

The primary challenge with a 600 score is accessing affordable credit. High interest rates on loans and credit cards make debt management more difficult. Securing favorable terms on mortgages, auto loans, or even smaller personal loans becomes extremely challenging. The solution lies in proactively addressing the underlying issues contributing to the low score and building a positive credit history.

4. Impact on Innovation:

While not directly impacting innovation, a low credit score can indirectly hinder entrepreneurial efforts. Securing funding for a new business or expansion becomes more difficult with a poor credit history. This underlines the importance of maintaining a strong credit profile for anyone with aspirations of starting or growing a business.

Closing Insights: Summarizing the Core Discussion

A 600 credit score presents significant financial hurdles. It's a clear signal that immediate action is needed to improve creditworthiness and unlock better financial opportunities. Ignoring the issue only exacerbates the problem, leading to more expensive borrowing options and limited access to credit. The path to improvement requires discipline, careful financial planning, and commitment to responsible credit management.

Exploring the Connection Between Payment History and a 600 Credit Score

Payment history is arguably the most critical factor influencing credit scores. It represents the consistency with which you've made your payments on time. A 600 score likely indicates a history of missed payments, late payments, or even defaults on previous loans or credit accounts.

Key Factors to Consider:

- Roles and Real-World Examples: A single missed payment can negatively impact a score, and multiple missed payments significantly lower it. For instance, consistently late credit card payments will severely affect your score. Defaults, which occur when you fail to make payments after repeated attempts by the lender, are particularly damaging.

- Risks and Mitigations: The risk associated with a poor payment history is limited access to credit and higher interest rates. Mitigation involves developing a budget, automating payments to ensure on-time payments, and seeking debt management solutions if necessary.

- Impact and Implications: The long-term implications of a poor payment history can be severe, making it challenging to secure loans for significant purchases like a house or a car. It can also lead to increased financial stress and a cycle of debt.

Conclusion: Reinforcing the Connection

The connection between payment history and a 600 credit score is undeniable. Consistent, on-time payments are essential for building and maintaining a good credit score. Addressing past payment issues and establishing a pattern of timely payments is crucial for improving a 600 score.

Further Analysis: Examining Debt-to-Credit Ratio in Greater Detail

Another significant factor affecting credit scores is the debt-to-credit ratio, often called the credit utilization ratio. This represents the amount of credit you're using compared to your total available credit. A high debt-to-credit ratio suggests that you're heavily reliant on credit, increasing the perceived risk for lenders. With a 600 score, a high debt-to-credit ratio is highly likely. Keeping this ratio low (ideally below 30%) is a critical step in improving your credit score.

FAQ Section: Answering Common Questions About a 600 Credit Score

Q: What is a 600 credit score? A: A 600 credit score is considered subprime, indicating a higher risk to lenders. It suggests a history of less-than-ideal credit management.

Q: How can I improve my 600 credit score? A: Consistent on-time payments, reducing debt, maintaining a positive credit mix, and avoiding new credit applications are crucial steps.

Q: Will a 600 credit score prevent me from getting a loan? A: It significantly reduces the chances of securing a loan with favorable terms. You might be able to obtain a loan, but expect higher interest rates and stricter requirements.

Q: How long does it take to improve a credit score? A: Improving a credit score takes time and consistent effort. It can take several months or even years, depending on the severity of the credit issues.

Q: What are the best resources for improving my credit? A: Reputable credit counseling agencies, financial literacy websites, and your credit reports can offer valuable guidance and tools.

Practical Tips: Maximizing the Benefits of Credit Repair

-

Monitor Your Credit Reports: Regularly check your credit reports from all three major bureaus (Equifax, Experian, and TransUnion) for errors. Dispute any inaccuracies promptly.

-

Create a Budget: Develop a realistic budget to track income and expenses. Identify areas where you can reduce spending to allocate more funds towards debt repayment.

-

Prioritize Debt Payment: Focus on paying down high-interest debt first, while still making minimum payments on other accounts.

-

Automate Payments: Set up automatic payments to ensure on-time payments and avoid late fees.

-

Use Credit Wisely: Avoid maxing out credit cards and maintain a low debt-to-credit ratio.

Final Conclusion: Wrapping Up with Lasting Insights

A 600 credit score presents a challenge, but it's not insurmountable. By understanding the factors that contribute to your score, actively addressing negative items on your credit report, and consistently practicing responsible credit management, you can steadily improve your creditworthiness. Remember, building a good credit score is a marathon, not a sprint. Patience, persistence, and a commitment to financial responsibility are key to achieving long-term success. The journey towards better financial health begins with understanding your credit and taking proactive steps to improve it.

Latest Posts

Latest Posts

-

What To Do When You Max Out A Credit Card

Apr 08, 2025

-

What Happens When You Max Out A Credit Card And Dont Pay It

Apr 08, 2025

-

What Does Total Franking Credits Mean

Apr 08, 2025

-

What Does Total Refundable Credits Mean

Apr 08, 2025

-

What Does Total Tax Credits Mean Nz Calculator

Apr 08, 2025

Related Post

Thank you for visiting our website which covers about If You Have A Credit Score Of 600 What Does That Mean . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.