How Low Should I Keep My Credit Card Utilization

adminse

Apr 07, 2025 · 6 min read

Table of Contents

How Low Should You Keep Your Credit Card Utilization?

Maintaining a low credit utilization ratio is crucial for a healthy credit score.

Editor’s Note: This article on credit card utilization was published today, providing readers with the most up-to-date information and strategies for managing credit effectively. Understanding and implementing these strategies can significantly improve your creditworthiness.

Why Credit Card Utilization Matters: Relevance, Practical Applications, and Industry Significance

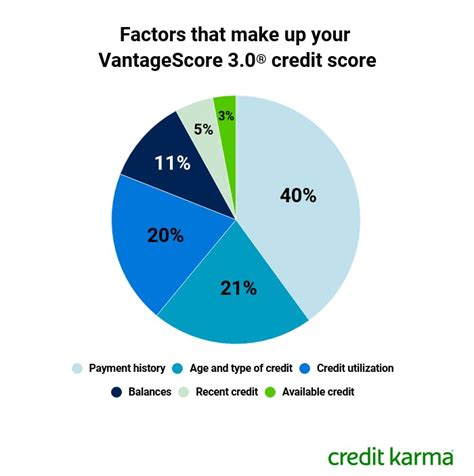

Your credit utilization ratio – the percentage of your available credit you're using – is a significant factor influencing your credit score. Lenders view a high utilization rate as a risk indicator, suggesting potential overspending and difficulty managing debt. Conversely, a low utilization ratio signals responsible credit management, improving your creditworthiness and potentially securing you better interest rates on loans and credit cards. This impacts not just your personal finances but also your ability to secure mortgages, car loans, and even some job opportunities.

Overview: What This Article Covers

This article comprehensively explores the ideal credit card utilization rate, examining its impact on credit scores, strategies for lowering utilization, and the benefits of maintaining a low ratio. We'll delve into the nuances of different credit scoring models, explore real-world examples, and provide actionable steps to optimize your credit health.

The Research and Effort Behind the Insights

This article is based on extensive research, incorporating data from leading credit bureaus like Experian, Equifax, and TransUnion, along with insights from financial experts and numerous case studies. The information presented aims to provide accurate and actionable guidance for readers seeking to improve their credit profiles.

Key Takeaways: Summarize the Most Essential Insights

- The Ideal Credit Utilization Ratio: Aim for under 30%, ideally under 10%.

- Impact on Credit Scores: High utilization significantly hurts your score; low utilization boosts it.

- Strategies for Lowering Utilization: Paying down balances, increasing credit limits, and using fewer cards are key strategies.

- Benefits of Low Utilization: Improved credit scores, better loan terms, and increased financial stability.

- Monitoring Your Credit Report: Regularly checking your credit report for inaccuracies and monitoring your utilization is crucial.

Smooth Transition to the Core Discussion

With a clear understanding of the importance of credit utilization, let's delve deeper into its impact on your credit score and explore effective strategies for keeping it low.

Exploring the Key Aspects of Credit Card Utilization

Definition and Core Concepts: Credit utilization is calculated by dividing your total credit card balances by your total available credit. For example, if you have $1000 in credit card debt and a total credit limit of $5000, your utilization rate is 20% ($1000/$5000).

Applications Across Industries: The concept of credit utilization applies across various industries dealing with credit. Lenders use it to assess risk when evaluating loan applications. Insurance companies may also consider it when assessing certain types of insurance.

Challenges and Solutions: The primary challenge lies in managing spending habits and effectively paying down balances. Solutions include budgeting, prioritizing debt repayment, and seeking professional financial advice when needed.

Impact on Innovation: The increasing use of credit scoring models and algorithms has led to more sophisticated ways of analyzing credit utilization, leading to more precise risk assessments by lenders.

Closing Insights: Summarizing the Core Discussion

Maintaining a low credit utilization ratio is a fundamental aspect of responsible credit management. By understanding its impact on credit scores and implementing effective strategies to keep it low, individuals can significantly improve their financial health and access better credit opportunities.

Exploring the Connection Between Payment History and Credit Card Utilization

The relationship between payment history and credit utilization is symbiotic. While a consistent history of on-time payments is crucial for a good credit score, high credit utilization can negate the positive impact of a strong payment history. Conversely, a poor payment history will be further exacerbated by high utilization.

Key Factors to Consider

-

Roles and Real-World Examples: A person with a consistently excellent payment history but high utilization (over 70%) will likely see their credit score negatively impacted. Conversely, someone with a few late payments but low utilization (under 10%) may see a less severe score reduction.

-

Risks and Mitigations: The risk of high utilization is a lower credit score and higher interest rates. Mitigation strategies include creating a budget, aggressively paying down balances, and requesting credit limit increases.

-

Impact and Implications: High utilization can lead to higher interest rates, difficulty securing loans, and even impacting insurance premiums in some cases. Conversely, low utilization significantly improves the chances of securing favorable loan terms and maintaining a healthy financial standing.

Conclusion: Reinforcing the Connection

The interplay between payment history and credit utilization highlights the holistic nature of credit scoring. Both factors are equally important, and a strong credit profile requires managing both effectively.

Further Analysis: Examining Payment History in Greater Detail

Payment history is one of the most significant factors in credit scoring models. Even a single missed payment can negatively impact your score, and multiple missed payments can have a more substantial and lasting effect. Consistent on-time payments demonstrate responsible credit behavior, building trust with lenders and improving your creditworthiness over time.

FAQ Section: Answering Common Questions About Credit Card Utilization

Q: What is the ideal credit utilization ratio?

A: While the ideal ratio is debated, aiming for under 30%, ideally under 10%, is generally recommended.

Q: How does credit utilization affect my credit score?

A: High utilization negatively impacts your credit score, while low utilization positively impacts it.

Q: What can I do if my credit utilization is too high?

A: Prioritize paying down balances, consider increasing your credit limits (if eligible), and avoid opening new credit accounts.

Q: Will paying my credit card in full every month eliminate the impact of utilization?

A: Yes, paying your balance in full before the due date each month will mitigate the negative impact of utilization, as the balance reported to credit bureaus will be zero.

Q: Should I close credit cards to lower my utilization?

A: This is a complex issue; Closing cards may hurt your credit score due to reduced available credit. Increasing credit limits is often a better approach.

Practical Tips: Maximizing the Benefits of Low Credit Utilization

- Track Your Spending: Use budgeting apps or spreadsheets to monitor spending and ensure you stay within your limits.

- Pay Down Balances: Prioritize paying down high-balance credit cards to reduce your utilization rate.

- Increase Credit Limits: If you have a good credit history, consider requesting a credit limit increase from your card issuer. This will lower your utilization ratio without changing your debt.

- Use Fewer Cards: Avoid opening new credit cards unnecessarily, as this can reduce your average credit limit across all your accounts.

- Monitor Your Credit Reports: Regularly check your credit reports from all three major credit bureaus (Experian, Equifax, and TransUnion) to identify any errors and monitor your utilization.

Final Conclusion: Wrapping Up with Lasting Insights

Maintaining a low credit utilization ratio is a cornerstone of responsible credit management. By understanding its impact on your credit score and implementing the strategies discussed, you can significantly improve your financial health, access better credit opportunities, and achieve long-term financial stability. Remember, consistent effort and responsible financial behavior are key to building and maintaining a strong credit profile.

Latest Posts

Latest Posts

-

Increase Limit Credit One Bank

Apr 08, 2025

-

Credit One Credit Increase

Apr 08, 2025

-

How Much Does Credit One Increase Credit Limit

Apr 08, 2025

-

How To Get Credit One To Increase Credit Limit

Apr 08, 2025

-

How Do I Increase My Credit One Credit Card Limit

Apr 08, 2025

Related Post

Thank you for visiting our website which covers about How Low Should I Keep My Credit Card Utilization . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.