Does Credit Karma Do Credit Reports

adminse

Apr 06, 2025 · 9 min read

Table of Contents

Unlocking Credit Karma's Secrets: Does It Provide Credit Reports?

Does Credit Karma offer the same comprehensive credit reports as the major credit bureaus? The answer is nuanced and crucial to understanding its true value.

Editor’s Note: This article on Credit Karma and credit reports was published today, offering the latest insights into its features and limitations. Consumers seeking to understand their credit health will find this information invaluable.

Why Credit Karma Matters: Navigating the Complex World of Credit Scores

Understanding your credit score is paramount for securing loans, mortgages, and even rental agreements. Credit reports, the foundation of your credit score, detail your borrowing history, payment patterns, and outstanding debts. This information directly impacts your financial opportunities. Credit Karma, a popular free financial tool, plays a significant role in helping consumers access and understand this crucial information, but the services it offers need careful consideration.

Overview: What This Article Covers

This in-depth article explores Credit Karma's relationship with credit reports. We will examine what Credit Karma provides, how it differs from credit reports from Equifax, Experian, and TransUnion, and ultimately, whether it's a sufficient substitute for obtaining your official credit reports. We'll discuss its benefits and drawbacks, guiding readers towards making informed decisions about their credit monitoring and management.

The Research and Effort Behind the Insights

This article draws upon extensive research from Credit Karma's official website, reputable financial websites, and consumer reviews. We have analyzed the terms of service, compared the information provided by Credit Karma with that of official credit reports, and considered the opinions of financial experts to present a balanced and informative overview.

Key Takeaways: Summarizing the Essential Insights

-

Credit Karma does not provide official credit reports: It provides a VantageScore 3.0 credit score and a summary of your credit information, but not the full, detailed reports from the three major credit bureaus (Equifax, Experian, and TransUnion).

-

Credit Karma uses a different scoring model: It uses VantageScore, which differs slightly from the FICO scores used by many lenders. While it provides a general indication of creditworthiness, it may not be perfectly aligned with the score a lender will see.

-

Credit Karma offers valuable monitoring tools: Its free services include credit score tracking, credit report summaries, and alerts for changes in your credit profile, which can be beneficial for proactive credit management.

-

Official credit reports offer comprehensive detail: Only the major credit bureaus offer the full credit report, providing a complete picture of your credit history, including detailed account information, inquiries, and potential errors.

-

Understanding the limitations is crucial: Consumers should be aware of Credit Karma’s limitations and consider supplementing its service with official credit reports from time to time for a complete understanding of their credit standing.

Smooth Transition to the Core Discussion

While Credit Karma is a useful tool for monitoring credit scores and identifying potential problems, it's essential to understand precisely what it offers and what it doesn't. Let's dive into the specifics to clarify its role in managing your financial health.

Exploring the Key Aspects of Credit Karma's Credit Information

1. Definition and Core Concepts: Understanding Credit Karma's Services

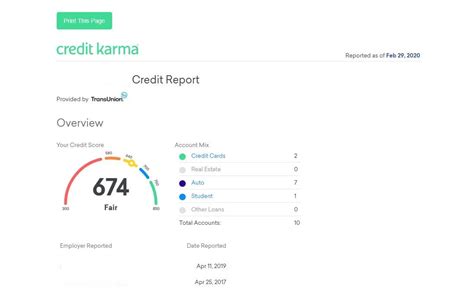

Credit Karma provides a free credit scoring service, offering users a VantageScore 3.0. This score is derived from data provided by two of the three major credit bureaus, Equifax and TransUnion (the specific bureaus used can vary). Credit Karma also provides a summarized view of your credit data, including information about your open accounts, payment history, and recent credit inquiries. This summary is simplified and lacks the level of detail found in a full credit report.

2. Applications Across Industries: Credit Karma's Role in Personal Finance

Credit Karma's primary application is in personal finance management. It helps individuals monitor their credit score over time, track changes, and receive alerts for potentially negative activity. This proactive monitoring allows individuals to address credit issues early, preventing more significant problems. Its features also include tools for identifying potential fraud and managing debt.

3. Challenges and Solutions: Addressing the Limitations of Credit Karma

The main challenge with Credit Karma is that it does not provide the complete credit report. Its summary view might miss crucial details, and the VantageScore may differ from the FICO score used by lenders. To overcome this, consumers should supplement Credit Karma's service with periodic access to their full credit reports from Equifax, Experian, and TransUnion directly.

4. Impact on Innovation: Credit Karma's Influence on Credit Monitoring

Credit Karma has played a significant role in making credit monitoring more accessible to consumers. Its free service has empowered individuals who previously lacked the resources or understanding to track their credit scores. However, the simplified nature of its reports requires users to be aware of its limitations and seek more comprehensive information when necessary.

Closing Insights: Summarizing Credit Karma's Position

Credit Karma offers a valuable, free service for general credit monitoring, but it shouldn't be considered a replacement for obtaining your official credit reports. Its simplified credit summary and alternative scoring model can be useful for tracking trends and identifying potential issues, but a complete understanding of your creditworthiness requires access to the full credit reports from the major credit bureaus.

Exploring the Connection Between Official Credit Reports and Credit Karma

The connection between official credit reports and Credit Karma lies in the data used to generate the VantageScore and summarized credit information. Credit Karma accesses and utilizes data from the credit bureaus (typically Equifax and TransUnion), but it does not provide the same level of detail. This difference is crucial for understanding the limitations of Credit Karma's service.

Key Factors to Consider:

Roles and Real-World Examples:

-

Credit Karma: Provides a free, simplified view of credit information, useful for quick monitoring and trend identification. For example, it can alert you to a new credit inquiry or a drop in your score, prompting you to investigate the cause.

-

Official Credit Reports: Provide a complete and detailed picture of your credit history, including individual account details, payment history, inquiries, and public records. This is what lenders use to assess your creditworthiness for loan applications. For example, a lender will use the full report to determine if you qualify for a mortgage based on the specifics of your payment history, outstanding balances, and credit utilization.

Risks and Mitigations:

-

Risk: Relying solely on Credit Karma for credit management without also reviewing your full credit reports from the bureaus could result in overlooking crucial details and potentially impacting your credit score negatively.

-

Mitigation: Regularly obtain your official credit reports from AnnualCreditReport.com to supplement the information provided by Credit Karma. This ensures a comprehensive view of your credit health and prevents surprises during loan applications.

Impact and Implications:

-

Impact: Credit Karma empowers consumers with greater accessibility to credit score information, fostering better financial literacy and proactive credit management. However, its limitations can leave users with a potentially incomplete understanding of their credit standing if not supplemented with official reports.

-

Implications: Consumers should use Credit Karma as a tool for regular monitoring but understand the necessity of reviewing their full credit reports, especially before applying for significant credit. This ensures accurate assessment and avoids potential credit application denials or less favorable terms due to unseen information.

Conclusion: Reinforcing the Complementary Nature of Credit Karma and Official Reports

Credit Karma and official credit reports are complementary, not mutually exclusive. Credit Karma provides a convenient and accessible tool for monitoring, but its limitations necessitate the periodic review of comprehensive credit reports directly from the bureaus. Together, these tools provide a robust approach to personal credit management.

Further Analysis: Examining VantageScore and FICO Scores in Detail

VantageScore and FICO scores, while both credit scoring models, differ in their methodology and weighting of various credit factors. This means that a VantageScore may not always perfectly correlate with a FICO score. Lenders often use FICO scores, so understanding the potential discrepancies is vital. Consumers should not solely rely on their VantageScore from Credit Karma as the definitive measure of their creditworthiness for loan applications.

FAQ Section: Answering Common Questions About Credit Karma and Credit Reports

Q: What is the difference between Credit Karma and a credit report from Equifax, Experian, or TransUnion?

A: Credit Karma provides a simplified summary of your credit information and a VantageScore 3.0, while the credit bureaus provide a complete and detailed credit report, including all your accounts, payment history, public records, and inquiries.

Q: Does Credit Karma provide my FICO score?

A: No, Credit Karma primarily provides a VantageScore 3.0. While correlated, it may differ from the FICO score used by many lenders.

Q: How often can I access my credit reports for free?

A: You are entitled to a free credit report from each of the three major credit bureaus (Equifax, Experian, and TransUnion) once every 12 months through AnnualCreditReport.com. This is different from the ongoing access to simplified credit information that Credit Karma offers.

Q: Should I use Credit Karma exclusively to monitor my credit?

A: No, it's best to use Credit Karma as a supplementary tool for ongoing monitoring, but always obtain your full credit reports directly from the bureaus at least annually to ensure a complete and accurate picture of your credit health.

Practical Tips: Maximizing the Benefits of Credit Karma and Official Credit Reports

-

Set up alerts: Utilize Credit Karma's alert system to be immediately notified of significant changes in your credit score or report.

-

Review your reports regularly: Check your Credit Karma dashboard frequently and obtain your full credit reports annually through AnnualCreditReport.com.

-

Address any errors promptly: If you identify any errors on your Credit Karma summary or your official credit report, contact the appropriate credit bureau to initiate a dispute and correction.

-

Understand your score: Learn how the VantageScore and FICO score work to better understand the factors influencing your creditworthiness.

-

Develop healthy credit habits: Practice responsible borrowing and payment habits to maintain a good credit score.

Final Conclusion: A Balanced Approach to Credit Management

Credit Karma offers valuable free services for monitoring your credit score and identifying potential issues. However, it’s crucial to remember that it does not replace obtaining official credit reports from Equifax, Experian, and TransUnion. By combining the convenience of Credit Karma’s monitoring with the comprehensive detail of official credit reports, consumers can effectively manage their credit health and make informed financial decisions. A balanced approach, leveraging both tools, is the key to success in navigating the complexities of personal credit.

Latest Posts

Latest Posts

-

Can I Fix My Credit In 6 Months To Buy A House

Apr 08, 2025

-

How To Fix My Credit To Buy A House With Bad Credit

Apr 08, 2025

-

How Long After I Fix My Credit Can I Buy A House

Apr 08, 2025

-

How To Repair My Credit To Buy A House

Apr 08, 2025

-

How To Improve My Credit To Buy A House

Apr 08, 2025

Related Post

Thank you for visiting our website which covers about Does Credit Karma Do Credit Reports . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.