How To Make Money Management In Excel

adminse

Apr 06, 2025 · 9 min read

Table of Contents

Mastering Money Management in Excel: A Comprehensive Guide

What if effortless budgeting and financial forecasting were just a few clicks away? Excel, when used strategically, can become your ultimate personal finance power tool, offering unparalleled control and clarity over your financial life.

Editor’s Note: This comprehensive guide to money management in Excel was created to empower you with practical skills and actionable strategies. Whether you’re a seasoned investor or just starting your financial journey, this article provides the tools and knowledge you need to effectively manage your finances using Microsoft Excel.

Why Excel Matters for Money Management:

In today's complex financial landscape, effective money management is crucial. Excel provides a robust and flexible platform for organizing, analyzing, and projecting your finances. From simple budgeting to sophisticated investment tracking, its versatility makes it an invaluable asset for individuals and small businesses alike. The ability to create custom reports, visualize data through charts, and perform complex calculations grants you deep insights into your spending habits, investment performance, and overall financial health. This level of control fosters informed decision-making and empowers you to achieve your financial goals more effectively.

Overview: What This Article Covers:

This article will take you on a step-by-step journey through the world of Excel-based money management. We will cover essential techniques for budgeting, tracking income and expenses, creating financial statements, managing investments, and forecasting future financial scenarios. You will gain practical insights, backed by clear examples and actionable steps, transforming your approach to personal finance.

The Research and Effort Behind the Insights:

The information presented here is based on extensive research encompassing best practices in personal finance, practical applications of Excel functionalities, and insights from financial literacy experts. The methods outlined are designed to be accessible to users of all skill levels, providing a comprehensive resource for effective money management.

Key Takeaways:

- Budgeting Fundamentals: Learn to create a detailed budget that accurately reflects your income and expenses.

- Income and Expense Tracking: Implement robust systems for recording and categorizing your financial transactions.

- Financial Statement Creation: Generate key financial reports such as balance sheets and income statements.

- Investment Portfolio Management: Track your investment performance and optimize your portfolio allocation.

- Financial Forecasting: Project future financial scenarios and make informed decisions based on data-driven analysis.

Smooth Transition to the Core Discussion:

Now that we've established the importance of Excel in personal finance, let's delve into the practical techniques and strategies that will transform your financial management.

Exploring the Key Aspects of Money Management in Excel:

1. Budgeting Fundamentals:

The cornerstone of effective money management is a well-defined budget. In Excel, this can be achieved by creating a simple spreadsheet with columns for income sources, expense categories, budgeted amounts, and actual spending. Using formulas, you can easily calculate the difference between your budgeted and actual spending, providing immediate insights into areas where adjustments might be needed. Consider these categories:

- Income: Salaries, bonuses, investments, side hustles.

- Expenses: Housing, transportation, food, utilities, entertainment, debt payments, savings.

Example:

| Category | Budgeted Amount | Actual Spending | Difference |

|---|---|---|---|

| Rent | $1000 | $1000 | $0 |

| Groceries | $200 | $250 | -$50 |

| Transportation | $150 | $120 | $30 |

| Entertainment | $100 | $75 | $25 |

| Savings | $300 | $300 | $0 |

2. Income and Expense Tracking:

Accurate tracking of your income and expenses is crucial for creating a realistic budget and monitoring your financial progress. Excel allows you to meticulously record each transaction, categorizing it for later analysis. You can use different methods:

- Manual Entry: Directly entering transactions into your spreadsheet.

- Import from Bank Statements: Many banks offer downloadable transaction history in CSV or other importable formats. This significantly streamlines the process.

Example:

| Date | Description | Category | Amount |

|---|---|---|---|

| 2024-03-01 | Salary | Income | $3000 |

| 2024-03-05 | Groceries | Food | -$150 |

| 2024-03-10 | Rent | Housing | -$1000 |

| 2024-03-15 | Restaurant | Entertainment | -$50 |

3. Financial Statement Creation:

Excel facilitates the creation of key financial statements, providing a comprehensive overview of your financial position.

- Balance Sheet: Shows your assets (what you own), liabilities (what you owe), and net worth (assets minus liabilities) at a specific point in time.

- Income Statement: Summarizes your income and expenses over a specific period (e.g., monthly, annually), showing your net income or loss.

Example (Balance Sheet):

| Assets | Amount | Liabilities | Amount |

|---|---|---|---|

| Cash | $500 | Credit Card Debt | $2000 |

| Savings Account | $2000 | Mortgage | $150000 |

| Investments | $10000 | ||

| Total Assets | $12500 | Total Liabilities | $152000 |

| Net Worth | -$140000 |

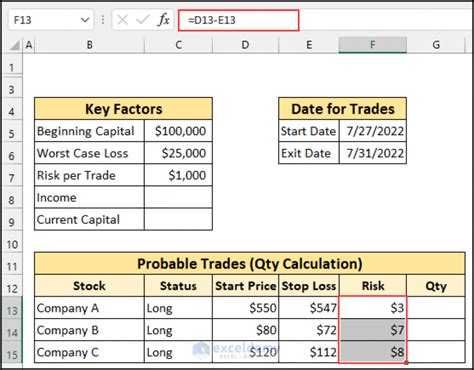

4. Investment Portfolio Management:

For those with investments, Excel allows for detailed tracking of portfolio performance. You can record the purchase date, price, quantity, and current value of each asset. Formulas can automatically calculate gains/losses, returns, and portfolio diversification.

Example:

| Stock | Purchase Date | Purchase Price | Quantity | Current Price | Total Value | Gain/Loss |

|---|---|---|---|---|---|---|

| AAPL | 2023-10-26 | $150 | 10 | $175 | $1750 | $250 |

| GOOG | 2023-11-15 | $100 | 5 | $120 | $600 | $100 |

5. Financial Forecasting:

Excel's capabilities extend to predicting future financial scenarios. By using historical data and projecting future income and expenses, you can create realistic financial forecasts. This helps in planning for major purchases, investments, or retirement. “What-if” analysis is especially powerful here. Changing inputs (like salary increase or unexpected expenses) instantly updates projections, offering a dynamic view of your finances.

Exploring the Connection Between Data Visualization and Money Management in Excel:

Data visualization significantly enhances the utility of Excel for money management. Charts and graphs transform raw data into easily digestible insights. A simple bar chart can quickly show your largest expense categories, highlighting areas for potential savings. Line charts can track your net worth over time, visualizing your financial progress. Pie charts offer a clear representation of your asset allocation in an investment portfolio. These visual aids make it much easier to understand complex financial information and make informed decisions.

Key Factors to Consider:

- Data Accuracy: The accuracy of your financial statements and forecasts directly depends on the accuracy of the data you enter. Regularly review and update your spreadsheets to ensure accuracy.

- Security: Protect your financial data by using strong passwords and limiting access to your spreadsheets. Consider using cloud storage with robust security features.

- Regular Maintenance: Consistent data entry is crucial. Setting aside regular time for updates will prevent your spreadsheet from becoming outdated and unusable.

Roles and Real-World Examples:

A freelancer might use Excel to track income from various clients and manage expenses related to their business. A family might use it to budget for monthly expenses and plan for major purchases like a new car or a house. An investor might use it to track their portfolio performance and make informed investment decisions.

Risks and Mitigations:

Incorrect formulas or data entry errors can lead to inaccurate financial reports. Regularly auditing your spreadsheets and using data validation features can minimize these risks.

Impact and Implications:

Effective money management using Excel can lead to improved financial health, increased savings, reduced debt, and more informed financial decisions. It empowers individuals to take control of their finances and achieve their financial goals.

Conclusion: Reinforcing the Connection:

The connection between Excel and effective money management is undeniable. By leveraging Excel's features, you can create robust systems for budgeting, tracking, analyzing, and forecasting your finances, leading to greater financial clarity and control.

Further Analysis: Examining Data Validation in Greater Detail:

Data validation in Excel is a crucial feature for ensuring data accuracy. It allows you to restrict the type of data entered into specific cells, preventing errors and inconsistencies. For example, you could restrict a “Category” column to only accept values from a predefined list (e.g., “Housing,” “Food,” “Transportation”), preventing typos and ensuring consistency. This significantly enhances the reliability of your financial data. Data validation can also be used to set limits on numerical values, for example, ensuring that spending in a particular category doesn't exceed a predetermined budget.

FAQ Section: Answering Common Questions About Money Management in Excel:

-

What is the best way to organize my Excel spreadsheet for money management? A common approach is to separate sheets for budgeting, income tracking, expense tracking, and financial statements. Use clear headings and consistent formatting to maintain organization.

-

Can I connect my bank accounts to Excel? While direct connection isn't possible, you can usually download transaction history in CSV or other importable formats and import it into your spreadsheet.

-

How can I protect my financial data in Excel? Use strong passwords and restrict access to your files. Consider encrypting your files for enhanced security. Regular backups are also crucial.

-

What are some advanced features of Excel that can be used for money management? Pivot tables can be used for summarizing and analyzing large datasets. Macros can automate repetitive tasks. Goal Seek can be used for “what-if” analysis.

-

Is there a specific template I can use for money management in Excel? While numerous templates are available online, creating a custom spreadsheet tailored to your specific needs is often more effective.

Practical Tips: Maximizing the Benefits of Excel for Money Management:

-

Start Simple: Begin with a basic budget and gradually incorporate more advanced features as you become more comfortable.

-

Regularly Update: Make data entry a habit to maintain accuracy. Aim for daily or weekly updates.

-

Use Formulas: Leverage Excel’s formulas for automatic calculations, saving time and reducing errors.

-

Visualize Your Data: Create charts and graphs to quickly understand trends and patterns.

-

Learn Keyboard Shortcuts: Mastering keyboard shortcuts can significantly speed up your workflow.

Final Conclusion: Wrapping Up with Lasting Insights:

Mastering money management in Excel is an investment in your financial future. By embracing its capabilities, you gain the power to track, analyze, and project your finances with unprecedented accuracy and clarity. This empowers you to make informed decisions, achieve your financial goals, and build a secure and prosperous future. Remember that consistency and accuracy are key. Regular updates and a well-organized spreadsheet will be your most valuable assets on your journey to financial mastery.

Latest Posts

Latest Posts

-

Can I Get A Loan With A 705 Credit Score

Apr 07, 2025

-

What Credit Card Can I Get With A 705 Score

Apr 07, 2025

-

What Kind Of Car Loan Can I Get With A 705 Credit Score

Apr 07, 2025

-

What Can You Get With A 705 Credit Score

Apr 07, 2025

-

What Interest Rate Can I Get With A 705 Credit Score

Apr 07, 2025

Related Post

Thank you for visiting our website which covers about How To Make Money Management In Excel . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.