What Percentage Should You Keep Your Credit Utilization Under

adminse

Apr 06, 2025 · 7 min read

Table of Contents

What Percentage Should You Keep Your Credit Utilization Under? Unlocking the Secrets to a Stellar Credit Score

What if maintaining a healthy credit score was as simple as understanding one key metric? Keeping your credit utilization low is the cornerstone of excellent credit, directly impacting your financial future.

Editor’s Note: This article on credit utilization was published today, providing readers with the most up-to-date information and best practices for maintaining a healthy credit score.

Why Credit Utilization Matters: A Foundation of Financial Health

Credit utilization is the percentage of your total available credit that you're currently using. It's a crucial factor in determining your creditworthiness, significantly influencing your credit score. Lenders use this metric to assess your risk profile – a low credit utilization ratio indicates responsible credit management, while a high ratio suggests potential overspending and financial instability. This impacts not only your ability to secure loans and credit cards with favorable interest rates but also your chances of qualifying for mortgages, insurance policies, and even certain job opportunities.

Overview: What This Article Covers

This article provides a comprehensive exploration of credit utilization, detailing its significance, ideal percentages to maintain, strategies for lowering your ratio, and the broader impact on your financial well-being. You'll gain actionable insights backed by industry best practices and expert analysis.

The Research and Effort Behind the Insights

This article is the culmination of extensive research, drawing upon data from reputable credit bureaus, financial experts' analyses, and real-world case studies. The information presented is designed to empower readers with the knowledge and strategies necessary for effective credit management.

Key Takeaways:

- Optimal Credit Utilization: The generally recommended target is to keep credit utilization below 30%, ideally under 10%.

- Impact on Credit Score: High credit utilization significantly lowers credit scores, potentially affecting loan approvals and interest rates.

- Strategies for Improvement: Practical steps are outlined to reduce credit utilization and enhance credit health.

- Long-Term Financial Benefits: Maintaining low credit utilization fosters better financial habits and improves long-term financial stability.

Smooth Transition to the Core Discussion

Now that we understand the importance of credit utilization, let's delve into the specifics. We'll examine the ideal percentages, the consequences of exceeding these thresholds, and effective strategies to manage credit responsibly.

Exploring the Key Aspects of Credit Utilization

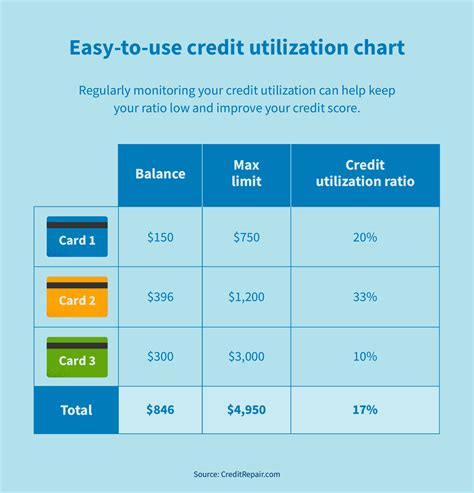

1. Definition and Core Concepts: Credit utilization is calculated by dividing your total outstanding credit card balances by your total available credit across all your accounts. For example, if you have $1,000 in credit card debt and a total credit limit of $5,000, your credit utilization is 20% ($1,000/$5,000).

2. Applications Across Industries: Lenders across various sectors – from credit card companies and banks to mortgage lenders and insurance providers – use credit utilization as a key metric to assess risk. A low utilization ratio signals financial responsibility and increases the likelihood of loan approval with favorable terms.

3. Challenges and Solutions: Many individuals struggle to maintain low credit utilization due to unforeseen expenses, impulsive spending, or simply a lack of awareness. The solutions involve budgeting, debt management strategies, and proactive monitoring of credit card balances.

4. Impact on Innovation: The increasing reliance on credit scoring models has driven innovation in financial technology (FinTech). Apps and tools are now readily available to help individuals monitor their credit utilization and manage their finances effectively.

Closing Insights: Summarizing the Core Discussion

Credit utilization is not just a number; it's a reflection of your overall financial health. By keeping it low, you demonstrate responsible credit management, signaling to lenders that you're a low-risk borrower. This translates to better interest rates, increased borrowing power, and improved financial stability overall.

Exploring the Connection Between Payment History and Credit Utilization

While credit utilization is a critical factor, it's crucial to understand its interplay with payment history. Consistent on-time payments are equally vital in building a strong credit profile. Even with low credit utilization, consistently late payments will severely damage your credit score.

Key Factors to Consider:

-

Roles and Real-World Examples: Imagine two individuals with the same credit utilization (20%). One consistently pays their bills on time; the other frequently misses payments. The individual with consistent on-time payments will likely have a significantly higher credit score.

-

Risks and Mitigations: The risk of high credit utilization is a lower credit score, resulting in higher interest rates and potential loan rejections. Mitigation strategies include creating a budget, paying down debt aggressively, and utilizing credit responsibly.

-

Impact and Implications: The long-term implications of consistently high credit utilization can be detrimental. It can lead to a cycle of debt, limited access to credit, and higher overall borrowing costs.

Conclusion: Reinforcing the Connection

The interplay between payment history and credit utilization underscores the holistic nature of credit management. Both factors are crucial, and neglecting either can negatively impact your credit score. Maintaining a low utilization rate and a flawless payment history are essential for building and maintaining excellent credit.

Further Analysis: Examining Payment History in Greater Detail

Payment history accounts for a significant portion (typically 35%) of your credit score. Even minor payment delays can have a noticeable negative impact. This emphasizes the importance of setting up automatic payments, budgeting effectively, and promptly addressing any financial setbacks to prevent late payments. Regularly reviewing your credit report allows for early detection of any errors that may negatively affect your score.

FAQ Section: Answering Common Questions About Credit Utilization

Q: What is the ideal credit utilization percentage?

A: While some sources suggest 30% as an acceptable limit, aiming for under 10% is generally recommended for optimal credit health. The lower, the better.

Q: How often should I check my credit utilization?

A: It's advisable to monitor your credit utilization regularly, ideally monthly, to maintain control of your credit usage.

Q: What if my credit utilization is already high?

A: Develop a repayment plan focusing on high-interest debt first. Consider a debt consolidation loan or balance transfer to lower your interest rates and manage debt more effectively.

Q: Does credit utilization affect all types of credit?

A: While it primarily impacts revolving credit (like credit cards), it can indirectly influence other credit types by affecting your overall credit score.

Q: How long does it take for a change in credit utilization to reflect on my credit score?

A: The impact of a change in credit utilization on your credit score isn't immediate. It usually takes a few months for credit bureaus to update their records and reflect these changes.

Practical Tips: Maximizing the Benefits of Low Credit Utilization

-

Understand the Basics: Clearly grasp the concept of credit utilization and its influence on your credit score.

-

Track Your Spending: Utilize budgeting tools or apps to monitor your spending and credit card balances.

-

Pay Down Debt: Aggressively pay down high-interest debt to lower your credit utilization quickly.

-

Consider a Balance Transfer: Transfer high-interest debt to a card with a 0% introductory APR to reduce interest charges and pay down the principal faster.

-

Request a Credit Limit Increase: If you have a long history of responsible credit use, request a credit limit increase from your card issuer. This will lower your credit utilization ratio without changing your spending habits. Be mindful though that a higher credit limit doesn't give you permission to spend more.

Final Conclusion: Wrapping Up with Lasting Insights

Maintaining a low credit utilization percentage is a cornerstone of responsible financial management. By understanding its impact on your credit score and actively managing your credit usage, you can secure better interest rates, increase your borrowing power, and cultivate a solid foundation for long-term financial success. Remember, consistency is key—consistent on-time payments and keeping your credit utilization well below 30%, ideally under 10%, are crucial steps in building and maintaining excellent credit. It's a small change with significant, long-lasting rewards.

Latest Posts

Latest Posts

-

How Long Should I Keep A Car Loan To Build Credit

Apr 08, 2025

-

How Much Does A Car Loan Build Credit

Apr 08, 2025

-

How Fast Does Car Payment Build Credit

Apr 08, 2025

-

How Fast Does A Car Payment Build Your Credit

Apr 08, 2025

-

When Does Lowes Credit Card Report To Credit Bureaus

Apr 08, 2025

Related Post

Thank you for visiting our website which covers about What Percentage Should You Keep Your Credit Utilization Under . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.