What Is The Minimum Monthly Payment On 2000 Credit Card

adminse

Apr 05, 2025 · 8 min read

Table of Contents

Decoding the Minimum Payment on a $2,000 Credit Card: A Comprehensive Guide

What if the seemingly insignificant minimum payment on a $2,000 credit card could lead to a debt trap? Understanding the true cost of minimum payments is crucial for responsible credit card management.

Editor’s Note: This article provides up-to-date information on calculating and understanding minimum credit card payments. The information is for educational purposes and should not be considered financial advice. Always consult with a financial professional for personalized guidance.

Why Minimum Payments Matter: A $2,000 Debt's Long Shadow

Ignoring the seemingly small minimum payment on a $2,000 credit card balance can have significant long-term financial consequences. Many people mistakenly believe that paying the minimum is a viable strategy, unaware of the compounding interest that quickly transforms a manageable debt into an overwhelming burden. Understanding the factors that determine minimum payments and their impact on your overall debt repayment is essential for financial well-being. This article will explore these factors, detailing the calculations and showcasing the potential pitfalls of relying solely on minimum payments. We will also provide strategies for managing and reducing your credit card debt effectively.

Overview: What This Article Covers

This comprehensive guide dives deep into the intricacies of minimum credit card payments on a $2,000 balance. We will cover:

- Understanding Minimum Payment Calculation: The mechanics behind how your minimum payment is determined.

- Factors Influencing Minimum Payments: Exploring the variables that affect the minimum amount due.

- The High Cost of Minimum Payments: Illustrating the long-term financial implications of only paying the minimum.

- Strategies for Accelerating Debt Repayment: Practical steps to pay off your $2,000 credit card debt faster.

- Avoiding the Debt Trap: Preventing future credit card debt accumulation.

- Alternative Debt Management Options: Exploring options like balance transfers and debt consolidation.

- Frequently Asked Questions (FAQ): Addressing common queries about minimum payments and credit card debt.

- Practical Tips for Responsible Credit Card Use: Actionable advice for managing your credit effectively.

The Research and Effort Behind the Insights

This article draws on extensive research from reputable financial institutions, consumer protection agencies, and expert analyses of credit card agreements. All information is supported by credible sources to ensure accuracy and reliability. The analysis presented is designed to be easily understood and applied to your own financial situation.

Key Takeaways:

- Minimum payments are not designed for long-term debt repayment. They primarily serve to keep your account in good standing, not to eliminate the debt quickly.

- Interest accrual significantly extends the repayment period and increases the total cost of borrowing. The longer you only pay the minimum, the more interest you pay.

- Developing a strategic repayment plan is crucial for effective debt management. Prioritizing higher-interest debt and exploring options to increase payments can drastically reduce your overall debt burden.

Smooth Transition to the Core Discussion

Now that we've established the importance of understanding minimum payments, let's delve into the specifics of calculating and managing the minimum payment on a $2,000 credit card debt.

Exploring the Key Aspects of Minimum Credit Card Payments

1. Understanding Minimum Payment Calculation:

The minimum payment calculation is not a fixed percentage across all credit card companies. It typically falls within a range, often between 1% and 3% of the outstanding balance, or a fixed minimum dollar amount (often $25-$35), whichever is greater. Credit card companies use a complex formula that considers factors such as your credit history, credit limit, and payment history. It's crucial to check your credit card statement for the precise calculation used by your issuer.

For a $2,000 balance, a 1% minimum payment would be $20, while a 3% payment would be $60. A fixed minimum of $25 would also be the minimum due. The higher the minimum payment percentage, the faster you’ll pay off the debt (and pay less interest overall).

2. Factors Influencing Minimum Payments:

Several factors contribute to the variation in minimum payments:

- Credit Card Issuer: Each issuer has its own policy regarding minimum payment calculations.

- Credit History: A strong credit history might influence a slightly higher minimum payment requirement, while a poor history could lead to a fixed minimum, regardless of the balance.

- Account Age: Newer accounts may have a fixed minimum payment.

- Promotional Periods: Some cards offer introductory periods with lower minimum payments. These are temporary, and once over, the minimum payment will often increase.

3. The High Cost of Minimum Payments:

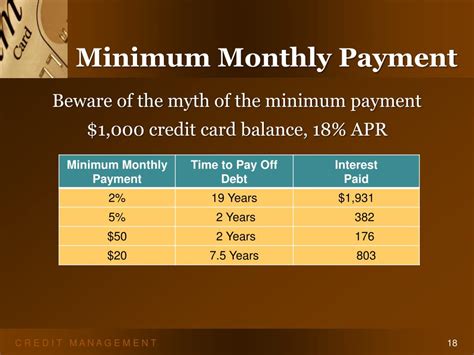

The allure of a small minimum payment is deceptive. Paying only the minimum on a $2,000 balance means a significant portion of your payment goes towards interest, with only a small fraction going toward reducing the principal. This prolongs the repayment period dramatically and results in paying significantly more in interest over the life of the loan. The difference between paying the minimum and making larger payments can be staggering. Using a credit card repayment calculator can clearly illustrate this difference.

4. Strategies for Accelerating Debt Repayment:

Several strategies can help you pay off your $2,000 credit card debt more quickly:

- Increase Your Minimum Payment: Paying even slightly more than the minimum each month will make a significant difference over time.

- Create a Budget: Identify areas where you can cut expenses to allocate more funds towards debt repayment.

- Debt Avalanche or Snowball Method: Prioritize high-interest debts (avalanche) or focus on paying off the smallest debt first for motivation (snowball).

- Set Up Automatic Payments: Automate a larger payment than the minimum to ensure consistent progress.

- Negotiate with Your Credit Card Company: Explore options for lower interest rates or payment plans.

5. Avoiding the Debt Trap:

To avoid the cycle of minimum payments and mounting debt, consider these strategies:

- Track Your Spending: Monitor your spending habits to identify areas of overspending and curb unnecessary purchases.

- Pay Your Balance in Full Each Month: This avoids accruing interest and keeps your credit utilization low.

- Use Credit Cards Responsibly: Only spend what you can afford to pay back immediately.

- Build an Emergency Fund: This prevents resorting to credit cards for unexpected expenses.

Exploring the Connection Between Interest Rates and Minimum Payments

The relationship between interest rates and minimum payments is paramount. A higher interest rate means a larger portion of your minimum payment goes towards interest, leaving less to reduce the principal balance. This dramatically increases the overall cost and repayment time. Let's illustrate this with a few scenarios:

Key Factors to Consider:

Roles and Real-World Examples:

A 20% APR on a $2,000 balance will significantly inflate the amount paid in interest over time, compared to a 10% APR. This is illustrated by many online credit card calculators, which show that even modest increases in interest rates can translate into thousands of dollars in additional interest paid over several years.

Risks and Mitigations:

The risk of prolonging debt and paying excessive interest is substantial. Mitigation involves actively paying more than the minimum payment, seeking lower interest rates through balance transfers or negotiations, and establishing a robust budget.

Impact and Implications:

Failure to address a high-interest rate on credit card debt can lead to financial stress, impacting credit scores and preventing financial goals. Conversely, addressing high interest through proactive debt management allows for achieving financial goals faster.

Conclusion: Reinforcing the Connection

The interplay between interest rates and minimum payments highlights the importance of proactive debt management. By carefully monitoring interest rates and taking steps to reduce or refinance high-interest debt, one can significantly reduce the long-term financial burden.

Further Analysis: Examining Interest Rates in Greater Detail

Interest rates are determined by several factors, including the creditworthiness of the borrower, the prevailing market conditions, and the credit card issuer's policies. Understanding these factors can help you negotiate lower rates or choose credit cards with more favorable terms. Annual Percentage Rate (APR) is a key metric to monitor when comparing credit cards.

FAQ Section: Answering Common Questions About Minimum Payments on Credit Cards

-

What happens if I only pay the minimum payment? You will accumulate interest, prolonging repayment and increasing the overall cost of your debt.

-

Can I negotiate a lower minimum payment? You can try, but success isn't guaranteed. A hardship program might be an option, depending on your circumstances.

-

What are the consequences of missing a minimum payment? Late fees, increased interest rates, and damage to your credit score are all potential consequences.

-

How can I calculate the total interest paid over time? Use online credit card repayment calculators, which allow you to input your balance, interest rate, and payment amounts.

-

What should I do if I can't afford my minimum payment? Contact your credit card company immediately to discuss your options, such as hardship programs or payment plans.

Practical Tips: Maximizing the Benefits of Responsible Credit Card Use

- Create a Realistic Budget: Track your spending and ensure your budget allocates enough for debt repayment.

- Pay More Than the Minimum: Even small increases will significantly reduce the total interest paid.

- Monitor Your Credit Report: Regular monitoring helps you detect any errors and track your credit health.

- Consider Debt Consolidation: This might help you secure a lower interest rate and simplify repayment.

- Use Credit Cards Wisely: Avoid using credit cards for expenses you can't afford.

Final Conclusion: Wrapping Up with Lasting Insights

Understanding minimum payments on a $2,000 credit card is crucial for responsible financial management. While the minimum payment might seem convenient, it can lead to a debt trap if not managed carefully. By adopting proactive strategies, actively paying more than the minimum, and monitoring interest rates, you can effectively manage your debt and avoid the high costs of prolonged repayment. Remember that responsible credit card use involves a combination of financial discipline and strategic planning. By understanding the calculations and implications, you can take control of your finances and build a healthier financial future.

Latest Posts

Latest Posts

-

What Is Credit Utilization Rate Mean

Apr 07, 2025

-

What Is An Ideal Credit Utilization Percentage

Apr 07, 2025

-

What Is An Ideal Credit Utilization Rate

Apr 07, 2025

-

What Is Ideal Credit Utilization

Apr 07, 2025

-

What Is A Good Credit Utilization Ratio

Apr 07, 2025

Related Post

Thank you for visiting our website which covers about What Is The Minimum Monthly Payment On 2000 Credit Card . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.