What Is Nfc Payment On Phone

adminse

Apr 06, 2025 · 9 min read

Table of Contents

Unlock the Power of Tap: A Deep Dive into NFC Phone Payments

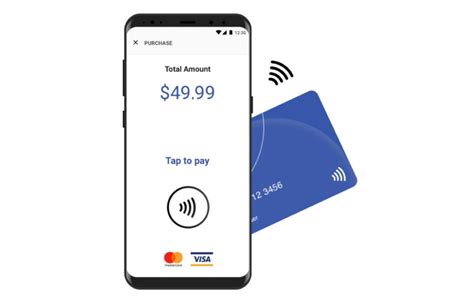

What if effortless, secure transactions were as simple as a tap of your phone? Near Field Communication (NFC) payment technology is revolutionizing how we handle money, offering unparalleled convenience and security.

Editor’s Note: This article on NFC phone payments has been updated today to reflect the latest advancements and security protocols in this rapidly evolving technology. This comprehensive guide will equip you with the knowledge to understand, utilize, and appreciate the power of NFC payments.

Why NFC Phone Payments Matter:

NFC payments are transforming the way individuals and businesses conduct transactions. The convenience factor alone is a significant driver of adoption; the ability to pay for goods and services with a simple tap of your smartphone eliminates the need for cash, cards, or even typing in lengthy payment details. This speed and efficiency are particularly appealing in busy environments, such as public transportation or crowded retail stores. Beyond convenience, NFC payments offer enhanced security features, reducing the risk of fraud and loss compared to traditional methods. The integration with mobile wallets also allows for seamless tracking of expenses and management of financial resources. For businesses, NFC payments provide streamlined checkout processes, reduced transaction costs, and potentially increased sales due to improved customer experience.

Overview: What This Article Covers

This article provides a comprehensive exploration of NFC phone payments. We will delve into the underlying technology, examining its functionality and security features. We will explore various mobile payment platforms utilizing NFC, including Apple Pay, Google Pay, Samsung Pay, and others. Further, we will discuss the benefits and drawbacks of this technology, addressing common concerns and misconceptions. The article will conclude with actionable tips on how to maximize the benefits of NFC payments and stay informed about the latest developments in this dynamic field.

The Research and Effort Behind the Insights

This in-depth analysis draws upon extensive research, incorporating technical specifications, industry reports, user reviews, and security analyses from reputable sources. The information presented is verified and cross-referenced to ensure accuracy and reliability. The goal is to provide readers with a clear, unbiased, and up-to-date understanding of NFC phone payments.

Key Takeaways:

- Understanding NFC Technology: A detailed explanation of Near Field Communication and how it enables contactless payments.

- Popular Mobile Payment Platforms: An overview of major players like Apple Pay, Google Pay, and Samsung Pay, highlighting their features and differences.

- Security Measures: An in-depth look at the robust security protocols employed to protect users’ financial data.

- Benefits and Drawbacks: A balanced assessment of the advantages and disadvantages of NFC payments.

- Future Trends: A glimpse into the evolving landscape of mobile payment technology and its potential future impacts.

Smooth Transition to the Core Discussion:

Now that we've established the importance of NFC payments, let's explore the technology's intricacies, starting with a fundamental understanding of Near Field Communication.

Exploring the Key Aspects of NFC Phone Payments

1. Definition and Core Concepts:

Near Field Communication (NFC) is a short-range wireless technology that enables two devices to communicate when they are within a few centimeters of each other. It operates on the principle of radio frequency identification (RFID) but with enhanced security features designed specifically for data exchange and secure transactions. In the context of mobile payments, the NFC chip embedded in a smartphone acts as a virtual payment card, transmitting encrypted payment information to a contactless payment terminal. This terminal, usually found at point-of-sale (POS) systems, reads the information and processes the payment.

2. Applications Across Industries:

The applications of NFC payments extend far beyond simple retail transactions. This technology is increasingly integrated into various sectors:

- Transportation: Many public transit systems utilize NFC for contactless ticketing and fare payment, providing a seamless and efficient commuting experience.

- Access Control: NFC-enabled access cards are replacing traditional key cards, providing secure and convenient access to buildings and facilities.

- Loyalty Programs: Retailers use NFC tags to enhance customer loyalty programs, offering personalized discounts and promotions.

- Event Ticketing: NFC-enabled tickets eliminate the need for paper tickets, simplifying entry to events and concerts.

- Healthcare: NFC is explored for secure patient identification and data exchange within healthcare settings.

3. Challenges and Solutions:

Despite its numerous advantages, NFC payments face some challenges:

- Adoption Rates: While adoption is increasing, some regions and demographics still lag behind in adopting contactless payment methods.

- Security Concerns: Although highly secure, concerns about data breaches and potential fraud persist. However, robust encryption and tokenization significantly mitigate these risks.

- Infrastructure Limitations: Not all POS systems are equipped with NFC readers, limiting the accessibility of NFC payments in certain locations. However, the rapid deployment of updated systems is continuously expanding coverage.

- Technical Glitches: As with any technology, occasional technical glitches can occur, such as connection problems or payment failures. However, these are typically rare and quickly resolved.

4. Impact on Innovation:

NFC payments are driving innovation in various areas:

- Mobile Wallets: The rise of mobile wallets (Apple Pay, Google Pay, Samsung Pay) has revolutionized how we manage and utilize our finances, offering centralized platforms for payments, loyalty cards, and other digital assets.

- Biometric Authentication: Many NFC payment systems integrate biometric authentication, such as fingerprint or facial recognition, adding an extra layer of security and convenience.

- Peer-to-Peer (P2P) Payments: NFC enables seamless peer-to-peer transactions between individuals, eliminating the need for bank transfers or cash exchanges.

Closing Insights: Summarizing the Core Discussion

NFC payments are transforming the way we transact, offering a secure, convenient, and efficient alternative to traditional payment methods. While challenges exist, the ongoing advancements in technology and infrastructure are continuously addressing these limitations, paving the way for widespread adoption across various industries.

Exploring the Connection Between Security and NFC Phone Payments

The relationship between security and NFC phone payments is paramount. The success and widespread acceptance of this technology hinge on the confidence that users have in its ability to protect their financial data.

Key Factors to Consider:

Roles and Real-World Examples: NFC payment systems employ several security measures to safeguard user information:

- Tokenization: Instead of transmitting actual credit card numbers, NFC transactions use unique tokens that represent the card information. Even if a token is compromised, the actual card number remains secure.

- Encryption: All communication between the smartphone and the payment terminal is heavily encrypted, preventing unauthorized access to sensitive data.

- Biometric Authentication: Many platforms incorporate fingerprint or facial recognition to further enhance security by ensuring only the authorized user can initiate a transaction.

- Device Security: The security of the device itself plays a crucial role. Strong passwords, regular software updates, and anti-malware protection are essential to prevent unauthorized access to the NFC functionality and stored payment information.

Risks and Mitigations:

While NFC payments are inherently secure, potential risks include:

- Skimming: Malicious devices can attempt to intercept payment information during a transaction. However, the encryption protocols significantly mitigate this risk. Users should be wary of unusual POS terminals or irregularities during the transaction process.

- Phishing: Phishing attempts can target users to steal their payment information by masquerading as legitimate payment platforms. Users should exercise caution and only access trusted websites and applications.

- Loss or Theft of Device: If a device is lost or stolen, the user should immediately report it to their mobile provider and financial institutions to prevent unauthorized transactions. Features like remote device locking and data wiping can help mitigate this risk.

Impact and Implications:

The robust security measures implemented in NFC payments are essential for building user trust and ensuring the widespread adoption of this technology. The ongoing development and implementation of advanced security protocols will continue to improve the safety and reliability of NFC transactions.

Conclusion: Reinforcing the Connection

The security of NFC phone payments is not merely an afterthought; it is an integral part of the technology's design. The combination of tokenization, encryption, biometric authentication, and robust device security protocols makes NFC payments a safe and reliable method for conducting financial transactions. Continuous improvements and advancements in these areas further enhance the security of this rapidly evolving technology.

Further Analysis: Examining Tokenization in Greater Detail

Tokenization is a cornerstone of NFC payment security. It replaces sensitive payment data, like credit card numbers, with unique, non-sensitive tokens. These tokens can be used for transactions without revealing the actual card information. If a token is compromised, it can be easily replaced, preventing unauthorized access to the underlying account. This process significantly reduces the risk of fraud and data breaches. Many major payment processors and mobile wallets employ sophisticated tokenization systems that meet industry security standards, assuring users of a high level of protection.

FAQ Section: Answering Common Questions About NFC Phone Payments

Q: What is NFC? A: NFC stands for Near Field Communication, a short-range wireless technology that enables communication between two devices within a few centimeters.

Q: How do NFC payments work? A: Your phone's NFC chip communicates with a contactless payment terminal at the point of sale. Encrypted data is exchanged, and the payment is processed securely.

Q: Are NFC payments safe? A: Yes, NFC payments employ robust security measures, including tokenization and encryption, to protect user data.

Q: What mobile payment platforms use NFC? A: Popular platforms include Apple Pay, Google Pay, Samsung Pay, and others, each with its own features and benefits.

Q: What if my phone doesn't have NFC? A: You can't use NFC payments without an NFC-enabled device. Consider upgrading to a newer smartphone with NFC capabilities.

Q: How do I add my credit card to my mobile wallet? A: The process varies slightly across platforms, but generally involves opening your mobile wallet app, adding your card details, and verifying your identity.

Practical Tips: Maximizing the Benefits of NFC Phone Payments

- Enable NFC on your phone: Ensure NFC is activated in your phone's settings.

- Download a mobile wallet: Choose a compatible mobile wallet and add your payment cards.

- Keep your software updated: Regularly update your phone's operating system and mobile wallet app for security patches.

- Use strong passwords and biometric security: Protect your device with strong passwords and utilize biometric authentication when available.

- Be aware of your surroundings: Pay attention to the payment terminal and avoid using it in suspicious environments.

- Monitor your transactions: Regularly check your banking statements for unauthorized activity.

Final Conclusion: Wrapping Up with Lasting Insights

NFC phone payments are transforming the landscape of financial transactions. The convenience, security, and efficiency offered by this technology are driving widespread adoption, impacting individuals, businesses, and various industries. By understanding the underlying technology, security measures, and potential benefits, users can leverage the power of NFC payments for a seamless and secure financial experience. As technology continues to evolve, we can expect even more innovative applications and enhanced security features to further enhance the convenience and safety of this transformative payment method.

Latest Posts

Latest Posts

-

Credit Lock Definition

Apr 07, 2025

-

Security Freeze Definition

Apr 07, 2025

-

Credit Freeze Definition Personal Finance

Apr 07, 2025

-

Credit Freeze Definition Finance

Apr 07, 2025

-

What Credit Score Do You Need To Get The Venmo Credit Card

Apr 07, 2025

Related Post

Thank you for visiting our website which covers about What Is Nfc Payment On Phone . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.