What Funeral Expenses Can Be Paid By An Estate

adminse

Apr 01, 2025 · 8 min read

Table of Contents

What Funeral Expenses Can Be Paid by an Estate? Uncovering the Legalities and Practicalities

What if the financial burden of a loved one's funeral unexpectedly falls on grieving survivors? Understanding which funeral expenses an estate can cover is crucial for both financial peace of mind and respectful end-of-life planning.

Editor’s Note: This article on funeral expenses payable by an estate has been updated [Date] to reflect current legal and practical considerations. Navigating the complexities of estate settlement can be challenging, so we provide clear, concise information to help you through this difficult time.

Why Knowing About Estate-Paid Funeral Expenses Matters

The death of a loved one is a profoundly emotional experience, often compounded by the immediate financial responsibilities of funeral arrangements. Knowing which expenses an estate can cover provides crucial relief during this difficult period. This knowledge allows families to make informed decisions about funeral services without undue financial strain, ensuring a respectful and fitting farewell while mitigating potential legal complications. It's also essential for estate executors and administrators to understand their responsibilities regarding the payment of these expenses.

Overview: What This Article Covers

This comprehensive guide explores the complexities of funeral expenses and their payment from an estate. We will examine the legal frameworks governing such payments, differentiating between permissible and impermissible expenses. We'll also delve into practical considerations, providing real-world examples and addressing frequently asked questions. Furthermore, we will examine the role of wills, probate, and other legal instruments in determining the allocation of funds. Finally, we’ll explore strategies for pre-planning funeral arrangements to alleviate financial burdens on surviving family members.

The Research and Effort Behind the Insights

This article draws upon extensive research, encompassing legal statutes, case studies, and consultations with estate planning attorneys and funeral directors. Information presented is intended for informational purposes only and should not be considered legal advice. Consult with legal professionals for guidance specific to your situation.

Key Takeaways:

- Defining “Reasonable” Funeral Expenses: The law generally allows for the payment of "reasonable" funeral expenses from an estate. This term is subjective and depends on various factors, including local customs, the deceased's wishes, and the estate's overall value.

- Probate and Estate Settlement: The process of paying funeral expenses is typically handled through probate, the legal process of administering a deceased person's estate.

- Priority of Claims: Funeral expenses usually hold a high priority in the order of claims against an estate, meaning they're often paid before other debts.

- Documentation is Crucial: Maintaining meticulous records of all funeral expenses is essential for reimbursement from the estate.

- Pre-Need Planning: Proactive planning, such as pre-funded funeral arrangements or detailed instructions in a will, can significantly reduce financial stress for surviving family members.

Smooth Transition to the Core Discussion

Now that we've established the importance of understanding estate-paid funeral expenses, let's delve into the specifics. We'll explore the types of expenses typically covered, the legal considerations, and best practices for managing these costs.

Exploring the Key Aspects of Estate-Paid Funeral Expenses

1. Defining "Reasonable" Expenses:

The cornerstone of estate-paid funeral expenses lies in the concept of "reasonableness." Courts typically define this based on several factors:

- Local Customs and Traditions: Funeral costs vary significantly by region and cultural background. A lavish funeral in one area might be considered excessive in another.

- The Deceased's Wishes: If the deceased expressed specific preferences regarding their funeral (e.g., through a will or pre-need arrangements), the court will typically consider these wishes when determining reasonableness.

- The Estate's Value: An estate with substantial assets can typically afford more expensive funeral arrangements than one with limited funds.

- Family Circumstances: The court may consider the financial capabilities of the family in determining what constitutes a reasonable expense.

2. Types of Expenses Typically Covered:

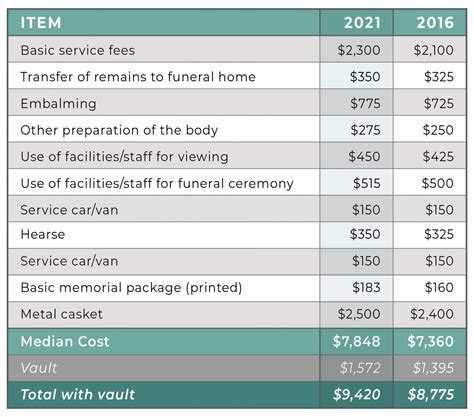

Generally, the following expenses are considered for payment from the estate:

- Embalming: Preservation of the body.

- Casket: The container for the deceased.

- Funeral Home Services: Fees charged by the funeral home for services rendered, such as arranging the funeral, coordinating with cemeteries, and providing other administrative support.

- Viewing and Funeral Services: Costs associated with the wake or visitation, funeral ceremony, and any other related services.

- Burial or Cremation: Expenses related to burial plots, interment, cremation fees, and urns.

- Transportation of the Remains: Costs associated with transporting the deceased's body to the funeral home, cemetery, or crematorium.

- Grave Marker or Headstone: Costs associated with a grave marker or headstone.

- Death Certificates and Other Legal Documents: Fees for obtaining necessary documents.

3. Expenses Generally NOT Covered:

While many funeral costs are considered, some are often excluded:

- Excessive or Luxurious Items: Items considered extravagant or unnecessary, far exceeding local customs or the deceased's wishes.

- Personal Expenses of the Family: Expenses incurred by the family, such as travel costs for attendees or catering unrelated to the funeral service itself.

- Debts of the Deceased: Funeral expenses generally take priority over other debts, but they are not considered part of the deceased's personal debt.

- Unnecessary Duplication of Services: Paying for multiple services that are essentially redundant.

4. The Role of Wills and Probate:

A will can provide specific instructions regarding funeral arrangements, including the allocation of funds for funeral expenses. If no will exists (intestate), state laws dictate the distribution of assets, and funeral expenses will be paid from the estate according to the established order of claims. The probate court oversees the process, ensuring the proper payment of legitimate expenses.

Exploring the Connection Between Pre-Need Planning and Estate-Paid Funeral Expenses

Pre-need planning plays a crucial role in simplifying the process of paying funeral expenses from an estate. By making arrangements in advance, individuals can:

- Specify their wishes: Clearly articulate their preferences regarding the type of funeral services they desire.

- Control costs: Pre-arrangements often lock in prices, protecting against future inflation.

- Reduce burden on family: Alleviate the emotional and financial strain on surviving loved ones.

- Ensure payment: Pre-funded arrangements guarantee that funds are available to cover expenses.

Key Factors to Consider in Pre-Need Planning:

- Funding options: Individuals can choose to pay for arrangements in full upfront, or establish a payment plan.

- Legal implications: Understanding the legal implications of pre-need contracts is essential.

- Provider selection: Choosing a reputable and trustworthy funeral home is crucial.

Risks and Mitigations in Pre-Need Planning:

- Provider insolvency: Selecting a financially stable provider is crucial to avoid the risk of losing funds.

- Contract terms: Carefully review the terms and conditions of the contract to understand all fees, restrictions, and potential adjustments.

Impact and Implications of Pre-Need Planning:

Pre-need planning offers considerable benefits, reducing financial stress and ensuring the deceased's wishes are honored. By proactively addressing end-of-life arrangements, individuals provide a significant gift to their families, allowing them to grieve without added financial burden.

Conclusion: Reinforcing the Connection Between Pre-Need Planning and Estate-Paid Funeral Expenses

Pre-need planning significantly impacts the estate's ability to cover funeral expenses efficiently and respectfully. By clarifying wishes and managing costs in advance, it simplifies the process for both the deceased and their surviving family.

Further Analysis: Examining Probate Procedures in Greater Detail

Probate is a complex legal process, but understanding its key steps is crucial for dealing with estate-paid funeral expenses. These steps typically include:

- Filing the will (or petition for intestacy): The executor (or administrator) initiates the probate process.

- Inventorying assets: All estate assets are identified and valued.

- Paying debts: Debts are paid in accordance with legal precedence, with funeral expenses often holding priority.

- Distributing remaining assets: Remaining assets are distributed according to the will (or intestacy laws).

FAQ Section: Answering Common Questions About Estate-Paid Funeral Expenses

Q: What happens if the estate doesn't have enough funds to cover all funeral expenses?

A: If the estate lacks sufficient funds, the family may need to cover the remaining balance. However, the court may allow for a partial payment based on the estate's value.

Q: Can I claim funeral expenses from life insurance?

A: Life insurance proceeds can often be used to cover funeral expenses, but this depends on the specific policy terms.

Q: Does the type of funeral service (burial vs. cremation) affect estate payment?

A: Generally, the type of service does not affect eligibility, but the costs associated with each type of service can vary significantly.

Q: What if there are disputes among family members regarding funeral expenses?

A: Disputes can be addressed through mediation or, if necessary, through the probate court.

Practical Tips: Maximizing the Benefits of Understanding Estate-Paid Funeral Expenses

- Maintain thorough documentation: Keep detailed records of all funeral expenses and receipts.

- Consult with professionals: Seek advice from an estate planning attorney and funeral director.

- Communicate openly: Discuss funeral arrangements and financial considerations with family members beforehand.

Final Conclusion: Wrapping Up with Lasting Insights

Understanding which funeral expenses can be paid by an estate is crucial for responsible estate planning and grief management. By understanding the legal framework, common practices, and the benefits of pre-need planning, individuals and families can navigate this complex process with clarity and peace of mind. Proactive planning and open communication are key to minimizing financial burden and ensuring a respectful and fitting farewell for loved ones. Remember, seeking professional legal and financial advice is always advisable when dealing with estate matters.

Latest Posts

Latest Posts

-

What Is Speedy Cash

Apr 02, 2025

-

Speed Up Cash Cash

Apr 02, 2025

-

What Time Does Speedy Cash Close

Apr 02, 2025

-

What Happens If You Miss A Payment With Speedy Cash

Apr 02, 2025

-

Speedy Cash Late Payment Fee

Apr 02, 2025

Related Post

Thank you for visiting our website which covers about What Funeral Expenses Can Be Paid By An Estate . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.