What Does Grace Period Mean When Talking About Credit Card Purchases

adminse

Apr 01, 2025 · 8 min read

Table of Contents

Decoding the Grace Period: Understanding Your Credit Card Purchase Window

What if navigating your credit card payments was simpler, free from unexpected fees and penalties? Understanding the grace period is the key to unlocking financial freedom and maximizing the benefits of your credit card.

Editor’s Note: This article on credit card grace periods was published today, offering the most up-to-date information on this crucial aspect of credit card management. We aim to clarify common misconceptions and empower you to manage your finances effectively.

Why the Grace Period Matters: Relevance, Practical Applications, and Financial Implications

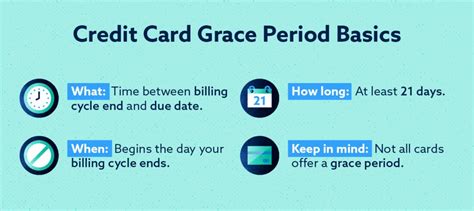

The grace period on your credit card is a crucial element often overlooked. It's the period between the end of your billing cycle and the due date of your payment. Understanding this window is vital for avoiding interest charges, managing your credit score, and ultimately, saving money. Failure to grasp its mechanics can lead to unnecessary debt and negatively impact your financial health. This period directly affects your overall credit utilization, a significant factor influencing your creditworthiness.

Overview: What This Article Covers

This article provides a comprehensive overview of credit card grace periods. We’ll explore its definition, how it works, factors influencing its length, situations where it doesn't apply, common misconceptions, and practical tips for maximizing its benefits. Readers will gain actionable insights to confidently manage their credit card accounts and avoid accruing unwanted interest.

The Research and Effort Behind the Insights

This article draws upon research from reputable financial institutions, consumer protection agencies, and legal resources. The information provided is based on commonly accepted credit card practices and is intended to be a general guide. Specific terms and conditions may vary depending on your individual credit card agreement, so always refer to your cardholder agreement for the most accurate and detailed information.

Key Takeaways:

- Definition and Core Concepts: A precise definition of the grace period and its core components.

- Eligibility Requirements: The conditions that must be met to qualify for a grace period.

- Calculating the Grace Period: A step-by-step guide to understanding your individual grace period.

- Situations Where Grace Periods Don't Apply: Exceptions to the grace period rule.

- Impact on Credit Score: How the grace period affects your credit utilization and score.

- Practical Strategies: Actionable steps to utilize the grace period effectively.

Smooth Transition to the Core Discussion:

Now that we understand the importance of the grace period, let's delve into its specifics, examining its intricacies and practical applications.

Exploring the Key Aspects of the Grace Period

1. Definition and Core Concepts:

A grace period, in the context of credit cards, is the time you have after the closing date of your billing cycle to pay your balance in full without incurring interest charges on purchases. This period allows you to make use of your credit card for purchases and then repay the amount owed before interest starts accumulating. It's a critical benefit offered by many credit card issuers to encourage responsible spending and repayment.

2. Eligibility Requirements:

While most credit cards offer a grace period, certain conditions must usually be met to qualify:

- Payment in Full: You must pay your previous statement balance in full by the due date. Any outstanding balance from the previous month will negate the grace period for new purchases made in the current cycle.

- No Existing Interest-Bearing Balances: If you carry a balance from the previous month, interest will accrue on that balance, and it will usually also prevent a grace period for new purchases.

- No Cash Advances: Cash advances, balance transfers, and other fees typically do not qualify for the grace period and accrue interest immediately.

- Account in Good Standing: Your account must be in good standing, meaning no late payments or other violations of the cardholder agreement.

3. Calculating the Grace Period:

The length of your grace period isn't standardized. It typically ranges from 21 to 25 days and is stated clearly in your credit card agreement. The grace period begins on the closing date of your billing cycle and ends on your payment due date. To calculate your specific grace period, carefully review your statement for both dates.

4. Situations Where Grace Periods Don't Apply:

There are several situations where the grace period may not apply:

- Cash Advances: As mentioned earlier, cash advances incur interest immediately, regardless of whether you pay your other purchases in full.

- Balance Transfers: Similar to cash advances, balance transfers usually don't benefit from the grace period.

- Late Payments: If you miss your payment due date, the grace period for the following month is usually voided, and interest will likely be charged retroactively.

- Fees: Any fees charged to your account (like late payment fees or over-limit fees) typically do not have a grace period and will accrue interest immediately.

5. Impact on Credit Score:

While the grace period itself doesn't directly impact your credit score, effectively utilizing it can indirectly improve your score. Paying your balance in full by the due date, consistently avoiding interest charges, and maintaining low credit utilization (the percentage of your available credit that you're using) all positively contribute to a better credit score. Conversely, consistently carrying a balance, missing payments, and having high credit utilization can negatively affect your score.

Exploring the Connection Between Payment Habits and Grace Periods

The relationship between responsible payment habits and maximizing the grace period is critical. Consistent on-time payments are essential for maintaining a good credit history and avoiding the accumulation of interest. Failure to pay on time can negate the benefits of the grace period and lead to a snowball effect of debt.

Key Factors to Consider:

- Roles and Real-World Examples: Consider a scenario where someone makes several purchases during the month. By paying their balance in full before the due date, they avoid interest charges, benefiting from the grace period. Conversely, someone who carries a balance from the previous month loses the grace period on new purchases.

- Risks and Mitigations: The risk of not understanding the grace period is incurring unnecessary interest charges, potentially leading to debt accumulation and a lower credit score. Mitigation involves carefully reviewing your credit card statement, understanding your billing cycle, and setting up automatic payments to ensure on-time payments.

- Impact and Implications: The implications of consistently mismanaging the grace period are long-term financial instability and potential damage to your creditworthiness. It can severely limit your access to credit in the future, impacting major financial decisions like mortgages and loans.

Conclusion: Reinforcing the Connection

The connection between payment habits and the grace period is undeniable. Responsible financial practices, such as paying your balance in full and on time, are crucial for leveraging the full benefits of the grace period and maintaining a strong credit profile.

Further Analysis: Examining Payment Methods in Greater Detail

Different payment methods can impact the effectiveness of the grace period. Using auto-pay systems can help ensure on-time payments, while manual payments require diligent monitoring of billing cycles and due dates. Understanding these nuances is crucial for maximizing the grace period.

FAQ Section: Answering Common Questions About Grace Periods

Q: What happens if I miss my payment due date?

A: Missing your payment due date will likely result in interest charges on your outstanding balance and may void your grace period for the next billing cycle. Late payment fees may also be applied.

Q: Can I still get a grace period if I make a purchase after the statement closing date?

A: Yes, purchases made after the statement closing date will usually still be eligible for the grace period, provided you pay your previous balance in full by the due date.

Q: Does the grace period apply to all types of credit card transactions?

A: No, the grace period typically does not apply to cash advances, balance transfers, or fees. These transactions usually incur interest immediately.

Q: What should I do if I can't pay my balance in full?

A: If you can't pay your balance in full, contact your credit card issuer immediately. They may offer options to help manage your debt, such as payment plans or hardship programs. Avoid ignoring the situation, as interest charges will continue to accumulate.

Practical Tips: Maximizing the Benefits of the Grace Period

- Understand Your Billing Cycle: Know the closing date of your billing cycle and your payment due date to accurately track your grace period.

- Pay in Full and on Time: Make sure to pay your previous month's balance in full by the due date to qualify for the grace period on new purchases.

- Utilize Auto-Pay: Set up automatic payments to eliminate the risk of forgetting your due date and ensure on-time payments.

- Monitor Your Account: Regularly check your credit card statement to track your spending and ensure you understand your balance and due date.

- Read Your Credit Card Agreement: Familiarize yourself with your cardholder agreement to understand the specifics of your grace period and other terms and conditions.

Final Conclusion: Wrapping Up with Lasting Insights

Understanding and effectively utilizing the grace period on your credit card is a fundamental aspect of responsible credit management. By following the tips and insights provided in this article, you can navigate your credit card finances with confidence, avoid unnecessary interest charges, and maintain a healthy credit score. Remember, the grace period is a valuable tool; learn how to use it to your advantage and build a strong financial foundation.

Latest Posts

Latest Posts

-

What Is The Minimum Payment On A Credit Card With 0 Interest

Apr 05, 2025

-

What Is The Minimum Payment On A Credit Card Uk

Apr 05, 2025

-

What Is The Minimum Payment For A Wells Fargo Credit Card

Apr 05, 2025

-

What Is The Minimum Payment For A Capital One Credit Card

Apr 05, 2025

-

What Is The Minimum Payment For A Chase Credit Card

Apr 05, 2025

Related Post

Thank you for visiting our website which covers about What Does Grace Period Mean When Talking About Credit Card Purchases . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.