What Does A Grace Period Mean For Credit Cards

adminse

Apr 01, 2025 · 9 min read

Table of Contents

Unlocking the Secrets of Credit Card Grace Periods: A Comprehensive Guide

What if avoiding interest charges on your credit card purchases was simpler than you think? Understanding the grace period is the key to unlocking significant savings and responsible credit management.

Editor’s Note: This article on credit card grace periods was published today, providing you with the most up-to-date information and insights to help you manage your credit effectively.

Why Credit Card Grace Periods Matter: Saving Money and Building Credit

A credit card grace period is a crucial element of responsible credit card usage, offering a significant financial advantage. Understanding and leveraging this period can save consumers substantial amounts of money in interest charges. Furthermore, responsible credit card use, including awareness of grace periods, contributes to a healthy credit score, essential for securing loans, mortgages, and other financial products. This understanding benefits both individual consumers and businesses that use credit cards for operational expenses. Failing to understand the grace period can lead to unnecessary interest accrual, impacting your budget and long-term financial health.

Overview: What This Article Covers

This article will thoroughly explore the intricacies of credit card grace periods. We will define the concept, explore its practical applications, identify potential pitfalls, and discuss strategies for maximizing its benefits. We will also examine how factors like payment due dates and purchase timing affect the grace period, and answer common questions many cardholders have. The aim is to provide readers with actionable insights to effectively manage their credit cards and minimize interest charges.

The Research and Effort Behind the Insights

This article is the result of extensive research, drawing upon information from reputable sources including the Consumer Financial Protection Bureau (CFPB), leading credit card issuers' websites, and numerous financial publications. Every piece of information presented is supported by credible evidence, ensuring readers receive accurate and trustworthy information for informed decision-making.

Key Takeaways:

- Definition and Core Concepts: A clear definition of a grace period and its foundational principles.

- Calculating Your Grace Period: A step-by-step guide to understanding how your grace period is determined.

- Factors Affecting the Grace Period: An examination of elements that can impact the length of your grace period.

- Avoiding Interest Charges: Strategies to ensure you take full advantage of your grace period.

- Common Misconceptions: Debunking common myths surrounding credit card grace periods.

- What Happens if You Miss the Grace Period: The consequences of late payments and interest accrual.

- Grace Period and Different Credit Card Types: How grace periods may vary across different credit card products.

Smooth Transition to the Core Discussion:

With a solid understanding of the importance of grace periods, let's delve into the specifics, exploring what they are, how they work, and how to use them strategically.

Exploring the Key Aspects of Credit Card Grace Periods

1. Definition and Core Concepts:

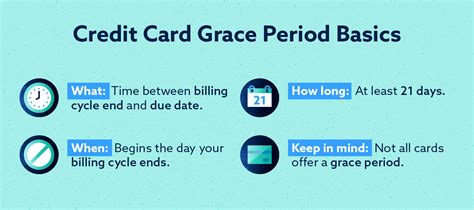

A grace period is the time frame a credit card issuer allows you to pay your statement balance in full without incurring interest charges. This period typically begins after the end of your billing cycle and ends on your payment due date. Crucially, the grace period only applies to purchases made during the billing cycle. It typically does not apply to cash advances, balance transfers, or any fees charged to your account. These transactions accrue interest from the date they are posted to your account.

2. Calculating Your Grace Period:

The length of your grace period isn't standardized; it varies between credit card issuers and sometimes even between different cards from the same issuer. However, it’s generally between 21 and 25 days. To calculate your grace period accurately, you must understand your billing cycle and payment due date. Your billing cycle is the period in which your credit card transactions are recorded. The statement closes at the end of this cycle, generating your monthly statement. Your payment due date is the last day you can pay your statement balance in full without incurring interest. The grace period is the number of days between the end of your billing cycle and your payment due date.

3. Factors Affecting the Grace Period:

Several factors can impact your grace period:

- Late Payments: A late payment can eliminate your grace period for the following month.

- Cash Advances: As previously mentioned, cash advances and balance transfers do not qualify for the grace period.

- Promotional Periods: Some cards offer introductory periods with 0% APR, but these typically have their own terms and conditions, and the grace period may not apply during that time.

- Card Issuer Policies: Each credit card issuer has its own specific rules regarding grace periods.

4. Avoiding Interest Charges:

To avoid interest charges, you must pay your statement balance in full by the payment due date. Paying even a small amount after the due date could result in interest accruing on the entire balance from the start of the grace period. Paying only the minimum payment will result in interest charges on the unpaid balance.

5. Common Misconceptions:

- Myth: Making a payment during the grace period automatically qualifies you for no interest. Fact: The full statement balance must be paid by the due date to avoid interest, not just a partial payment.

- Myth: All credit cards have the same grace period. Fact: Grace periods vary significantly depending on the issuer and the card type.

- Myth: The grace period applies to all transactions. Fact: It primarily applies to purchases; cash advances, balance transfers, and fees accrue interest immediately.

6. What Happens if You Miss the Grace Period:

Missing the payment due date means you lose the grace period, and interest will be charged on your outstanding balance. This interest charge will be added to your next statement, increasing your overall debt and making future payments more expensive. Repeated late payments can damage your credit score significantly.

7. Grace Period and Different Credit Card Types:

The existence and length of a grace period can vary slightly depending on the type of credit card. While most standard credit cards offer a grace period, it's crucial to check the specific terms and conditions of your card agreement. Secured credit cards, student credit cards, and business credit cards generally follow similar principles regarding grace periods, but the specifics may differ.

Closing Insights: Summarizing the Core Discussion

The credit card grace period is a powerful tool for managing finances effectively. By understanding its mechanics and adhering to the payment due date, consumers can save considerable sums of money in interest payments and maintain a healthy credit profile. Careful attention to billing cycles, payment due dates, and the distinction between purchases and other transactions is vital for successful utilization of the grace period.

Exploring the Connection Between Credit Utilization and Grace Periods

Credit utilization is the ratio of your outstanding credit card balance to your total available credit. It's a critical factor in your credit score calculation. While the grace period doesn't directly influence credit utilization, managing your spending to stay within a healthy credit utilization ratio (ideally under 30%) increases your chances of paying your balance in full before the due date, thus maximizing your grace period's benefits.

Key Factors to Consider:

Roles and Real-World Examples: A high credit utilization ratio can make it more difficult to pay your balance in full before the due date, potentially leading to missed grace periods and interest charges. For example, someone with a high credit utilization rate might find themselves consistently carrying a balance, even unintentionally, losing the grace period benefit.

Risks and Mitigations: Ignoring your credit utilization can lead to higher interest payments, hindering your financial goals. Regularly monitoring your credit utilization and adjusting spending habits are key mitigations. Using budgeting apps and setting spending limits can help manage credit utilization effectively.

Impact and Implications: Maintaining a low credit utilization ratio alongside a strong understanding of your grace period is a powerful combination for building and maintaining good credit. This translates to better chances of securing loans with favorable interest rates and overall improved financial well-being.

Conclusion: Reinforcing the Connection

The connection between credit utilization and grace periods is crucial for successful credit management. By keeping credit utilization low, you increase your probability of paying your balance in full on time, thus preventing interest charges and preserving the valuable benefits of the grace period.

Further Analysis: Examining Credit Utilization in Greater Detail

Credit utilization is a complex topic extending beyond its connection to grace periods. It impacts your credit score significantly, alongside factors such as payment history and length of credit history. Understanding how credit utilization is calculated and actively managing it is essential for achieving and maintaining a healthy credit score. Regularly checking your credit report to monitor your credit utilization ratio is a proactive step towards sound financial management.

FAQ Section: Answering Common Questions About Credit Card Grace Periods

Q: What is a grace period? A: A grace period is the time allowed to pay your statement balance in full without incurring interest charges.

Q: How long is a grace period? A: Grace periods typically range from 21 to 25 days but vary by issuer.

Q: Does the grace period apply to cash advances? A: No, cash advances and balance transfers accrue interest immediately.

Q: What happens if I miss my payment due date? A: You lose the grace period, and interest will be charged on your outstanding balance.

Q: How can I maximize my grace period? A: Pay your statement balance in full by the due date, carefully track your spending, and avoid cash advances.

Practical Tips: Maximizing the Benefits of Your Grace Period

- Understand Your Billing Cycle and Due Date: Keep track of these dates to ensure timely payments.

- Set Payment Reminders: Use online banking tools or calendar reminders to avoid missing payment deadlines.

- Budget Effectively: Track spending to ensure you can afford to pay your statement balance in full by the due date.

- Pay in Full Each Month: This is crucial for avoiding interest charges and maximizing the grace period benefit.

- Read Your Credit Card Agreement: Familiarize yourself with your card's specific terms and conditions regarding grace periods.

Final Conclusion: Wrapping Up with Lasting Insights

Understanding and utilizing the grace period on your credit card is a fundamental aspect of responsible financial management. By paying attention to your billing cycle, due dates, and spending habits, you can significantly reduce interest charges and cultivate healthy credit habits that will benefit your financial future. Remember, the grace period is a valuable tool—use it wisely.

Latest Posts

Latest Posts

-

Speedy Like

Apr 02, 2025

-

What Is Speedy Cash

Apr 02, 2025

-

Speed Up Cash Cash

Apr 02, 2025

-

What Time Does Speedy Cash Close

Apr 02, 2025

-

What Happens If You Miss A Payment With Speedy Cash

Apr 02, 2025

Related Post

Thank you for visiting our website which covers about What Does A Grace Period Mean For Credit Cards . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.