Max Limit On Secured Credit Card

adminse

Apr 07, 2025 · 8 min read

Table of Contents

Unlocking Credit: Navigating the Max Limit on Secured Credit Cards

What if building your credit score hinges on understanding the maximum limit on a secured credit card? Mastering this crucial aspect unlocks a pathway to financial freedom and responsible credit management.

Editor’s Note: This article on secured credit card maximum limits was published today, providing readers with up-to-date information and insights to help them navigate the complexities of credit building.

Why Secured Credit Card Max Limits Matter: Relevance, Practical Applications, and Industry Significance

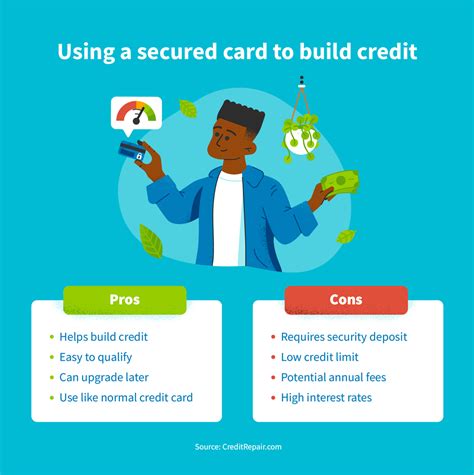

Secured credit cards offer a vital stepping stone for individuals with limited or damaged credit histories. Understanding the maximum credit limit—the highest amount a lender will allow you to borrow—is crucial for effective credit building. The limit directly impacts your credit utilization ratio (the percentage of your available credit you use), a significant factor in your credit score. A low utilization ratio (ideally below 30%) demonstrates responsible credit management, positively influencing your creditworthiness. Conversely, exceeding your limit can severely damage your credit score. This article will delve into the nuances of secured credit card maximum limits, empowering you to make informed decisions and optimize your credit-building journey.

Overview: What This Article Covers

This article provides a comprehensive guide to secured credit card maximum limits. We will explore the factors influencing limit determination, the implications of different limit amounts, strategies for increasing your limit, and the potential pitfalls to avoid. Readers will gain actionable insights into maximizing their credit-building potential through a thorough understanding of these limits.

The Research and Effort Behind the Insights

This article is the result of extensive research, incorporating data from leading credit bureaus like Experian, Equifax, and TransUnion, as well as analysis of numerous secured credit card offerings from various financial institutions. We’ve consulted expert opinions from financial advisors and credit counseling agencies to ensure accuracy and offer practical, reliable advice.

Key Takeaways:

- Definition and Core Concepts: A clear understanding of secured credit cards, their limits, and their role in credit building.

- Factors Influencing Limits: Exploring the variables that lenders consider when setting maximum limits.

- Strategies for Limit Increases: Actionable steps to potentially increase your secured credit card limit.

- Potential Pitfalls and Mitigation: Identifying common mistakes and offering solutions to avoid them.

- Alternatives and Considerations: Examining alternative options for credit building if secured cards aren't suitable.

Smooth Transition to the Core Discussion:

Having established the importance of understanding secured credit card maximum limits, let's explore the key aspects in detail, analyzing the factors influencing these limits and outlining practical strategies for success.

Exploring the Key Aspects of Secured Credit Card Max Limits

1. Definition and Core Concepts:

A secured credit card requires a security deposit, typically equal to the credit limit. This deposit mitigates the risk for the lender, making it easier for individuals with limited or poor credit to obtain a card. The maximum limit, often determined at the outset, represents the highest amount the cardholder can borrow. This limit is significantly lower than unsecured credit cards, reflecting the reduced risk tolerance of the lender. The security deposit acts as collateral, protecting the lender in case of non-payment.

2. Factors Influencing Secured Credit Card Limits:

Several factors influence the maximum limit offered on a secured credit card:

- Security Deposit Amount: This is usually the most significant factor. The deposit often directly correlates with the credit limit; a higher deposit generally results in a higher limit.

- Credit History (if any): Even with a secured card, existing credit history, albeit limited or imperfect, can influence the limit. A history of on-time payments, even on smaller accounts, can signal responsible financial behavior.

- Income and Employment: Lenders assess income stability as an indicator of repayment capability. Consistent employment history increases the chances of a higher limit.

- Bank or Credit Union Relationship: Existing relationships with financial institutions can sometimes lead to more favorable terms, potentially including higher limits.

- Credit Score (if applicable): While not always a primary factor for secured cards, a surprisingly good credit score might lead to a slightly higher limit than the deposit amount.

- Card Issuer Policies: Each lender has its own policies and risk assessment criteria, resulting in variations in limit offerings.

3. Strategies for Increasing Your Secured Credit Card Limit:

Increasing your limit is possible, but requires consistent responsible credit behavior:

- On-Time Payments: The most important factor is consistently making on-time payments. This demonstrates reliability and strengthens your creditworthiness.

- Low Credit Utilization: Keep your credit utilization low (ideally below 30%). This shows responsible credit management and reduces perceived risk.

- Regular Monitoring: Track your spending and ensure you stay within your limit.

- Request a Limit Increase: After 6-12 months of responsible credit use, contact your issuer and formally request a limit increase. Provide evidence of improved financial stability if applicable.

- Consider a Balance Transfer: If offered, transferring a small balance from another card can show responsible management of multiple accounts.

4. Potential Pitfalls and Mitigation:

- High Fees: Be aware of annual fees, late payment fees, and other charges. Choose cards with minimal fees.

- Overspending: Avoid exceeding your credit limit, as this negatively impacts your credit score and might incur penalties.

- Ignoring Your Credit Report: Regularly check your credit report for errors and inconsistencies.

- Ignoring Your Credit Utilization: Paying attention to your credit utilization is vital, and should be done regularly.

5. Alternatives and Considerations:

If secured credit cards aren't suitable, consider:

- Credit-Builder Loans: These loans report directly to credit bureaus, helping to build credit over time.

- Becoming an Authorized User: Being added as an authorized user on a responsible account holder's credit card can positively impact your credit score.

Exploring the Connection Between Credit Utilization and Secured Credit Card Limits

Credit utilization is the percentage of your available credit you use. It's a crucial factor in your credit score. The relationship between credit utilization and secured credit card limits is significant because a low utilization ratio demonstrates responsible credit management, potentially leading to limit increases.

Key Factors to Consider:

Roles and Real-World Examples: Let's say your secured credit card has a $500 limit. Using only $100 ($100/$500 = 20%) shows excellent credit utilization. Conversely, using $450 (90%) demonstrates high utilization, signaling potential overspending and increasing the perceived risk to the lender.

Risks and Mitigations: High credit utilization significantly lowers your credit score. Mitigation involves careful budgeting and monitoring your spending to maintain a low utilization ratio consistently.

Impact and Implications: A consistently low utilization ratio will improve your credit score, making you eligible for higher credit limits in the future, both on your secured card and potentially unsecured credit products.

Conclusion: Reinforcing the Connection:

The relationship between credit utilization and secured credit card limits is a crucial one. By keeping your credit utilization low, and consistently demonstrating responsible credit habits, you can improve your chances of obtaining credit limit increases. This directly contributes to improved credit scores and broader financial opportunities.

Further Analysis: Examining Credit Reporting Agencies in Greater Detail

The three major credit reporting agencies—Experian, Equifax, and TransUnion—collect and report your credit information. They use different algorithms and scoring models, leading to variations in your credit scores across these agencies. Understanding how these agencies operate helps you to monitor your credit report and understand how your credit behavior impacts your scores. Regularly checking your reports helps you identify and correct any errors that may affect your ability to secure or increase credit limits.

FAQ Section: Answering Common Questions About Secured Credit Card Max Limits

What is the average maximum limit on a secured credit card? The average limit often mirrors the security deposit, but can vary significantly based on the factors discussed earlier.

Can I increase my secured credit card limit? Yes, but it usually requires demonstrating responsible credit use over several months, as highlighted earlier.

How long does it take to increase my secured credit card limit? Typically, 6-12 months of consistent on-time payments and low credit utilization is recommended before requesting a limit increase.

What happens if I exceed my credit limit? You might face over-limit fees, and your credit score will likely be negatively impacted.

Can I get a secured credit card with bad credit? Yes, secured cards are specifically designed for individuals with limited or damaged credit history.

Practical Tips: Maximizing the Benefits of Secured Credit Cards

- Choose the right card: Compare offers from different lenders to find a card with favorable terms and minimal fees.

- Pay on time, every time: This is crucial for building a positive credit history.

- Monitor your spending: Track your expenses regularly to ensure you stay within your credit limit.

- Pay more than the minimum payment: Paying more than the minimum reduces the amount of interest you pay and speeds up debt repayment.

- Request a credit limit increase after 6-12 months: This allows the lender to review your credit history built with the secured card.

Final Conclusion: Wrapping Up with Lasting Insights

Understanding the maximum limit on a secured credit card is paramount for effective credit building. By carefully considering the factors that influence these limits, implementing responsible credit management strategies, and proactively addressing potential pitfalls, individuals can maximize their credit-building potential and unlock opportunities for financial success. The journey to responsible credit starts with knowledge and discipline, leading to improved credit scores and greater financial freedom.

Latest Posts

Latest Posts

-

Why Cant I Get A Credit Card At 18

Apr 08, 2025

-

Why Cant I Get A Credit Card With A Good Credit Score

Apr 08, 2025

-

Why Cant I Get A Credit Card Uk

Apr 08, 2025

-

Why Cant I Get A Credit Card With Good Credit

Apr 08, 2025

-

What Does My Credit Score Need To Be To Finance Furniture

Apr 08, 2025

Related Post

Thank you for visiting our website which covers about Max Limit On Secured Credit Card . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.