How To Money Management Skills

adminse

Apr 06, 2025 · 7 min read

Table of Contents

Mastering the Art of Money Management: A Comprehensive Guide to Financial Well-being

What if your financial future hinges on mastering just a few key money management skills? Effective money management isn't just about saving; it's about building a secure and prosperous future.

Editor’s Note: This comprehensive guide to money management skills was published today to provide readers with the latest strategies and tools for achieving financial well-being. This article offers actionable advice and practical steps you can implement immediately.

Why Money Management Matters:

In today's complex financial landscape, effective money management is no longer a luxury—it's a necessity. Whether you're a student, young professional, or seasoned individual, understanding how to manage your finances empowers you to achieve your financial goals, build wealth, and reduce stress. From purchasing a home to planning for retirement, sound financial practices are the cornerstone of a secure and fulfilling life. The ability to effectively manage your money impacts every aspect of your life, from reducing financial anxiety to unlocking opportunities for personal growth and investment.

Overview: What This Article Covers:

This article provides a detailed roadmap to effective money management. We'll delve into budgeting techniques, debt management strategies, saving and investing principles, and essential financial planning concepts. Readers will gain actionable insights and practical steps to take control of their financial lives.

The Research and Effort Behind the Insights:

This article draws upon decades of financial research, best practices from leading financial institutions, and insights from personal finance experts. We've meticulously reviewed numerous studies and consulted reputable sources to ensure the accuracy and reliability of the information presented.

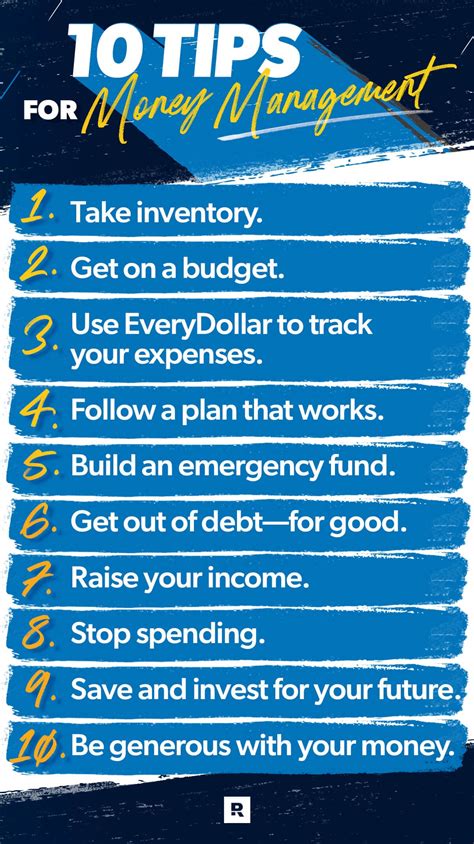

Key Takeaways:

- Understanding Your Financial Situation: Assessing income, expenses, assets, and liabilities is crucial.

- Creating a Realistic Budget: A well-structured budget is the foundation of sound financial management.

- Effective Debt Management: Strategies for tackling existing debt and avoiding future debt accumulation.

- Building a Robust Savings Plan: Methods for setting savings goals and developing effective saving habits.

- Investing for the Future: Exploring different investment options and developing a personalized investment strategy.

- Financial Planning for Long-Term Goals: Strategies for planning major life events like retirement and homeownership.

Smooth Transition to the Core Discussion:

With a clear understanding of why money management is crucial, let's explore the key aspects in detail, providing practical steps and strategies you can implement today.

Exploring the Key Aspects of Money Management:

1. Understanding Your Financial Situation:

Before you can effectively manage your money, you need to understand where you currently stand. This involves:

- Tracking your income: List all sources of income, including salary, investments, and other sources.

- Analyzing your expenses: Categorize your expenses (housing, food, transportation, entertainment, etc.) to identify areas where you can potentially reduce spending. Use budgeting apps or spreadsheets for accurate tracking.

- Assessing your assets: This includes bank accounts, investments, property, and other valuables.

- Identifying your liabilities: This includes outstanding debts such as loans, credit card balances, and mortgages. Calculate your total debt and the interest you are paying.

2. Creating a Realistic Budget:

A budget is a plan for how you will spend your money. There are several budgeting methods, including:

- 50/30/20 Rule: Allocate 50% of your income to needs, 30% to wants, and 20% to savings and debt repayment.

- Zero-Based Budgeting: Assign every dollar a specific purpose, ensuring expenses equal income.

- Envelope System: Allocate cash to different categories and track spending physically.

Choose a method that suits your lifestyle and preferences. Regularly review and adjust your budget as needed.

3. Effective Debt Management:

Debt can significantly hinder your financial progress. Effective debt management strategies include:

- Prioritize high-interest debt: Focus on paying off debts with the highest interest rates first (e.g., credit cards).

- Debt consolidation: Combine multiple debts into a single loan with a lower interest rate.

- Debt snowball or avalanche method: The snowball method focuses on paying off the smallest debt first for motivation, while the avalanche method prioritizes the debt with the highest interest rate.

- Negotiate with creditors: Explore options for reducing interest rates or monthly payments.

- Avoid accumulating new debt: Practice responsible spending habits to prevent further debt accumulation.

4. Building a Robust Savings Plan:

Saving is crucial for financial security and achieving long-term goals. Strategies for building a robust savings plan include:

- Setting clear savings goals: Define specific, measurable, achievable, relevant, and time-bound (SMART) goals.

- Automating savings: Set up automatic transfers from your checking account to your savings account.

- Emergency fund: Build an emergency fund to cover 3-6 months of living expenses.

- High-yield savings accounts: Explore options for higher interest rates on your savings.

5. Investing for the Future:

Investing your savings can help your money grow over time. Consider the following:

- Retirement planning: Start saving and investing early for retirement. Explore retirement accounts like 401(k)s and IRAs.

- Diversification: Spread your investments across different asset classes (stocks, bonds, real estate) to reduce risk.

- Long-term investment strategy: Invest for the long term, focusing on consistent growth rather than short-term gains.

- Seeking professional advice: Consider consulting with a financial advisor to create a personalized investment plan.

6. Financial Planning for Long-Term Goals:

Long-term financial planning is crucial for achieving major life goals such as:

- Homeownership: Saving for a down payment, understanding mortgage options, and managing mortgage payments.

- Education: Planning for college tuition or other educational expenses.

- Retirement: Determining retirement needs, developing a retirement savings plan, and managing retirement income.

Exploring the Connection Between Budgeting and Effective Money Management:

Budgeting forms the very foundation of effective money management. It provides a clear picture of income and expenses, allowing for informed decision-making and proactive financial planning. Without a well-structured budget, it's difficult to track progress towards financial goals or identify areas for improvement.

Key Factors to Consider:

- Roles and Real-World Examples: A well-defined budget allows individuals to allocate funds effectively towards needs, wants, and savings. For instance, someone aiming to buy a house might allocate a larger portion of their income towards savings.

- Risks and Mitigations: Failure to create and adhere to a budget can lead to overspending, debt accumulation, and missed financial goals. Regular budget reviews and adjustments can mitigate these risks.

- Impact and Implications: A meticulously maintained budget can significantly reduce financial stress, promote financial stability, and unlock opportunities for wealth building.

Conclusion: Reinforcing the Connection:

The relationship between budgeting and effective money management is undeniable. Budgeting isn't a restrictive measure; it's a powerful tool that empowers individuals to take control of their finances and achieve their aspirations. A well-crafted budget becomes a roadmap to financial freedom.

Further Analysis: Examining Budgeting in Greater Detail:

Different budgeting styles suit diverse needs. For instance, the 50/30/20 rule is a simple and widely accessible method. Zero-based budgeting requires more meticulous tracking but offers greater control over expenses. The envelope system utilizes cash, promoting a more tangible understanding of spending. The choice of budgeting style depends on individual preferences and financial complexity.

FAQ Section: Answering Common Questions About Money Management:

- What is a good savings rate? A generally recommended savings rate is at least 20% of your income, but this can vary based on individual circumstances and financial goals.

- How can I reduce my expenses? Analyze your spending habits, identify areas for potential cuts, and consider using budgeting apps to track expenses effectively. Negotiate better deals with service providers or switch to more affordable alternatives.

- What are some good investment options for beginners? Beginners can start with low-cost index funds or exchange-traded funds (ETFs) for diversification and long-term growth.

- Should I pay off debt or invest? This depends on your specific circumstances and the interest rates on your debt. High-interest debt should generally be prioritized over low-return investments.

Practical Tips: Maximizing the Benefits of Money Management:

- Set clear financial goals: Define your short-term and long-term financial objectives to give your efforts direction.

- Automate your finances: Use automatic bill payments and savings transfers to simplify your financial management.

- Track your progress regularly: Monitor your income, expenses, and savings to ensure you stay on track.

- Seek professional advice when needed: Consult a financial advisor for personalized guidance and support.

Final Conclusion: Wrapping Up with Lasting Insights:

Mastering money management skills isn't an overnight achievement; it's a continuous journey of learning and adaptation. By consistently implementing the strategies and techniques outlined in this article, you can build a solid foundation for financial well-being. Remember that financial success is not solely about accumulating wealth; it's about achieving financial security, reducing stress, and creating a prosperous future. Embrace the power of knowledge, take control of your finances, and embark on a path towards lasting financial freedom.

Latest Posts

Latest Posts

-

Utilization Of Credit Is Too High

Apr 07, 2025

-

What Is High Credit Utilization

Apr 07, 2025

-

How Can I Lower My Credit Card Utilization

Apr 07, 2025

-

How Do I Lower My Credit Utilization

Apr 07, 2025

-

Why Is High Credit Utilization Bad

Apr 07, 2025

Related Post

Thank you for visiting our website which covers about How To Money Management Skills . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.