How To Increase Credit Limit On Secured Card Capital One

adminse

Apr 07, 2025 · 7 min read

Table of Contents

How to Increase Your Credit Limit on a Capital One Secured Credit Card: A Comprehensive Guide

What if effortlessly boosting your credit limit could unlock a world of financial opportunities? Increasing your Capital One secured credit card limit is achievable with the right strategy, significantly impacting your credit score and financial flexibility.

Editor’s Note: This article provides up-to-date information on increasing your Capital One secured credit card limit. We've compiled research and advice to help you navigate this process effectively. Remember, individual experiences may vary, and it's crucial to review Capital One's specific terms and conditions.

Why Increasing Your Capital One Secured Credit Card Limit Matters

A secured credit card is a stepping stone to building or rebuilding credit. Increasing your credit limit on this card is a significant step forward. A higher limit reduces your credit utilization ratio – the percentage of available credit you're using. A lower utilization ratio (ideally below 30%) is a major factor in improving your credit score. This, in turn, opens doors to better interest rates on loans, improved chances of loan approval, and access to unsecured credit cards with more benefits. Furthermore, a higher credit limit provides more financial breathing room for unexpected expenses.

Overview: What This Article Covers

This article will guide you through the process of increasing your Capital One secured credit card limit, covering: understanding your current situation, preparing for the increase request, submitting your request effectively, understanding potential denials, and alternative strategies for improving your creditworthiness. We’ll also explore the relationship between on-time payments and credit limit increases.

The Research and Effort Behind the Insights

This guide is based on extensive research into Capital One's policies, credit scoring models, and best practices for credit management. We have reviewed numerous user experiences, official Capital One documentation, and financial expert advice to offer accurate and actionable insights.

Key Takeaways:

- Understanding Credit Utilization: Your credit utilization ratio is crucial.

- Timing Your Request: Knowing when to apply can improve your chances.

- Demonstrating Financial Responsibility: Consistent on-time payments are key.

- Alternative Strategies: Building credit through other means can be beneficial.

- Reviewing Your Credit Report: Understanding your credit history is essential.

Smooth Transition to the Core Discussion:

Now that we've established the importance of a credit limit increase, let's delve into the practical steps involved in successfully requesting one from Capital One.

Exploring the Key Aspects of Increasing Your Capital One Secured Credit Limit

1. Understanding Your Current Situation:

Before making a request, review your Capital One secured credit card statement. Note your current credit limit, your spending habits, and your payment history. Calculate your credit utilization ratio. A lower ratio strengthens your application. Check your credit report from one of the three major credit bureaus (Equifax, Experian, and TransUnion) for free annually at AnnualCreditReport.com. This allows you to identify any errors and see your credit score.

2. Preparing for the Increase Request:

- Time Your Request: Wait at least six months after opening the account before requesting a limit increase. This demonstrates responsible credit management to Capital One.

- Maintain a Low Credit Utilization Ratio: Keep your spending well below your credit limit. Aim for under 30%, ideally closer to 10%.

- Pay on Time, Every Time: Consistent on-time payments are critical. Late payments can severely damage your credit score and decrease your chances of approval.

- Increase Your Income (If Applicable): If possible, demonstrate increased income stability. This could be through a promotion, a new job, or increased income from self-employment.

- Review Your Credit Report for Errors: Ensure accuracy in your credit report. Dispute any errors that may negatively impact your score.

3. Submitting Your Request Effectively:

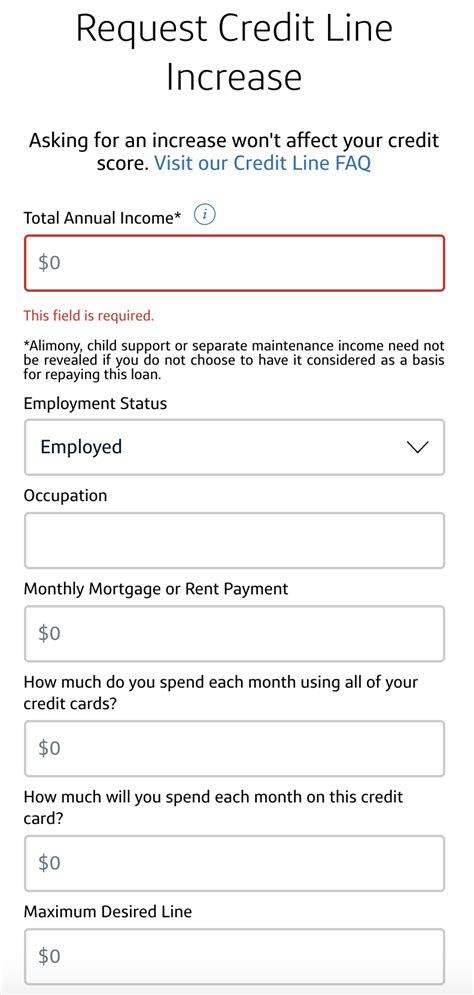

There are several ways to request a credit limit increase with Capital One:

- Online: Log in to your Capital One account online. Look for options related to credit limit increases or account management.

- Phone: Call Capital One's customer service number. Be prepared to provide personal information and answer questions about your financial situation.

- Written Request: Send a written request via mail. Include your account number, request, and supporting documentation (if applicable, like proof of increased income).

Regardless of the method, be polite and professional. Clearly state your request for a credit limit increase and explain why you deserve it (e.g., improved credit score, consistent on-time payments, increased income).

4. Understanding Potential Denials:

Capital One may deny your request for various reasons, including:

- Poor Payment History: Late payments or missed payments significantly reduce your chances.

- High Credit Utilization: Using a large percentage of your available credit signals poor financial management.

- Low Credit Score: A low credit score indicates higher risk to Capital One.

- Recent Account Opening: Applying too soon after opening the account may result in denial.

- Insufficient Income: Lack of sufficient and stable income can be a factor.

If denied, don't be discouraged. Review the reasons provided and work to improve your creditworthiness. Re-apply after addressing the issues identified.

5. Alternative Strategies for Improving Your Creditworthiness:

If a credit limit increase is denied, focus on improving your credit score. This increases your chances of approval in the future. Consider:

- Consistent On-Time Payments: This is the single most important factor in improving your credit score.

- Lowering Credit Utilization: Keep your credit card balances low.

- Paying Down Debt: Reduce existing debts to improve your debt-to-income ratio.

- Monitoring Your Credit Report: Regularly check your credit report for errors and track your progress.

- Opening Other Credit Accounts (Cautiously): If your credit score is improving, consider applying for another credit card, but only if you can manage it responsibly.

Exploring the Connection Between On-Time Payments and Credit Limit Increases

On-time payments are fundamentally intertwined with credit limit increases. Capital One, and all credit card issuers, view consistent on-time payments as a strong indicator of responsible credit management. This directly translates to a lower risk profile for the lender, making them more likely to approve a credit limit increase. Conversely, a history of late payments significantly increases your risk profile, decreasing the likelihood of approval.

Key Factors to Consider:

- Roles and Real-World Examples: A consistent history of on-time payments showcases your ability to manage debt responsibly. This can be demonstrated through your credit report.

- Risks and Mitigations: Failing to make on-time payments can severely damage your credit score and prevent you from obtaining a credit limit increase. Careful budgeting and setting payment reminders are crucial mitigations.

- Impact and Implications: The impact of on-time payments on your creditworthiness is substantial. It affects not only credit limit increases but also your ability to access loans and other financial products with favorable terms.

Conclusion: Reinforcing the Connection:

The relationship between on-time payments and credit limit increases is undeniable. By consistently making on-time payments, you demonstrate responsible credit behavior, increasing your chances of securing a higher credit limit on your Capital One secured credit card.

Further Analysis: Examining On-Time Payments in Greater Detail:

On-time payments aren't simply about avoiding late fees; they're a cornerstone of building a strong credit profile. Each on-time payment contributes to a positive credit history, showing lenders your reliability. Conversely, even a single missed payment can significantly harm your credit score and affect your future borrowing ability. Automating payments through online banking or setting payment reminders can help you avoid late payments.

FAQ Section: Answering Common Questions About Increasing Your Capital One Secured Credit Limit

Q: How long should I wait before requesting a credit limit increase?

A: Generally, wait at least six months after opening your account.

Q: What if my request is denied?

A: Review the reasons provided and work on improving your creditworthiness. Re-apply later.

Q: How often can I request a credit limit increase?

A: There's no set limit, but avoid frequent requests, as it might negatively impact your application.

Practical Tips: Maximizing the Benefits of a Credit Limit Increase

- Budgeting: Create a budget to ensure you don't overspend and maintain a low credit utilization ratio.

- Monitoring: Regularly check your credit report and credit score to track your progress.

- Financial Planning: Use the increased credit limit responsibly to achieve your financial goals.

Final Conclusion: Wrapping Up with Lasting Insights

Increasing your Capital One secured credit limit is a significant step towards improving your financial health. By understanding the process, preparing adequately, and maintaining responsible credit habits, you can significantly increase your chances of success. Remember, building a strong credit history takes time and discipline, but the rewards are well worth the effort.

Latest Posts

Latest Posts

-

Do Credit Combine When You Get Married

Apr 08, 2025

-

Do Credit Scores Merge After Marriage

Apr 08, 2025

-

When You Get Married Does Your Credit Score Combine

Apr 08, 2025

-

Does Your Credit Score Merge When You Get Married

Apr 08, 2025

-

Do Credit Scores Combined When Married

Apr 08, 2025

Related Post

Thank you for visiting our website which covers about How To Increase Credit Limit On Secured Card Capital One . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.