How To Get Credit Report On Credit Karma App

adminse

Apr 06, 2025 · 9 min read

Table of Contents

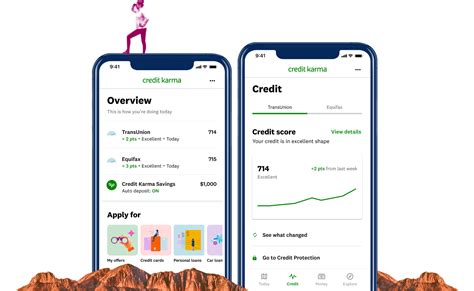

How to Access and Understand Your Credit Report on the Credit Karma App:

Is Credit Karma the ultimate solution for understanding your credit health? Credit Karma has become a household name for its free credit score and report services. But navigating the app and truly understanding what your report reveals can be tricky. This comprehensive guide will walk you through every step, from accessing your report to interpreting its intricacies, ensuring you're empowered to manage your credit effectively.

Editor’s Note: This article on accessing and understanding your credit report on the Credit Karma app was published today, providing you with the most up-to-date information and guidance.

Why Understanding Your Credit Karma Report Matters:

Your credit report is a financial snapshot, a detailed record of your credit history. Lenders use this information to assess your creditworthiness when you apply for loans, credit cards, mortgages, or even rent an apartment. A strong credit report can lead to better interest rates, more favorable loan terms, and greater financial opportunities. Conversely, a poor credit report can significantly hinder your financial prospects. Credit Karma provides a free and easily accessible way to monitor your credit health, allowing you to proactively address any issues.

Overview: What This Article Covers:

This article will comprehensively guide you through the process of accessing your credit report on the Credit Karma app. We’ll cover downloading the app, creating an account, understanding the different sections of your report, interpreting your credit score, identifying potential problems, and utilizing the app's resources to improve your credit health. Furthermore, we will discuss the limitations of Credit Karma and what else you might need to consider for a complete picture of your credit.

The Research and Effort Behind the Insights:

This article is based on extensive research, including direct experience using the Credit Karma app, analysis of the app's features, and consultation of official Credit Karma documentation and reputable financial sources. All information provided aims to be accurate and up-to-date, but it's crucial to always refer to official sources for the most current details.

Key Takeaways:

- Accessing Your Credit Report: Step-by-step instructions on using the Credit Karma app to view your TransUnion and Equifax reports.

- Understanding Report Components: Deciphering the different sections of your credit report, including personal information, credit accounts, inquiries, and public records.

- Interpreting Your Credit Score: Understanding the VantageScore 3.0 and how it reflects your creditworthiness.

- Identifying and Addressing Potential Issues: Recognizing negative marks on your report and exploring strategies to improve your credit score.

- Leveraging Credit Karma's Resources: Utilizing the app's tools and recommendations to enhance your financial literacy and credit management.

Smooth Transition to the Core Discussion:

Now that we've established the importance of understanding your credit report, let's delve into the practical steps involved in accessing and interpreting your report through the Credit Karma app.

Exploring the Key Aspects of Accessing Your Credit Report on Credit Karma:

1. Downloading and Installing the App:

Begin by downloading the Credit Karma app from your device's app store (Google Play Store for Android or the App Store for iOS). The app is free to download and use. Once downloaded, install the app and launch it.

2. Creating an Account:

You’ll need to create a free account to access your credit information. This usually involves providing your email address, creating a password, and verifying your identity using your full name, date of birth, and Social Security number. Credit Karma uses this information to securely link your credit report and protect your personal data. Be cautious about entering your information accurately to avoid any delays or issues with verification.

3. Linking Your Credit Reports:

After creating your account, Credit Karma will guide you through linking your credit reports from TransUnion and Equifax. These are two major credit bureaus in the United States. The app will use the information you provided to securely access your credit information. This process typically involves consent and verification steps to ensure the security and accuracy of the data being accessed.

4. Accessing Your Credit Report:

Once your accounts are successfully linked, you will gain access to your credit report. This report will typically be presented in a clear and concise format, making it easy to navigate and understand. You'll find sections dedicated to your credit score, accounts, inquiries, and public records, each detailed below.

5. Understanding the Components of Your Credit Report:

- Personal Information: This section will display your name, address, and other identifying information. Verify this information is accurate to prevent any issues with credit reporting.

- Credit Accounts: This is a detailed list of all your credit accounts, including credit cards, loans, and mortgages. It shows your account balances, credit limits, payment history, and account ages. This section is crucial in understanding your credit utilization and payment patterns.

- Credit Inquiries: This section lists all inquiries (requests for your credit report) made by lenders and other companies within the past two years. Numerous hard inquiries can negatively impact your credit score.

- Public Records: This section might include information such as bankruptcies, foreclosures, tax liens, and judgments. This information significantly impacts your credit score and should be addressed if present.

6. Interpreting Your Credit Score:

Credit Karma utilizes the VantageScore 3.0 model. Understanding how this score is calculated is essential for improving your credit health. VantageScore considers various factors, including payment history, amounts owed, length of credit history, credit mix, and new credit. Credit Karma will generally provide a breakdown showing how each factor contributes to your overall score. A higher VantageScore generally indicates better creditworthiness.

7. Identifying and Addressing Potential Issues:

Carefully review your credit report for any errors or negative marks that could be impacting your score. This might include late payments, collections, or bankruptcies. If you identify any errors, dispute them immediately with the credit bureaus directly. If there are negative items that are accurate, develop a plan to improve your credit health, such as paying down debt or improving your payment history.

Exploring the Connection Between Credit Monitoring and Credit Karma:

Credit monitoring is a crucial aspect of managing your credit health. Credit Karma offers a basic form of credit monitoring by providing regular updates to your credit score and report. However, it’s important to remember that Credit Karma is not a credit repair service. It primarily provides information and tools for you to manage your credit yourself.

Key Factors to Consider:

- Accuracy: While Credit Karma strives for accuracy, it's vital to verify the information against your own records and, if necessary, dispute any inaccuracies with the credit bureaus directly.

- Completeness: Credit Karma primarily utilizes TransUnion and Equifax data. Your credit report may also include information from Experian, which Credit Karma does not typically offer. Consider obtaining a complete report from all three bureaus for a holistic view.

- Limitations: Credit Karma provides valuable insights, but it's not a substitute for professional financial advice. Seek guidance from a financial advisor or credit counselor for complex financial situations.

Roles and Real-World Examples:

Many users rely on Credit Karma for its free credit monitoring and score updates. It provides a convenient way to track your credit health and identify potential issues early on. For instance, a user might discover a late payment reported incorrectly, allowing them to promptly dispute it and avoid a negative impact on their score.

Risks and Mitigations:

The main risk associated with Credit Karma (and other similar services) is the reliance on free services without understanding the limitations. Users should not solely rely on Credit Karma for complex financial decision-making or credit repair. Always verify information and seek professional advice when needed.

Impact and Implications:

Credit Karma has democratized access to credit information, empowering individuals to manage their credit more effectively. However, it’s crucial to use the information responsibly and understand its limitations.

Conclusion: Reinforcing the Connection:

The connection between Credit Karma and effective credit management is clear. The app provides valuable tools and information for individuals to monitor their credit health and improve their credit scores. However, understanding the app's limitations and utilizing other resources for a complete picture of your credit is crucial.

Further Analysis: Examining Credit Report Accuracy in Greater Detail:

The accuracy of your credit report is paramount. Incorrect information can negatively impact your score and financial opportunities. Always review your Credit Karma report carefully and compare it to your own records. If you find discrepancies, immediately dispute them with the respective credit bureaus (TransUnion and Equifax) using their official channels.

FAQ Section: Answering Common Questions About Credit Karma and Credit Reports:

What is Credit Karma? Credit Karma is a free financial technology company that provides users with access to their credit scores and reports from TransUnion and Equifax.

How is Credit Karma different from a credit reporting agency? Credit Karma is not a credit reporting agency. Credit bureaus (like Equifax and TransUnion) are the sources of the data. Credit Karma aggregates and presents this data in a user-friendly format.

Is my information safe on Credit Karma? Credit Karma utilizes security measures to protect user data. However, it's essential to practice good online security habits, including using strong passwords and being cautious of phishing scams.

Can Credit Karma help me repair my credit? Credit Karma does not offer credit repair services. It provides tools and information to help you understand and manage your credit, but you are responsible for taking the necessary steps to improve your credit yourself.

What if I find an error on my credit report? Immediately dispute any errors with the respective credit bureaus (TransUnion and Equifax). Credit Karma usually provides tools and guidance within the app to facilitate this process.

Practical Tips: Maximizing the Benefits of Credit Karma:

- Regularly Check Your Report: Make it a habit to review your credit report on Credit Karma at least once a month to monitor your credit score and identify any potential issues promptly.

- Understand Your Score: Take time to understand how your VantageScore is calculated and which factors are most significantly impacting your score.

- Utilize Credit Karma's Tools: Take advantage of the app's resources, such as the credit score simulator and educational materials, to improve your financial literacy and credit management skills.

- Don't Rely Solely on Credit Karma: Remember that Credit Karma provides only part of the picture. Consider obtaining reports from all three major credit bureaus for a complete view.

- Practice Good Credit Habits: Maintain responsible spending habits, pay your bills on time, and keep your credit utilization low to improve your credit score over time.

Final Conclusion: Wrapping Up with Lasting Insights:

Credit Karma offers a valuable service by providing free access to your credit score and report. Utilizing the app effectively can significantly empower you to monitor your financial health and make informed decisions. However, remember that it's a tool, not a solution. Active management of your finances, understanding your credit report thoroughly, and potentially seeking professional advice when needed are crucial for achieving lasting financial success. By understanding and leveraging the resources available on Credit Karma, combined with responsible financial habits, you can build a stronger financial future.

Latest Posts

Latest Posts

-

Do Your Credit Scores Merge When You Get Married

Apr 08, 2025

-

What Happens After You Max Out Your Credit Card

Apr 08, 2025

-

What Happens If You Max Out Your Credit Card

Apr 08, 2025

-

What Happens When You Pay Off A Maxed Out Credit Card

Apr 08, 2025

-

What Will Happen If You Max Out Your Credit Card

Apr 08, 2025

Related Post

Thank you for visiting our website which covers about How To Get Credit Report On Credit Karma App . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.