How To Get Better At Money Management

adminse

Apr 06, 2025 · 8 min read

Table of Contents

Unlocking Financial Freedom: Your Comprehensive Guide to Better Money Management

What if mastering your finances wasn't about strict deprivation, but about strategic choices that lead to a richer, more fulfilling life? Effective money management is not just about saving; it's about building a secure future and achieving your financial goals.

Editor’s Note: This article on improving money management skills provides practical strategies and actionable advice to help you take control of your finances. Updated for 2024.

Why Better Money Management Matters:

In today's complex economic landscape, effective money management is no longer a luxury—it's a necessity. Whether your goal is buying a home, retiring comfortably, or simply reducing financial stress, mastering your finances empowers you to achieve your aspirations. Poor money management, on the other hand, can lead to debt, financial instability, and missed opportunities. This guide provides a framework for building a strong financial foundation, regardless of your current financial situation. Understanding budgeting, saving, investing, and debt management are crucial components of long-term financial well-being. This knowledge empowers individuals to make informed financial decisions, ultimately leading to greater financial security and peace of mind.

Overview: What This Article Covers:

This comprehensive guide explores the key aspects of effective money management, encompassing budgeting techniques, saving strategies, investment options, debt management strategies, and planning for the future. We'll delve into practical applications, address common challenges, and outline actionable steps you can take to improve your financial well-being.

The Research and Effort Behind the Insights:

This article draws upon extensive research from reputable financial institutions, academic studies, and expert advice. We've synthesized this information to provide clear, practical, and actionable strategies for readers of all financial backgrounds. Every recommendation is supported by evidence-based principles, ensuring the advice is both accurate and reliable.

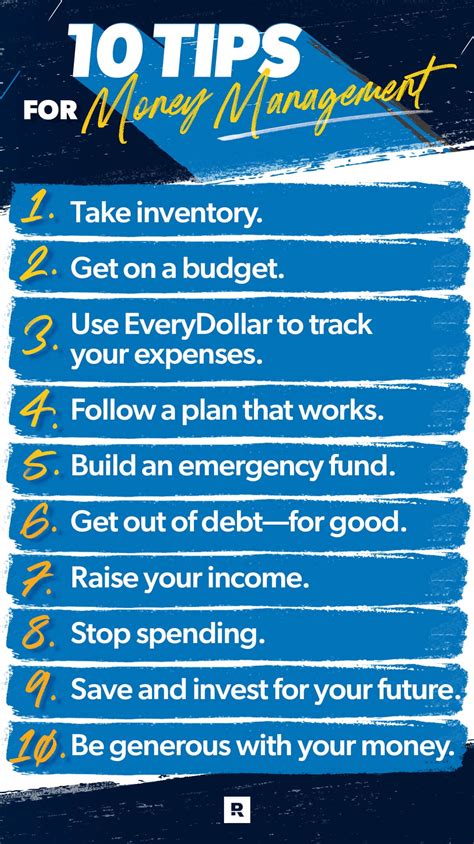

Key Takeaways:

- Creating a Realistic Budget: Learn to track your income and expenses, identify areas for improvement, and allocate funds strategically.

- Developing Effective Saving Habits: Explore diverse saving strategies, from emergency funds to long-term investment goals.

- Understanding Investment Options: Discover various investment vehicles and how to choose the ones that align with your risk tolerance and financial objectives.

- Managing and Reducing Debt: Learn strategies to tackle existing debt and avoid accumulating more.

- Planning for the Future: Develop a financial plan that encompasses retirement savings, insurance, and estate planning.

Smooth Transition to the Core Discussion:

Now that we've established the importance of effective money management, let's explore the essential elements in detail. This journey will equip you with the tools and knowledge necessary to take control of your financial future.

Exploring the Key Aspects of Money Management:

1. Creating a Realistic Budget:

The foundation of successful money management lies in understanding where your money goes. Start by tracking your income and expenses for a month or two. Use budgeting apps, spreadsheets, or even a simple notebook. Categorize your expenses (housing, food, transportation, entertainment, etc.) to identify spending patterns. Once you have a clear picture of your finances, you can create a realistic budget that aligns with your income and goals. The 50/30/20 rule is a popular guideline: 50% of your after-tax income for needs, 30% for wants, and 20% for savings and debt repayment. Remember, your budget should be flexible and adaptable to changing circumstances.

2. Developing Effective Saving Habits:

Saving isn't just about putting money aside; it's about building a financial safety net and achieving your long-term goals. Start by establishing an emergency fund—ideally, 3-6 months' worth of living expenses—to cover unexpected events. Once your emergency fund is secured, you can focus on other savings goals, such as a down payment on a house, a new car, or retirement. Automate your savings by setting up automatic transfers from your checking account to your savings account. Consider setting up separate savings accounts for different goals to track progress and stay motivated.

3. Understanding Investment Options:

Investing allows your money to grow over time, potentially outpacing inflation. The best investment strategy depends on your risk tolerance, time horizon, and financial goals. Options include stocks, bonds, mutual funds, exchange-traded funds (ETFs), and real estate. Consider consulting a financial advisor to create a diversified investment portfolio that aligns with your individual needs and circumstances. It’s crucial to understand the risks involved with each investment type and diversify your portfolio to mitigate potential losses. Investing requires patience and discipline; avoid impulsive decisions driven by short-term market fluctuations.

4. Managing and Reducing Debt:

High-interest debt can significantly hinder your financial progress. Develop a plan to manage and reduce your debt. Prioritize high-interest debt (credit card debt) and explore options like debt consolidation or balance transfers to lower interest rates. Create a debt repayment plan, perhaps using the debt snowball or debt avalanche method, and stick to it. Avoid accumulating new debt whenever possible. Understanding your credit score and credit report is crucial for securing favorable interest rates and managing your debt effectively.

5. Planning for the Future:

Financial planning extends beyond immediate needs and involves preparing for long-term goals. Retirement planning is a critical aspect of long-term financial security. Start saving early and take advantage of employer-sponsored retirement plans like 401(k)s or 403(b)s. Explore other retirement savings vehicles, such as IRAs or Roth IRAs, to maximize your savings potential. Insurance (health, life, disability, homeowners/renters) is another crucial aspect of financial planning, protecting you against unexpected events. Estate planning ensures your assets are distributed according to your wishes. Consult with legal and financial professionals to develop a comprehensive estate plan.

Closing Insights: Summarizing the Core Discussion:

Effective money management is a multifaceted process that requires planning, discipline, and consistent effort. By implementing the strategies outlined above—budgeting, saving, investing, debt management, and future planning—you can take control of your finances, build a secure future, and achieve your financial goals. Remember, this is a journey, not a destination. Regularly review and adjust your plan as your circumstances change.

Exploring the Connection Between Financial Literacy and Money Management:

Financial literacy plays a crucial role in successful money management. Financial literacy encompasses the knowledge and skills needed to make informed financial decisions. Without a strong foundation in financial literacy, even the best intentions can fall short. Understanding basic financial concepts like interest rates, credit scores, and investment strategies is essential for effective money management.

Key Factors to Consider:

- Roles and Real-World Examples: Individuals with higher financial literacy levels tend to manage their finances more effectively, saving more, investing wisely, and accumulating less debt. For example, individuals who understand compound interest are more likely to prioritize long-term savings and investments.

- Risks and Mitigations: Lack of financial literacy can lead to poor financial decisions, such as taking on excessive debt, making unwise investments, and failing to plan for retirement. Mitigation involves increasing financial literacy through education, resources, and seeking professional advice.

- Impact and Implications: Financial literacy significantly impacts overall financial well-being. Improved financial literacy can lead to reduced stress, increased financial security, and greater opportunities for financial success.

Conclusion: Reinforcing the Connection:

The link between financial literacy and money management is undeniable. By investing in your financial education and continuously learning, you equip yourself with the tools necessary to make sound financial decisions, leading to a more secure and prosperous future.

Further Analysis: Examining Financial Literacy in Greater Detail:

Financial literacy is not a one-time achievement but rather an ongoing process of learning and adaptation. It encompasses a wide range of topics, including budgeting, saving, investing, debt management, insurance, and estate planning. Access to reliable financial education resources, such as government websites, non-profit organizations, and reputable financial institutions, is crucial for improving financial literacy.

FAQ Section: Answering Common Questions About Money Management:

Q: What is the best budgeting method?

A: The best budgeting method depends on individual preferences and financial situations. Popular methods include the 50/30/20 rule, zero-based budgeting, and envelope budgeting. Experiment with different methods to find the one that works best for you.

Q: How much should I save for retirement?

A: The amount you should save for retirement depends on your income, expenses, retirement goals, and time horizon. A general guideline is to save at least 15% of your pre-tax income.

Q: How can I improve my credit score?

A: Improve your credit score by paying your bills on time, keeping your credit utilization low, maintaining a diverse credit history, and avoiding applying for too much credit at once.

Q: What are the risks of investing?

A: Investing involves risk, and there's always the possibility of losing money. Diversification and a long-term investment strategy can help mitigate risks.

Practical Tips: Maximizing the Benefits of Money Management:

-

Track your spending: Use budgeting apps, spreadsheets, or a notebook to monitor your income and expenses.

-

Set realistic financial goals: Define short-term and long-term goals to stay motivated and focused.

-

Automate savings: Set up automatic transfers to your savings and investment accounts.

-

Create a debt repayment plan: Prioritize high-interest debt and stick to a repayment schedule.

-

Review your budget regularly: Adjust your budget as your income, expenses, or goals change.

-

Seek professional advice: Consider consulting a financial advisor to create a personalized financial plan.

Final Conclusion: Wrapping Up with Lasting Insights:

Mastering money management is a journey that demands consistent effort and a proactive approach. By embracing the principles discussed in this article, you can build a strong financial foundation, achieve your financial goals, and secure a more prosperous future. Remember that effective money management is not about restriction but about empowered choices that lead to financial freedom and a richer, more fulfilling life.

Latest Posts

Latest Posts

-

What Does A 666 Credit Score Mean

Apr 07, 2025

-

Why Does Higher Credit Utilization Increase Your Credit Score

Apr 07, 2025

-

Utilization Of Credit

Apr 07, 2025

-

Utilization Of Credit Is Too High

Apr 07, 2025

-

What Is High Credit Utilization

Apr 07, 2025

Related Post

Thank you for visiting our website which covers about How To Get Better At Money Management . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.