How To Find Monthly Payment On A Loan

adminse

Apr 06, 2025 · 7 min read

Table of Contents

Decoding Loan Payments: A Comprehensive Guide to Calculating Your Monthly Outlay

What if effortlessly understanding your loan payments unlocked financial clarity and empowered smarter borrowing decisions? Mastering loan payment calculations is the key to responsible financial management.

Editor’s Note: This article provides a comprehensive guide to calculating monthly loan payments, covering various methods and scenarios. We've compiled this resource to empower you with the knowledge to understand and manage your loan obligations effectively. Updated [Date].

Why Understanding Loan Payments Matters:

Understanding how to calculate your monthly loan payment is crucial for several reasons. It allows you to:

- Budget effectively: Knowing your exact monthly obligation helps you create a realistic budget and avoid overspending.

- Compare loan offers: You can compare different loan options based on their monthly payment amounts and total interest paid.

- Avoid financial surprises: Calculating payments beforehand prevents unexpected financial strain.

- Negotiate better loan terms: Armed with knowledge, you can negotiate more favorable terms with lenders.

- Make informed borrowing decisions: Understanding the payment calculation empowers you to choose the loan that best suits your financial capabilities.

Overview: What This Article Covers

This article will explore various methods for calculating monthly loan payments, including:

- Using the standard loan payment formula: A detailed explanation of the formula and how to use it.

- Utilizing online loan calculators: A review of readily available online tools and their advantages.

- Understanding amortization schedules: How to interpret these schedules to track your loan repayment.

- Exploring the impact of different interest rates and loan terms: Analyzing how these factors affect monthly payments.

- Addressing common scenarios and complexities: Handling situations like balloon payments, bi-weekly payments, and loan refinancing.

The Research and Effort Behind the Insights

This article draws upon established financial principles, widely accepted loan calculation formulas, and real-world examples to provide accurate and practical guidance. Information is sourced from reputable financial websites, textbooks, and industry best practices.

Key Takeaways:

- Loan Payment Formula: Understanding the components of the formula and how they interact.

- Online Calculators: Leveraging readily available tools for quick and accurate calculations.

- Amortization Schedules: Interpreting these schedules to understand loan repayment timelines.

- Impact of Loan Terms: Assessing how interest rates and loan durations influence monthly payments.

- Complex Scenarios: Handling variations in payment schedules and loan structures.

Smooth Transition to the Core Discussion:

Now that we understand the importance of calculating loan payments, let's delve into the practical methods for determining your monthly outlay.

Exploring the Key Aspects of Calculating Loan Payments

1. The Standard Loan Payment Formula:

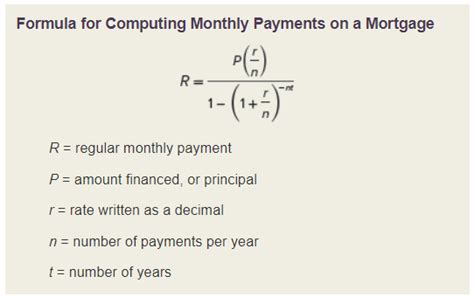

The most accurate way to calculate a monthly loan payment is using the following formula:

M = P [ i(1 + i)^n ] / [ (1 + i)^n – 1]

Where:

- M = Monthly Payment

- P = Principal Loan Amount (the total amount borrowed)

- i = Monthly Interest Rate (annual interest rate divided by 12)

- n = Total Number of Payments (loan term in years multiplied by 12)

Let's illustrate with an example:

Suppose you borrow $10,000 (P) at an annual interest rate of 5% (annual interest rate), with a loan term of 3 years (loan term).

- Calculate the monthly interest rate (i): 5% annual interest rate / 12 months = 0.05 / 12 = 0.004167

- Calculate the total number of payments (n): 3 years * 12 months/year = 36 months

- Substitute the values into the formula:

M = 10000 [ 0.004167 (1 + 0.004167)^36 ] / [ (1 + 0.004167)^36 – 1]

M ≈ $299.70

Therefore, your estimated monthly payment would be approximately $299.70. Note that this calculation does not include any additional fees or charges that may be associated with the loan.

2. Utilizing Online Loan Calculators:

Numerous online loan calculators are available that simplify the calculation process. These calculators typically require you to input the loan amount, interest rate, and loan term, and they instantly provide the estimated monthly payment. This is a quick and convenient method, especially for comparing different loan offers. However, always verify the results against the formula to ensure accuracy, especially with complex loan structures.

3. Understanding Amortization Schedules:

An amortization schedule is a table that details each payment made towards a loan, showing the portion allocated to principal and interest for each payment. These schedules are invaluable for tracking loan repayment progress and understanding how much of the loan is paid off over time. Many online loan calculators generate amortization schedules alongside the monthly payment calculation.

4. Impact of Interest Rates and Loan Terms:

The monthly payment amount is significantly influenced by the interest rate and loan term. Higher interest rates result in higher monthly payments, while longer loan terms lead to lower monthly payments but higher overall interest paid. It's crucial to carefully consider the trade-offs between lower monthly payments and increased total interest costs.

5. Addressing Common Scenarios and Complexities:

- Balloon Payments: Some loans have a larger final payment (balloon payment) due at the end of the loan term. These require separate calculation of the regular monthly payments and the final balloon payment.

- Bi-Weekly Payments: Making half the monthly payment every two weeks can reduce the total interest paid over the loan term and shorten the repayment period. The calculation requires adjustment to account for the more frequent payments.

- Loan Refinancing: Refinancing involves replacing your existing loan with a new one, often with different interest rates or loan terms. Calculating the new monthly payment is crucial to assess the financial impact of refinancing.

Exploring the Connection Between APR and Loan Payments

The Annual Percentage Rate (APR) plays a crucial role in determining loan payments. The APR represents the total annual cost of borrowing, including interest and any additional fees. A higher APR will lead to higher monthly payments. It’s important to compare the APRs of different loan offers to ensure you’re getting the best possible interest rate. Understanding how APR factors into the monthly payment calculation is essential for making an informed borrowing decision.

Key Factors to Consider:

- Roles and Real-World Examples: A higher APR, due to factors like credit score or loan type, directly increases the monthly payment. For example, a credit card with a 20% APR will have much higher monthly payments than a mortgage with a 4% APR.

- Risks and Mitigations: Failing to understand the impact of APR can result in unexpected financial strain. Mitigation strategies include thoroughly researching loan options, comparing APRs, and budgeting effectively based on the expected monthly payment.

- Impact and Implications: The APR significantly influences the total interest paid over the loan’s life. A small difference in APR can result in thousands of dollars more in interest charges over the loan's duration.

Conclusion: Reinforcing the Connection

The connection between APR and loan payments is undeniable. Understanding how APR influences the monthly payment is paramount for responsible borrowing. By carefully considering the APR and its impact, borrowers can make informed decisions to minimize financial risks and optimize their loan repayment strategy.

Further Analysis: Examining APR in Greater Detail

Further research into APR calculation methodologies and the factors that influence APR can enhance understanding of its impact on loan payments. This can involve exploring how credit scores, loan type, and lender policies affect the final APR offered, allowing for more accurate estimations and better decision-making.

FAQ Section: Answering Common Questions About Loan Payments

-

Q: What is an amortization schedule?

- A: An amortization schedule is a detailed table showing the breakdown of each loan payment, including the portion allocated to interest and principal.

-

Q: How do I calculate bi-weekly payments?

- A: Bi-weekly payments calculations involve adjusting the monthly payment formula to account for more frequent payments. Online calculators can simplify this process.

-

Q: What is the difference between interest rate and APR?

- A: The interest rate is the basic cost of borrowing money, while the APR includes the interest rate plus additional fees and charges.

-

Q: How can I reduce my monthly loan payment?

- A: You can reduce your monthly payment by increasing the loan term (though this increases total interest paid), finding a loan with a lower interest rate, or making a larger down payment.

Practical Tips: Maximizing the Benefits of Understanding Loan Payments

- Use a loan calculator: Leverage online calculators for quick and accurate estimations.

- Review your amortization schedule: Understand how your payments are allocated over time.

- Compare APRs: Don’t just compare interest rates; compare APRs for a complete picture.

- Negotiate: Attempt to negotiate lower interest rates with lenders.

- Budget meticulously: Ensure your monthly budget accommodates your loan payments.

Final Conclusion: Wrapping Up with Lasting Insights

Understanding how to calculate your monthly loan payment is a cornerstone of responsible financial management. By mastering these calculations and understanding the influence of factors like interest rates, loan terms, and APR, you can make informed decisions that minimize financial risk and align your borrowing strategies with your overall financial goals. Empowering yourself with this knowledge provides a strong foundation for successful financial planning.

Latest Posts

Latest Posts

-

What Credit Score Do I Need To Buy A Mobile Home

Apr 07, 2025

-

What Credit Score Do U Need For T Mobile

Apr 07, 2025

-

Credit Facility Adalah

Apr 07, 2025

-

Freezing Of Credit

Apr 07, 2025

-

How Do I Unfreeze My Credit Freeze

Apr 07, 2025

Related Post

Thank you for visiting our website which covers about How To Find Monthly Payment On A Loan . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.