How To Create A Fund Management Company

adminse

Apr 06, 2025 · 8 min read

Table of Contents

Launching Your Fund Management Company: A Comprehensive Guide

What if the future of your financial success hinges on understanding the intricacies of establishing a fund management company? This complex yet rewarding endeavor demands meticulous planning, robust expertise, and unwavering dedication.

Editor’s Note: This article provides a comprehensive overview of the steps involved in creating a fund management company. While offering valuable insights, it's crucial to consult with legal and financial professionals for personalized advice tailored to your specific circumstances and jurisdiction. This information is for educational purposes and not financial or legal advice.

Why Starting a Fund Management Company Matters:

The asset management industry is vast and dynamic, offering significant opportunities for skilled professionals. Creating a fund management company allows you to leverage investment expertise, build a strong brand, and generate substantial returns. The industry's growth is fueled by increasing global wealth, sophisticated investors seeking diversification, and the continued evolution of investment strategies. From managing traditional equity and fixed-income portfolios to specializing in alternative investments like private equity or hedge funds, the potential is immense. Successfully navigating the regulatory landscape and building a reputable firm can lead to significant financial success and professional fulfillment.

Overview: What This Article Covers

This article will guide you through the essential steps of launching a fund management company. We will explore legal structures, regulatory compliance, fund structuring, marketing strategies, risk management, and operational considerations. Readers will gain a foundational understanding of the challenges and opportunities involved in establishing a successful fund management firm.

The Research and Effort Behind the Insights

This article draws upon extensive research, including regulatory documents, industry reports, and best practices from established fund management companies. The information presented reflects current industry standards and legal requirements, although specific regulations can vary by jurisdiction. It is essential to conduct thorough due diligence and seek professional guidance throughout the process.

Key Takeaways:

- Legal Structure Selection: Understanding the various legal structures available (e.g., limited partnership, limited liability company) and choosing the most suitable one.

- Regulatory Compliance: Navigating the complex web of regulatory requirements and obtaining necessary licenses and approvals.

- Fund Structuring: Designing investment strategies, selecting target markets, and determining the appropriate fund structure (e.g., open-ended, closed-ended).

- Marketing and Client Acquisition: Developing a compelling brand and implementing effective strategies to attract high-net-worth individuals and institutional investors.

- Risk Management and Compliance: Implementing robust risk management frameworks and ensuring adherence to regulatory compliance standards.

- Operational Efficiency: Building an efficient operational infrastructure and employing experienced professionals.

Smooth Transition to the Core Discussion:

Now that we understand the importance and scope of this undertaking, let's delve into the detailed steps involved in establishing your fund management company.

Exploring the Key Aspects of Creating a Fund Management Company:

1. Developing a Business Plan:

Before taking any action, a comprehensive business plan is crucial. This document will outline your investment strategy, target market, competitive advantage, management team, marketing plan, financial projections, and risk management strategy. A well-structured business plan will serve as a roadmap for your venture and will be essential when seeking funding from investors. It should clearly articulate the fund's investment philosophy, its risk tolerance, and its expected return profile.

2. Legal Structure and Registration:

The choice of legal structure is a critical decision. Common structures include limited partnerships (LPs), limited liability companies (LLCs), and corporations. Each has unique legal and tax implications. You'll need to register your firm with the relevant authorities, which often involves compliance with securities regulations and obtaining the necessary licenses and permits. This process can be complex and vary significantly depending on your chosen jurisdiction. Consulting with legal counsel specializing in investment management is highly recommended.

3. Regulatory Compliance:

Navigating the regulatory landscape is a cornerstone of success. This involves understanding and adhering to rules and regulations concerning investment strategies, client disclosures, risk management, anti-money laundering (AML) compliance, and investor protection. Specific regulations vary widely by jurisdiction, often dictated by bodies such as the Securities and Exchange Commission (SEC) in the United States, or the Financial Conduct Authority (FCA) in the United Kingdom. Non-compliance can result in severe penalties. Engaging legal and compliance experts is essential to ensure ongoing adherence to all applicable regulations.

4. Fund Structuring:

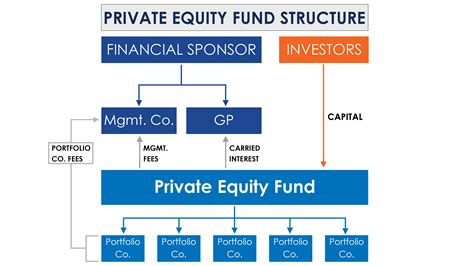

Designing your fund structure requires careful consideration. Open-ended funds allow investors to buy and sell shares at regular intervals, while closed-ended funds have a fixed life span and a limited number of shares. Hedge funds, private equity funds, mutual funds, and exchange-traded funds (ETFs) each have their unique structures, regulatory requirements, and investor profiles. The chosen structure must align with your investment strategy, target market, and risk tolerance. Experienced fund structuring specialists can guide you through this complex process.

5. Assembling Your Team:

Building a skilled and experienced team is essential. This includes professionals with expertise in investment management, portfolio construction, risk management, compliance, operations, legal, and marketing. The caliber of your team significantly impacts your fund's performance and reputation. Recruiting individuals with proven track records and strong industry networks is crucial.

6. Marketing and Client Acquisition:

Attracting investors requires a well-defined marketing strategy. This could include creating a compelling fund prospectus, building a strong online presence, networking at industry events, and establishing relationships with high-net-worth individuals, family offices, and institutional investors. Clear communication of your investment philosophy, risk profile, and performance expectations is crucial to attracting the right investors.

7. Operational Infrastructure:

Setting up an efficient operational infrastructure is essential for smooth daily operations. This includes establishing robust accounting and reporting systems, implementing secure technology infrastructure, and ensuring compliance with data privacy regulations. Outsourcing certain operational functions might be cost-effective, especially in the initial stages.

8. Risk Management:

Implementing a comprehensive risk management framework is critical to protect your fund's assets and maintain investor confidence. This involves identifying, assessing, mitigating, and monitoring various risks, including market risk, credit risk, liquidity risk, operational risk, and regulatory risk. Regular reviews and adjustments to your risk management framework are necessary to adapt to changing market conditions and regulatory requirements.

9. Seeking Funding:

Securing funding is often a crucial step, especially for startups. This could involve attracting seed funding from angel investors, venture capital firms, or private equity investors. A strong business plan, a compelling investment strategy, and a proven management team are essential to attracting investors.

10. Ongoing Compliance and Reporting:

After launch, ongoing compliance with regulations and timely reporting to investors are crucial for maintaining the fund's reputation and attracting further investments. This involves regular audits, compliance checks, and transparent reporting of fund performance and risk metrics.

Exploring the Connection Between Technology and Fund Management Company Creation:

The relationship between technology and fund management company creation is increasingly pivotal. Technology plays a crucial role in enhancing operational efficiency, improving risk management, and facilitating client communication. Utilizing advanced analytics, algorithmic trading, and sophisticated portfolio management systems can improve investment performance and provide a competitive edge. Cloud-based solutions enhance collaboration, data security, and accessibility.

Key Factors to Consider:

- Roles and Real-World Examples: Technology streamlines portfolio accounting, trade execution, and regulatory reporting. Firms like BlackRock and Vanguard heavily leverage technology for automation and scalability.

- Risks and Mitigations: Cybersecurity risks are significant; robust security measures are essential to protect sensitive client data. Regular system updates and penetration testing mitigate these threats.

- Impact and Implications: Technology allows for the creation of innovative fund products and expands access to global markets. Increased automation allows firms to manage larger assets with fewer employees.

Conclusion: Reinforcing the Technology Connection

Technology is no longer a luxury; it's a necessity for modern fund management companies. By strategically integrating technology, firms can enhance their operational efficiency, improve investment decisions, and enhance client experiences.

Further Analysis: Examining Regulatory Compliance in Greater Detail

Regulatory compliance is a constantly evolving field. Staying abreast of changes in regulations is crucial to avoid penalties and maintain investor confidence. This involves ongoing professional development for compliance officers, regular internal audits, and close monitoring of regulatory updates. Failure to comply with regulations can lead to substantial fines, reputational damage, and legal action.

FAQ Section:

- What is the minimum capital required to start a fund management company? This varies significantly depending on the jurisdiction and the type of fund. Consult with legal and financial professionals for specific requirements.

- How long does it take to obtain the necessary licenses and approvals? The timeframe can range from several months to over a year, depending on the jurisdiction and the complexity of the application.

- What are the ongoing costs of running a fund management company? Ongoing costs include regulatory fees, legal fees, compliance costs, technology infrastructure costs, and personnel costs.

Practical Tips:

- Develop a strong business plan: This will guide your actions and attract potential investors.

- Seek expert advice: Engage legal, financial, and compliance professionals throughout the process.

- Build a skilled team: Invest in experienced and talented individuals.

- Prioritize regulatory compliance: Adherence to regulations is paramount for success.

- Implement robust risk management: Protect your fund's assets and investor confidence.

- Develop a strong marketing strategy: Attract high-quality investors.

Final Conclusion:

Creating a fund management company is a challenging yet potentially rewarding endeavor. By meticulously following these steps, understanding the regulatory landscape, assembling a skilled team, and developing a robust business plan, you can increase your chances of establishing a successful and sustainable fund management firm. Remember, ongoing adaptation, innovation, and adherence to best practices are key to long-term success in this dynamic industry.

Latest Posts

Latest Posts

-

What Credit Score Do I Need To Finance A Mobile Home

Apr 07, 2025

-

What Credit Score Do I Need To Get A Mobile Home

Apr 07, 2025

-

What Credit Score Do I Need To Buy A Mobile Home

Apr 07, 2025

-

What Credit Score Do U Need For T Mobile

Apr 07, 2025

-

Credit Facility Adalah

Apr 07, 2025

Related Post

Thank you for visiting our website which covers about How To Create A Fund Management Company . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.