How Long After Paying Off Student Loans Does It Affect Credit Score

adminse

Apr 07, 2025 · 9 min read

Table of Contents

How Long After Paying Off Student Loans Does It Affect My Credit Score? The Complete Guide

What if the seemingly simple act of paying off student loans doesn't instantly boost your credit score as expected? The impact of student loan payoff on your creditworthiness is more nuanced than you might think, involving a complex interplay of factors and timelines.

Editor’s Note: This article on the impact of student loan payoff on credit scores was published today, offering up-to-date information and insights for those managing their student loan debt and aiming for improved credit health.

Why Paying Off Student Loans Matters:

Paying off student loans is a significant financial achievement, symbolizing fiscal responsibility and potentially freeing up substantial monthly cash flow. While the psychological benefits are undeniable, the impact on your credit score isn't instantaneous. Understanding this timeline and the contributing factors is crucial for effective financial planning and credit management. Improved credit scores unlock better interest rates on mortgages, auto loans, and even credit cards, translating to significant long-term savings.

Overview: What This Article Covers:

This article will explore the multifaceted relationship between student loan payoff and credit scores. We’ll delve into how student loans affect credit initially, the process of reporting payoff to credit bureaus, the time it takes for the positive impact to reflect, factors influencing the speed of improvement, and common misconceptions surrounding this topic. Finally, we'll address frequently asked questions and provide practical tips for maximizing the positive credit impact of paying off your student loans.

The Research and Effort Behind the Insights:

This article draws upon extensive research, including analysis of credit scoring models (like FICO and VantageScore), studies on credit reporting practices, and insights from financial experts and consumer credit agencies. Data-driven analysis and real-world examples are used throughout to provide accurate and actionable information.

Key Takeaways:

- It's not instant: Paying off student loans doesn't immediately boost your credit score. The process involves reporting, updating, and recalculation by credit bureaus.

- Time varies: The time it takes for the positive impact to be visible typically ranges from one to two billing cycles (30-60 days), but it could be longer in some instances.

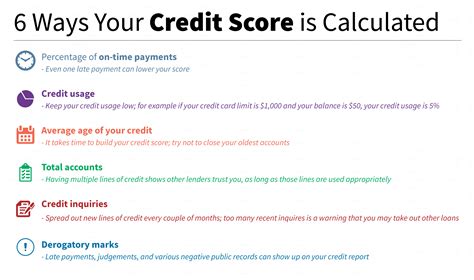

- Credit utilization matters: Reducing your overall credit utilization (the amount of credit used compared to your available credit) is crucial for improving your credit score, irrespective of student loans.

- Account age impacts credit: Keeping accounts open (even after payoff) and maintaining a diverse credit history can positively affect your score.

- Errors can happen: Always double-check the accuracy of reporting to credit bureaus to avoid delays or negative impacts.

Smooth Transition to the Core Discussion:

Now that we’ve established the context, let’s dive deeper into the specific mechanics of how paying off your student loans affects your credit score and the factors that influence the timeframe involved.

Exploring the Key Aspects of Student Loan Payoff and Credit Scores:

1. How Student Loans Initially Affect Your Credit:

Student loans, like other forms of credit, initially impact your credit score in several ways:

- Credit history length: Opening and maintaining student loan accounts contributes positively to the length of your credit history, a critical factor in credit scoring models. Longer credit histories generally lead to higher scores.

- Credit mix: Including student loans (installment loans) in your credit mix demonstrates your ability to manage various types of credit, which is viewed favorably.

- Payment history: Consistent on-time payments on your student loans demonstrate responsible credit behavior, a major factor in calculating your credit score. Late or missed payments negatively impact your score.

- Credit utilization (indirectly): While not directly related to the student loan itself, a high overall credit utilization ratio (often exceeding 30%) can negatively affect your score, even if you pay your student loans on time.

2. Reporting Payoff to Credit Bureaus:

Once you pay off your student loan, the lender is responsible for reporting this to the three major credit bureaus (Equifax, Experian, and TransUnion). This process doesn’t happen instantly. The lender typically updates its records and then submits this information to the bureaus, which can take several weeks. This is a crucial step in reflecting the positive impact on your credit score.

3. The Timeframe for Credit Score Improvement:

The time it takes for your credit score to reflect the payoff of your student loan varies, but generally falls within one to two billing cycles (30-60 days). Several factors can influence this timeframe:

- Lender’s reporting practices: Some lenders are more efficient than others at reporting payoff information.

- Credit bureau processing times: The credit bureaus' processing speeds and internal systems can influence how quickly updates are reflected.

- Account closure: Closing the account immediately after paying off the loan might sometimes take longer for the positive effect to reflect on your score.

- Data errors: There's always a possibility of errors in the reporting process which needs to be rectified through contacting the respective credit bureaus and the lender.

4. Factors Influencing the Speed of Improvement:

Several factors besides the payment itself influence how quickly your credit score improves after paying off your student loan:

- Credit utilization: Reducing your overall credit utilization by paying down other debts is often a more immediate and impactful method to improve your score than just paying off student loans.

- Credit mix diversity: Maintaining a healthy mix of credit accounts (credit cards, installment loans, etc.) is seen positively.

- Account age: Keeping your accounts open (even after payoff) demonstrates a longer history of responsible credit management. However, this does not mean you need to continuously have debt.

- New credit applications: Applying for new credit shortly after paying off your student loan may temporarily lower your score as it impacts your credit utilization and average age of accounts.

- Errors in credit report: It's important to regularly check your credit report for any errors to ensure an accurate reflection of your financial status.

5. Impact on Innovation: Optimizing Credit Strategies

The increasing availability of financial management tools and insights allow for more effective credit strategies. Understanding the nuances of credit scoring models and optimizing repayment strategies can lead to faster credit score improvements and better long-term financial health.

Closing Insights: Summarizing the Core Discussion

Paying off student loans is a significant financial milestone, but its impact on your credit score isn’t immediate. The process involves lender reporting, credit bureau processing, and the interplay of various factors influencing the speed of improvement. Active management of your credit utilization and maintaining a healthy credit history are critical for maximizing the positive credit benefits of your repayment efforts.

Exploring the Connection Between Credit Utilization and Student Loan Payoff:

Credit utilization, the percentage of your available credit that you are currently using, is a critical factor in credit scoring. A low credit utilization ratio (ideally under 30%) signals responsible credit management. Paying off student loans directly reduces your overall debt, potentially lowering your credit utilization. However, this improvement is separate from the payoff reporting itself and usually has a more immediate effect on your credit score.

Key Factors to Consider:

- Roles and Real-World Examples: A person with high credit card debt and a paid-off student loan may still have a relatively high credit utilization ratio, limiting the immediate impact of the student loan payoff. Conversely, someone with low credit card debt will see a more significant credit score boost once their utilization drops after the student loan payoff.

- Risks and Mitigations: Ignoring other debts while focusing solely on student loan payoff can hinder the overall credit score improvement. A holistic debt management approach is crucial.

- Impact and Implications: Understanding the interplay between credit utilization and student loan payoff helps in strategically managing credit to achieve the best possible credit score improvement.

Conclusion: Reinforcing the Connection:

The relationship between credit utilization and student loan payoff highlights the importance of a comprehensive credit management strategy. While paying off student loans is a significant step, it's only one piece of the puzzle. Optimizing credit utilization through responsible spending and debt management is crucial for achieving the most significant and rapid improvement in your credit score.

Further Analysis: Examining Credit Reporting Practices in Greater Detail:

Credit reporting agencies follow specific protocols and timelines for processing information from lenders. Understanding these processes helps manage expectations and proactively address potential delays or errors.

FAQ Section: Answering Common Questions About Student Loan Payoff and Credit Scores:

-

Q: What is the average time it takes for my credit score to improve after paying off student loans? A: One to two billing cycles (30-60 days) is a typical timeframe, but it can vary depending on lender practices and credit bureau processing.

-

Q: Does paying off student loans immediately remove the negative impact of any past late payments? A: No, the negative impact of past late payments remains on your credit report for a specific period (usually 7 years). Paying off the loan will improve your credit outlook over time, but not erase previous negative marks immediately.

-

Q: Should I close my student loan account after paying it off? A: This is a matter of debate among financial experts. Some advise keeping accounts open to increase your credit history length and improve your credit mix. However, this does not necessarily mean keeping the loan active as you are not required to use it or have a balance on it. Closing an account after payoff can slightly affect your credit score.

-

Q: My credit score hasn't changed after paying off my student loans. What should I do? A: Check your credit report for errors. Contact your lender to verify that the payoff has been accurately reported to the credit bureaus. If errors persist, dispute them with the relevant credit bureau.

Practical Tips: Maximizing the Benefits of Student Loan Payoff:

-

Monitor Your Credit Report Regularly: Regularly check your credit report from all three major bureaus for accuracy and to track progress.

-

Maintain a Low Credit Utilization Ratio: Keep your credit card balances low, ideally under 30% of your available credit limit, for optimal credit score impact.

-

Pay Bills On Time: Consistent on-time payments are essential for maintaining a strong credit history and a healthy credit score.

-

Diversify Your Credit Mix: Maintain a healthy mix of credit accounts (credit cards, installment loans, etc.).

-

Consider Keeping Your Account Open (If Possible): Consult a financial advisor to see if it is best to keep the paid off account open for an extended period of time for a potential credit score boost.

Final Conclusion: Wrapping Up with Lasting Insights:

Paying off student loans is a significant achievement that positively impacts your financial well-being. While the impact on your credit score isn’t immediate, understanding the factors influencing the timeframe, and proactively managing your credit, will significantly enhance your credit health. Remember that a holistic approach to credit management, not just focusing on student loans, is key to achieving optimal credit scores. Regular monitoring, responsible spending, and proactive credit report management are all crucial steps in ensuring your financial future reflects your hard work and dedication.

Latest Posts

Latest Posts

-

What Does 0 Credit Utilization Mean

Apr 08, 2025

-

What Does 30 Credit Utilization Mean

Apr 08, 2025

-

What Does Credit Utilization Rate Mean

Apr 08, 2025

-

What Does Low Credit Utilization Mean

Apr 08, 2025

-

What Does High Credit Utilization Mean

Apr 08, 2025

Related Post

Thank you for visiting our website which covers about How Long After Paying Off Student Loans Does It Affect Credit Score . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.