How Does Capital One Balance Transfer Work

adminse

Apr 01, 2025 · 8 min read

Table of Contents

Unlock Savings: A Deep Dive into Capital One Balance Transfers

What if you could significantly reduce your credit card debt and save thousands in interest payments? Capital One balance transfers offer a powerful pathway to financial freedom, but understanding how they work is crucial for maximizing their benefits.

Editor’s Note: This article on Capital One balance transfers was published [Date]. This comprehensive guide provides up-to-date information on the process, helping you make informed decisions about managing your credit card debt.

Why Capital One Balance Transfers Matter:

In today’s economy, high-interest credit card debt can feel overwhelming. Capital One balance transfers provide a viable strategy to consolidate debt, lower interest rates, and accelerate repayment. By shifting high-interest balances to a lower-rate Capital One card, individuals can save considerable money on interest charges over time. This strategy becomes particularly relevant during periods of economic uncertainty or when unexpected expenses strain household budgets. Understanding how these transfers function is paramount to successfully leveraging this financial tool.

Overview: What This Article Covers:

This article explores the intricacies of Capital One balance transfers. We will delve into the application process, eligibility requirements, fees involved, interest rate implications, and potential pitfalls to avoid. Furthermore, we will analyze the strategic considerations for utilizing balance transfers effectively and explore alternative debt management solutions. Readers will gain actionable insights to optimize their debt reduction strategies and make well-informed financial choices.

The Research and Effort Behind the Insights:

This article is based on extensive research, drawing upon Capital One's official website, publicly available financial reports, independent consumer finance resources, and expert opinions from financial advisors. All information presented is rigorously cross-referenced to ensure accuracy and reliability, providing readers with trustworthy and evidence-based guidance.

Key Takeaways:

- Understanding the Basics: A detailed explanation of Capital One balance transfers and their core mechanics.

- Eligibility and Application: A step-by-step guide on how to apply and the criteria you need to meet.

- Fees and Interest Rates: A transparent overview of associated costs and interest rate structures.

- Strategic Considerations: Practical strategies for maximizing the benefits of balance transfers.

- Alternatives and Considerations: An exploration of alternative debt management approaches and crucial factors to consider.

Smooth Transition to the Core Discussion:

Now that we've established the importance of understanding Capital One balance transfers, let's delve into the specifics of how this process works, exploring its intricacies and potential benefits.

Exploring the Key Aspects of Capital One Balance Transfers:

1. Definition and Core Concepts:

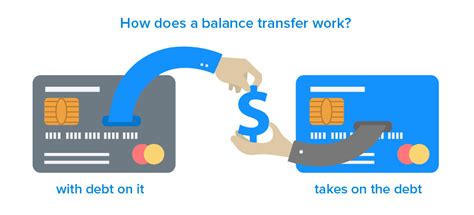

A Capital One balance transfer involves moving existing debt from one credit card (the "source" card) to a Capital One credit card (the "destination" card). This is done by applying for a new Capital One card specifically designed for balance transfers or by utilizing a balance transfer feature on an existing Capital One account. The primary goal is to consolidate debt onto a card with a lower interest rate, thus reducing the overall cost of borrowing.

2. Eligibility and the Application Process:

Eligibility for a Capital One balance transfer hinges on several factors, including your credit score, credit history, existing debt levels, and income. Capital One assesses your financial profile to determine your creditworthiness and risk level. The application process typically involves:

- Applying for a Balance Transfer Card: You'll need to complete an online application, providing personal and financial information.

- Credit Check: Capital One will conduct a hard credit inquiry, impacting your credit score temporarily.

- Approval and Credit Limit: Upon approval, Capital One will determine a credit limit for the new card. This limit dictates how much debt you can transfer.

- Transferring the Balance: Once approved, you'll need to provide the details of your existing credit card(s) from which you wish to transfer the balances. This often involves submitting the account number and the amount to be transferred.

3. Fees and Interest Rates:

Balance transfer cards usually come with fees, including:

- Balance Transfer Fee: This is a percentage of the transferred amount (typically 3-5%), charged once the balance is successfully transferred.

- Annual Fee: Some Capital One cards have annual fees, which add to the overall cost.

- Interest Rate: While the initial interest rate might be low (often 0% for a promotional period), it will revert to a higher standard rate after a specified timeframe (typically 6-18 months). Understanding this promotional period is critical.

It's crucial to carefully compare the balance transfer fees and interest rates offered by different Capital One cards to determine the most cost-effective option. The savings from a lower interest rate must outweigh the balance transfer fees for the strategy to be financially beneficial.

4. Impact on Credit Score:

While a hard credit inquiry from the application process will slightly impact your credit score, successfully managing a balance transfer can positively affect your credit score over time. Consistent on-time payments on the new Capital One card demonstrate responsible credit management and improve your credit utilization ratio.

5. Promotional Periods and APR:

Capital One often offers promotional periods with 0% APR (Annual Percentage Rate) on balance transfers for a limited time. This is a significant advantage, allowing you to pay down your debt without accruing interest during the promotional period. However, it's vital to pay off as much of the balance as possible before the promotional period ends to avoid accruing interest at the higher standard APR.

Exploring the Connection Between Financial Planning and Capital One Balance Transfers:

Effective financial planning plays a crucial role in maximizing the benefits of Capital One balance transfers. Careful budgeting, debt management strategies, and a realistic repayment plan are essential for success. Ignoring these factors can lead to further debt accumulation and negate the advantages of the balance transfer.

Key Factors to Consider:

-

Roles and Real-World Examples: A detailed budget, including all income and expenses, helps determine a realistic repayment plan for the transferred balance. For instance, allocating a specific amount each month to the Capital One card ensures timely payment and avoids late fees.

-

Risks and Mitigations: Failure to repay the balance before the promotional period ends can lead to significant interest charges. Establishing an automated payment system reduces the risk of missed payments.

-

Impact and Implications: Successfully managing a balance transfer can significantly reduce overall debt and improve credit scores, leading to better financial health. However, mismanagement can lead to increased debt and damage to your credit profile.

Conclusion: Reinforcing the Connection:

The interplay between financial planning and Capital One balance transfers is crucial for successful debt management. A well-defined budget, a realistic repayment plan, and careful monitoring of the promotional period are essential for leveraging the benefits of balance transfers and avoiding potential pitfalls.

Further Analysis: Examining Repayment Strategies in Greater Detail:

Effective repayment strategies are the cornerstone of successful balance transfers. Consider these approaches:

-

Debt Avalanche Method: Prioritize paying off the debt with the highest interest rate first, regardless of balance size. This method saves the most money on interest in the long run.

-

Debt Snowball Method: Prioritize paying off the smallest debt first, regardless of the interest rate. This method provides psychological motivation by achieving quick wins, boosting morale and perseverance.

-

Combination Approach: A blend of both methods, prioritizing high-interest debts while also tackling smaller debts for psychological reinforcement.

FAQ Section: Answering Common Questions About Capital One Balance Transfers:

-

What is a Capital One balance transfer? It's the process of moving existing credit card debt from another lender to a Capital One credit card, often with a lower interest rate.

-

How long does a balance transfer take? The transfer process usually takes a few business days to a couple of weeks.

-

What happens if I miss a payment after a balance transfer? Missing payments can result in late fees, a higher interest rate, and damage to your credit score.

-

Can I transfer balances from non-Capital One cards? Yes, you can typically transfer balances from other credit cards to a Capital One balance transfer card.

-

What is the minimum credit score required for a Capital One balance transfer card? Credit score requirements vary depending on the specific card and your financial profile.

-

How do I know which Capital One card is best for a balance transfer? Compare APRs, fees, and promotional periods from various cards to find the most suitable option.

Practical Tips: Maximizing the Benefits of Capital One Balance Transfers:

-

Compare Offers: Carefully compare interest rates, fees, and promotional periods across multiple Capital One cards.

-

Create a Budget: Develop a detailed budget that incorporates the balance transfer repayment plan.

-

Automate Payments: Set up automatic payments to ensure timely payments and avoid late fees.

-

Track Progress: Regularly monitor your progress and adjust your repayment plan if necessary.

-

Pay More Than the Minimum: Paying more than the minimum payment each month accelerates debt repayment and reduces the overall interest paid.

Final Conclusion: Wrapping Up with Lasting Insights:

Capital One balance transfers offer a valuable tool for managing credit card debt, but success depends on careful planning, responsible financial behavior, and a commitment to repayment. By understanding the intricacies of the process, comparing offers meticulously, and implementing effective repayment strategies, individuals can unlock significant savings and improve their long-term financial well-being. Remember, a balance transfer is a tool; effective debt management requires discipline and planning.

Latest Posts

Latest Posts

-

What Credit Score Do You Need To Get Chase Sapphire Reserve

Apr 06, 2025

-

What Credit Score Do You Need To Get Approved For Chase Sapphire Reserve

Apr 06, 2025

-

What Credit Score Does Chase Sapphire Reserve Use

Apr 06, 2025

-

What Credit Score You Need For Chase Sapphire Reserve

Apr 06, 2025

-

What Kind Of Credit Score Do You Need For Chase Sapphire Reserve

Apr 06, 2025

Related Post

Thank you for visiting our website which covers about How Does Capital One Balance Transfer Work . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.