Aplikasi Money Management

adminse

Apr 06, 2025 · 8 min read

Table of Contents

Mastering Your Finances: A Deep Dive into Money Management Apps

What if achieving financial freedom was as simple as downloading an app? Effective money management apps are revolutionizing personal finance, empowering individuals to take control of their spending, saving, and investing.

Editor’s Note: This article on money management apps provides a comprehensive overview of their features, benefits, and considerations. It's been updated to reflect the latest trends and advancements in the field of personal finance technology.

Why Money Management Apps Matter:

In today's fast-paced world, juggling bills, tracking expenses, and planning for the future can feel overwhelming. Money management apps offer a streamlined solution, providing the tools and insights needed to make informed financial decisions. Their relevance stems from several key factors:

- Increased Accessibility: Financial literacy is no longer confined to financial experts. Apps democratize access to sophisticated financial tools, putting them within reach of everyone, regardless of their financial background.

- Improved Tracking & Budgeting: Manually tracking expenses is time-consuming and prone to errors. Apps automate this process, offering real-time insights into spending habits and enabling users to create and stick to budgets.

- Enhanced Savings & Investment Opportunities: Many apps integrate savings and investment features, simplifying the process of building wealth and achieving financial goals. They often offer automated savings plans and investment recommendations.

- Debt Management Tools: For those struggling with debt, apps provide tools to track payments, manage multiple loans, and explore debt reduction strategies.

- Improved Financial Awareness: By visualizing spending patterns and providing personalized insights, these apps foster greater financial awareness and empower users to make more responsible choices.

Overview: What This Article Covers:

This article will explore the multifaceted world of money management apps. We will delve into their core functionalities, discuss the different types available, highlight their benefits and limitations, and offer practical advice on choosing and effectively utilizing these powerful tools. We will also examine specific features like budgeting, expense tracking, savings goals, investment options, and debt management. Finally, we’ll address security concerns and best practices for responsible app usage.

The Research and Effort Behind the Insights:

This article draws upon extensive research, including analysis of popular money management apps, user reviews, expert opinions from financial advisors, and relevant academic studies. The information provided is intended to be factual and unbiased, helping readers make informed decisions about selecting and using these applications.

Key Takeaways:

- Understanding App Features: A breakdown of the essential functionalities offered by money management apps.

- Choosing the Right App: Factors to consider when selecting an app based on individual needs and financial goals.

- Effective App Usage: Strategies for maximizing the benefits of money management apps.

- Security and Privacy Considerations: Best practices for protecting personal financial data.

- Future Trends: The evolving landscape of money management apps and their potential impact on personal finance.

Smooth Transition to the Core Discussion:

Having established the importance of money management apps, let's now delve into their key aspects and explore how they can help individuals achieve their financial objectives.

Exploring the Key Aspects of Money Management Apps:

1. Definition and Core Concepts:

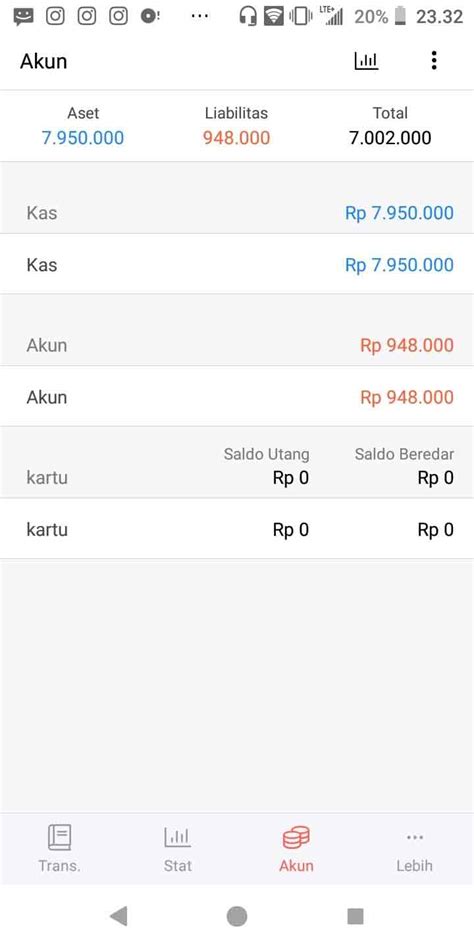

Money management apps are software applications designed to assist individuals in tracking their income and expenses, creating budgets, setting financial goals, and managing their investments. They typically offer a range of features, including expense tracking, budgeting tools, savings goal setting, investment options, and debt management capabilities. The core concept revolves around providing users with a centralized platform to monitor and control their finances, promoting financial literacy and informed decision-making.

2. Applications Across Industries:

While primarily targeted at individual users, money management apps have indirect applications in other industries. Financial institutions may use them to better understand customer behavior and offer personalized financial products. Businesses can use similar technology for internal expense management and accounting. The broader impact extends to financial education initiatives, where apps can serve as educational tools to promote responsible financial habits.

3. Challenges and Solutions:

Despite their numerous benefits, money management apps face certain challenges. Data security and privacy remain paramount concerns. Users need to choose reputable apps with robust security measures to protect their sensitive financial information. Another challenge is user engagement; many users download apps but fail to consistently use them. Gamification and personalized feedback mechanisms can improve user engagement and encourage adherence to financial goals. Finally, the complexity of some apps can be overwhelming for users with limited financial literacy. Apps need to be user-friendly and offer clear explanations of their functionalities.

4. Impact on Innovation:

Money management apps have significantly impacted the personal finance landscape, driving innovation in several ways. They have fostered competition among financial institutions, leading to more user-friendly products and services. The development of open banking APIs has facilitated data integration between apps and financial institutions, improving data accuracy and enhancing functionality. Furthermore, the integration of AI and machine learning capabilities is leading to more sophisticated features like personalized financial advice and predictive analytics.

Closing Insights: Summarizing the Core Discussion:

Money management apps are no longer a niche tool; they are becoming an essential component of modern personal finance. By providing easy-to-use platforms for tracking expenses, budgeting, saving, and investing, they empower individuals to achieve their financial goals. However, responsible app selection and usage are critical for maximizing benefits and mitigating risks.

Exploring the Connection Between User Experience (UX) and Money Management Apps:

The relationship between user experience (UX) and money management apps is pivotal. A well-designed UX is critical for user engagement and adoption. Poor UX can lead to frustration, abandonment, and ultimately, a failure to achieve financial goals.

Key Factors to Consider:

- Roles and Real-World Examples: Intuitive interfaces, clear visualizations of financial data, and personalized insights are crucial for a positive user experience. Apps like Mint and Personal Capital are examples of apps that prioritize UX, resulting in high user engagement.

- Risks and Mitigations: Poorly designed interfaces, confusing navigation, and a lack of personalized feedback can lead to user frustration and app abandonment. Thorough user testing and iterative design improvements are essential to mitigate these risks.

- Impact and Implications: A positive UX contributes to increased financial literacy, improved budgeting habits, and better financial decision-making. Conversely, a negative UX can reinforce poor financial habits and hinder progress towards financial goals.

Conclusion: Reinforcing the Connection:

The success of money management apps hinges on their ability to provide a seamless and engaging user experience. By focusing on intuitive design, personalized insights, and clear communication, app developers can empower users to take control of their finances and achieve lasting financial well-being.

Further Analysis: Examining Data Security in Greater Detail:

Data security is a paramount concern in the realm of money management apps. These apps handle sensitive personal and financial information, making them prime targets for cyberattacks.

- Cause-and-Effect Relationships: Breaches of data security can result in identity theft, financial losses, and reputational damage for both the app provider and the users. The use of weak security protocols, lack of encryption, and inadequate access controls can significantly increase the risk of breaches.

- Significance: Robust security measures are not merely a technical detail; they are a fundamental aspect of building trust and ensuring user confidence. Users need to feel confident that their financial data is protected from unauthorized access and misuse.

- Real-World Applications: Multi-factor authentication, encryption of data both in transit and at rest, regular security audits, and compliance with industry standards (like GDPR and CCPA) are essential security measures that reputable app developers should implement.

FAQ Section: Answering Common Questions About Money Management Apps:

- What is a money management app? A money management app is a software application designed to help individuals track their income and expenses, create budgets, set financial goals, and manage their investments.

- How do I choose the right money management app? Consider your specific needs and financial goals when selecting an app. Look for features like budgeting, expense tracking, savings goals, investment options, and debt management. Read user reviews and compare features before making a decision.

- Are money management apps safe? Reputable money management apps employ robust security measures to protect user data. However, it's important to choose apps from trusted providers and be mindful of your own online security practices.

- How can I improve my budgeting skills using a money management app? Many apps offer budgeting tools that allow you to categorize expenses, set spending limits, and track your progress towards your financial goals. Start by understanding your current spending habits and then create a realistic budget that aligns with your income and goals.

- Can money management apps help me pay off debt? Yes, some apps offer debt management tools that can help you track your payments, manage multiple loans, and explore debt reduction strategies.

Practical Tips: Maximizing the Benefits of Money Management Apps:

- Understand the Basics: Before using any app, take the time to understand its core functionalities and features.

- Link Your Accounts: Connect your bank accounts, credit cards, and other financial accounts to the app for accurate and automated tracking.

- Set Realistic Goals: Define specific, measurable, achievable, relevant, and time-bound (SMART) financial goals.

- Regularly Review Your Finances: Check your app regularly to monitor your progress and make necessary adjustments to your budget and financial plans.

- Utilize Reporting Features: Take advantage of the app's reporting features to gain insights into your spending habits and identify areas for improvement.

Final Conclusion: Wrapping Up with Lasting Insights:

Money management apps are transforming the way people manage their finances. By providing convenient and user-friendly tools, they empower individuals to take control of their financial lives, make informed decisions, and achieve their financial aspirations. However, selecting the right app and utilizing its features effectively is critical to maximizing its benefits. Remember to prioritize data security and choose reputable providers to safeguard your sensitive financial information. With the right tools and strategies, achieving financial freedom is within reach.

Latest Posts

Latest Posts

-

How Do I Unfreeze My Credit Freeze

Apr 07, 2025

-

What Does It Mean When Your Credit Is Frozen

Apr 07, 2025

-

Credit Freeze Explained

Apr 07, 2025

-

What Does It Mean To Freeze Your Credit

Apr 07, 2025

-

Credit Report Freeze Definition

Apr 07, 2025

Related Post

Thank you for visiting our website which covers about Aplikasi Money Management . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.